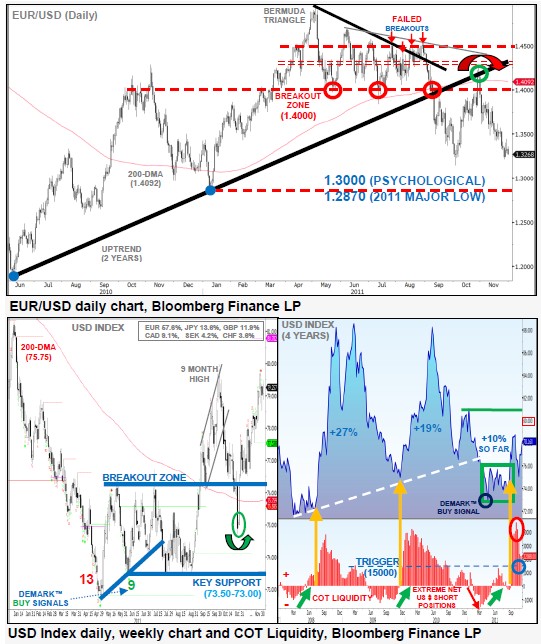

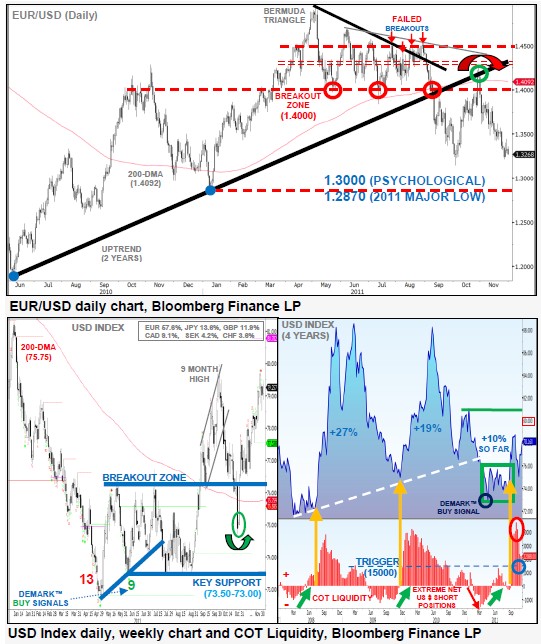

EUR/USD

Weak recovery warns of further downside risk.

EUR/USD’s weak recovery is warning of further downside risk. Expect the bearish impulsive to move extend from key overhead resistance (primarily a 2 year trend and its long-term 200-day average).

Bearish sentiment also remains anchored by heightened contagion fears driven from the greater European sovereign debt risk.

A sustained close beneath 1.3146 (Oct swing low) will re-establish the larger downtrend from April and target 1.3000 (psychological level), then 1.2870 (2011 major low). Resistance is likely to cap at 1.3610 and 1.3730.

Keep an eye on highly correlated risk-related proxies, such as the S&P500 and AUD/USD, which both continue to exhibit downside presssure.

Inversely, the USD Index is maintaining its recovery higher and is fast approaching the recent 9-month highs near 80, (a move worth almost 10%).

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

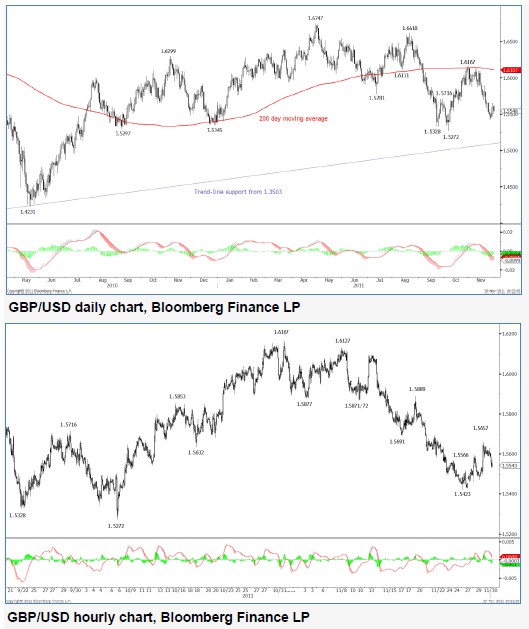

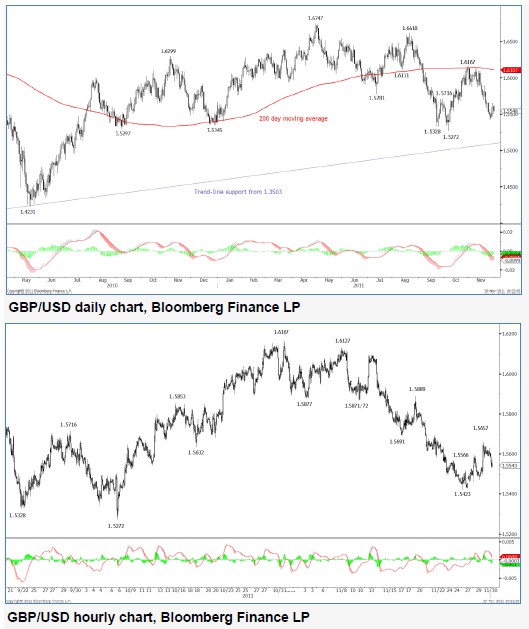

GBP/USD

Back over 1.5700 to strengthen outlook further.

