The past few weeks have provided a much needed shot of energy to crude oil bulls but, despite a short-lived rally, the risk of sharp declines still persists. Subsequently, despite an admirable push towards the top of the bearish trend line, the commodity ultimately failed to cement a move to the upside, leaving us with the question of what next for crude oil.

Firstly, it was largely no surprise that crude prices have declined following the release of the last round of EIA and API figures, which showed crude inventories again increasing. In fact, the stockpile build represents the seventh consecutive increase and further indicates that the required rebalancing within the US crude oil market is yet to be fully realised.

Subsequently, crude prices were under pressure early, following the data release yesterday and never really managed to regain their momentum. In fact, the selling saw over 22 cents evaporate from global Brent prices whilst WTI Crude slipped to below $38.00 a barrel. Despite a bevy of protests from crude oil bulls (including my Texan wife) the reality for crude is, it's a commodity under pressure in the coming few weeks.

In fact, despite the recent short-term rally, the long term bearish trend line remains intact and will continue to the dominate price action’s moves in the weeks ahead. The recent rally has done little to appease the fundamental supply imbalance that is still persisting within global crude markets. Subsequently, the commodity is likely to face plenty of selling pressure in the mid-term as the bearish trend line continues to descend.

Additionally, it is highly likely that the needed market re-balancing process could be further slowed by diminishing global growth. Even the venerable US Federal Reserve has gotten on the bandwagon recently, by suggesting that risks to global growth are mounting which is likely to impact their rate hike schedule. Subsequently, given global GDP growth’s role in oil demand, it isn’t a stretch to suggest that any potential economic downturn could impact oil markets.

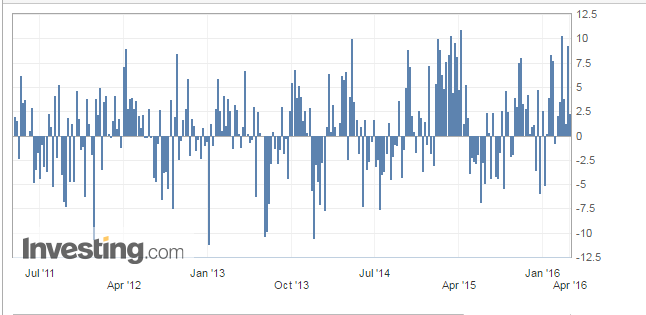

Ultimately, despite the current zig-zag pattern that oil prices are taking, the immediate fundamentals do not support anything other than a short term bounce. Any significant price rallies will be beaten down in short order by both sellers and the bearish trend line.

Subsequently, our internal modelling shows crude oil prices persisting between $32 and $35 a barrel, within the near term. However, the longer term view still suggests oil will need to persist below $30 a barrel before the inevitable rebalancing process can complete.