GBP/USD appears to have found a short-term base at 1.5423 for the time being. As highlighted in previous reports, Sterling has the capacity to be deemed as a safe haven in the event that Euro-Zone contagion escalates. It is this reasoning that leads us to continue to favour a return to the large range that has been witnessed for the majority of the year.

An earlier break under 1.5423, or resistance close to 1.5700 will warn of a larger extension lower. However, a failure to remain under 1.5700 will suggest scope for a larger recovery higher and a break down in negative structure.

Also, given the reasoning above, EUR/GBP, can positively impact on GBP/USD, if a break under 1.3146 can be achieved in EUR/USD. We also note that a sustained break under 1.5272 is required to turn the medium-term bias decidedly bearish.

We await the formation of short-term structure to assist us in our formulation of strategy.

USD/JPY

Minor rebound capped at 78.24 (DeMark™ Level).

USD/JPY’s minor rebound is still being capped at 78.24 (DeMark™ Level). Moreover, downside risks remain, with the growing probability of a third price retracement back to pre-intervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

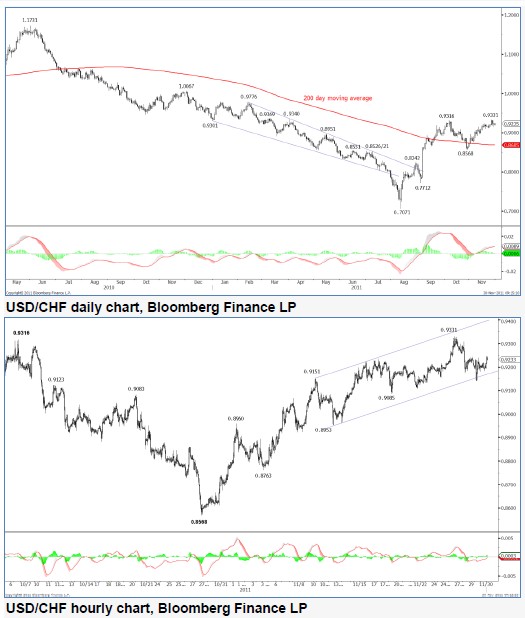

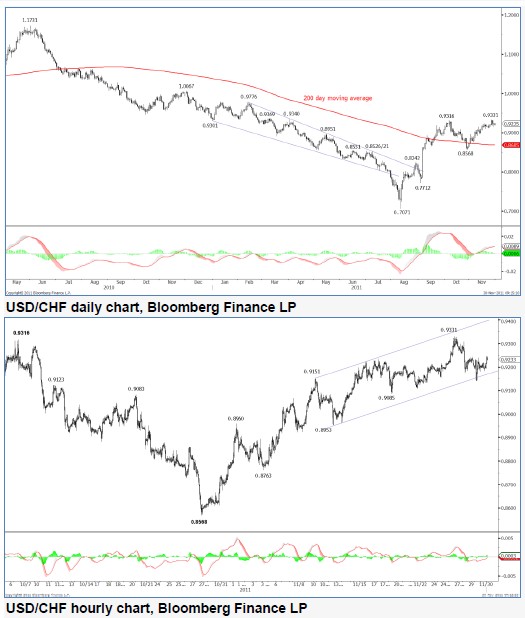

USD/CHF

Within the midst of a corrective phase.

USD/CHF has seen an initial corrective phase lower after peaking at 0.9331. This has met 0.9141 so far. Scope is now seen for a lower high to form versus 0.9331 for a further swing to the downside.

Downside pressure is also likely to remain given the elevated nature of yields in the Euro-Zone, creating a safe haven again for Swiss Francs. Spanish and Italian government bonds remain elevated, currently trading at 6.478% and 7.355% respectively.

We continue to monitor the German sovereign yield curve with ten year yields there currently trading close to 2.302%, up from 2.259% yesterday. If yields in Germany continue to rise, this will likely mark an acceleration of deterioration in the Euro Zone.

Movement in USD/CHF is likely to be affected by EUR/CHF should the latter rate get closer to the 1.2130 region, which marks the lower end of the recent trading range.

USD/CAD

Sharp Setbacks hold steady.

USD/CAD’s sharp setbacks are holding steady today, following the recent short-term DeMark™ exhaustion sell signal.

A directional confirmation above 1.0658 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle.

Only a sustained close beneath 1.0230 and parity unlocks bearish setbacks into the long-term 200-day MA at 0.9851 and 0.9726 (31st Aug low).

EUR/CAD remains beneath its 200-day MA, still within a large multi-month trading range. The strong multi-month distribution pattern is likely to breakdown further into support levels at 1.3570 and 1.3380.

CHF/CAD has also broken back beneath its 200-day MA at 1.1372, while maintaining a multi-week trading range. This follows the dramatic price slide lower (which was triggered by the SNB intervention). The cross-rate has retraced more than half of its 2011 gains.

AUD/USD

Minor recovery capped at 1.0080.

AUD/USD’s minor recovery has been capped at 1.0080 (38.2% Fib-28th Oct decline). A new short position is being activated, with a sell stop at 0.9940. The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. However, near-term price activity is mean reverting back into the 200- day MA. Expect a sharp setback to ensue over the multi-day horizon.

The Aussie dollar has triggered a mild recovery against the Japanese yen and is now trading back above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of risk appetite.

GBP/JPY

Over 121.77 may trigger a further recovery leg higher.

GBP/JPY may be entering a corrective phase higher following the break out of hourly bear channel resistance. With this in mind, a higher low is anticipated ahead of 119.38, should a short-term pullback take place. This is also supported by the minor recovery seen in equities globally and in particular in the S&P500.

Yesterday has also seen a push over 121.77, thus breaking the sequence of lower highs that had been witnessed from 127.32. This also increases the probability of a further leg higher to complete the corrective phase from 119.38.

A failure to hold over 119.38 will warn of a return to 116.84. Over a longer period of time a substantial recovery higher is favoured, initially towards 163.09.

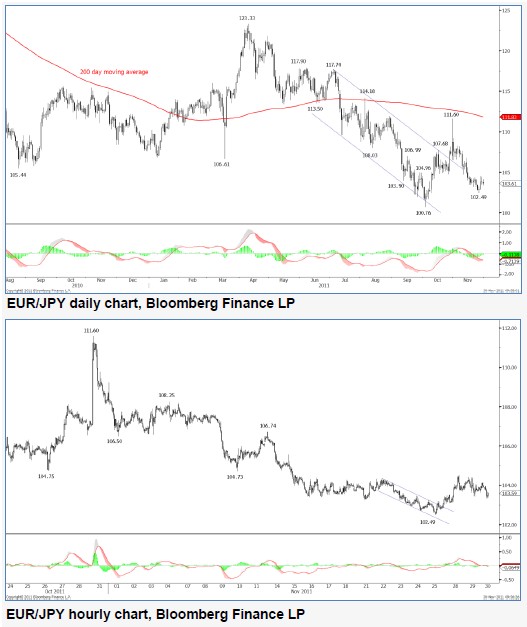

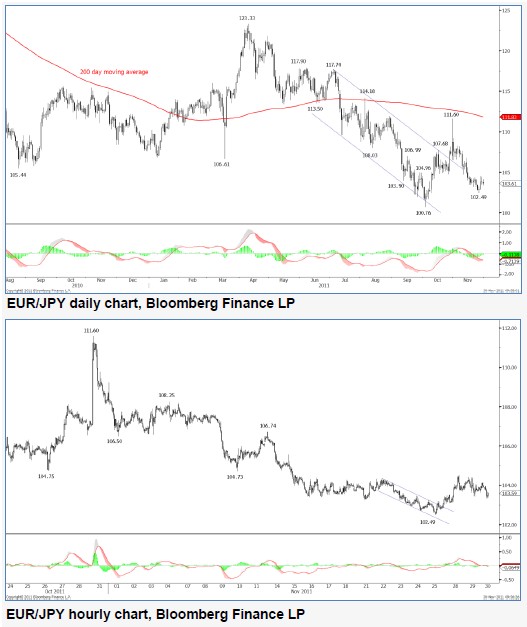

EUR/JPY

Further leg higher anticipated.

EUR/JPY appears to have completed an initial corrective phase higher, with scope now for a further swing to the upside. We view the fall that has taken place since 111.60 as being corrective in nature, suggesting potential for a further leg higher. The break out of the hourly falling channel that has taken place during recent sessions is now suggestive of a larger corrective phase higher.

However, the EUR component of this pair is highly affected by the movement in EUR/USD. As the yields in Spanish and Italian government bonds continue to rise, this puts more downside pressure on the EUR. A break under 1.3146 in EUR/USD will end the rising phase seen since 2010. This would likely be associated with a fall back down to 100.76 and potentially lower.

Given the above clash between the structure and the deterioration in the Euro-Zone, we prefer to wait on the sidelines.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Hourly structure warns of a re-test of the recent low at 0.8486.

A push under 0.8528 will negate the strategy given below.

EUR/GBP continues to frustrate, failing to garner any momentum, following the recent break of the key 0.8530/31 lows. However, the evolution of shortterm structure is suggestive of a re-test of 0.8486, under which will open up extensions near 0.8420 and 0.8340.

Given the precarious situation in the Euro-Zone, it is anticipated that if yield curve deterioration continues then Sterling could be viewed as a safe haven. Thus focus remains on the Italian and Spanish government bond markets.

Our bias remains mildly bearish with trade continuing under both the 200 day and 50 week moving averages. We keep an eye on the 1.3146 level in EUR/USD. A push under this level will mark a clear breakdown of confidence in the EUR, which would then likely have a knock on effect on all EUR crosses.

EUR/CHF

Under 1.2251 to weaken outlook further.

EUR/CHF continues to trade in a tight range just under the 1.2500 level. Downside pressure is favoured to resume as yields on Italian and Spanish sovereign debt remain elevated. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

Our strategy remains to trade opportunistically from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

Near-term, a break back under 1.2251 will warn of a failure to re-test the 1.2500 region, suggesting an earlier return to 1.2123/31. In any case, a retest of the base of the recent trading range is anticipated over coming sessions.

The failure of this pair to break over the 50 week moving average over recent weeks is also an initial warning that the prior downtrend may not be over. The large cluster of stops that is likely to be placed around the 1.2000 level is also anticipated to aid any short positioning, questioning the ability of the SNB to hold back the possible flow of funds into Swiss Francs.

Weak recovery warns of further downside risk.

EUR/USD’s weak recovery is warning of further downside risk. Expect the bearish impulsive to move extend from key overhead resistance (primarily a 2 year trend and its long-term 200-day average).

Bearish sentiment also remains anchored by heightened contagion fears driven from the greater European sovereign debt risk.

A sustained close beneath 1.3146 (Oct swing low) will re-establish the larger downtrend from April and target 1.3000 (psychological level), then 1.2870 (2011 major low). Resistance is likely to cap at 1.3610 and 1.3730.

Keep an eye on highly correlated risk-related proxies, such as the S&P500 and AUD/USD, which both continue to exhibit downside presssure.

Inversely, the USD Index is maintaining its recovery higher and is fast approaching the recent 9-month highs near 80, (a move worth almost 10%).

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

GBP/USD

Back over 1.5700 to strengthen outlook further.

GBP/USD appears to have found a short-term base at 1.5423 for the time being. As highlighted in previous reports, Sterling has the capacity to be deemed as a safe haven in the event that Euro-Zone contagion escalates. It is this reasoning that leads us to continue to favour a return to the large range that has been witnessed for the majority of the year.

An earlier break under 1.5423, or resistance close to 1.5700 will warn of a larger extension lower. However, a failure to remain under 1.5700 will suggest scope for a larger recovery higher and a break down in negative structure.

Also, given the reasoning above, EUR/GBP, can positively impact on GBP/USD, if a break under 1.3146 can be achieved in EUR/USD. We also note that a sustained break under 1.5272 is required to turn the medium-term bias decidedly bearish.

We await the formation of short-term structure to assist us in our formulation of strategy.

USD/JPY

Minor rebound capped at 78.24 (DeMark™ Level).

USD/JPY’s minor rebound is still being capped at 78.24 (DeMark™ Level). Moreover, downside risks remain, with the growing probability of a third price retracement back to pre-intervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

USD/CHF

Within the midst of a corrective phase.

USD/CHF has seen an initial corrective phase lower after peaking at 0.9331. This has met 0.9141 so far. Scope is now seen for a lower high to form versus 0.9331 for a further swing to the downside.

Downside pressure is also likely to remain given the elevated nature of yields in the Euro-Zone, creating a safe haven again for Swiss Francs. Spanish and Italian government bonds remain elevated, currently trading at 6.478% and 7.355% respectively.

We continue to monitor the German sovereign yield curve with ten year yields there currently trading close to 2.302%, up from 2.259% yesterday. If yields in Germany continue to rise, this will likely mark an acceleration of deterioration in the Euro Zone.

Movement in USD/CHF is likely to be affected by EUR/CHF should the latter rate get closer to the 1.2130 region, which marks the lower end of the recent trading range.

USD/CAD

Sharp Setbacks hold steady.

USD/CAD’s sharp setbacks are holding steady today, following the recent short-term DeMark™ exhaustion sell signal.

A directional confirmation above 1.0658 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott Wave cycle.

Only a sustained close beneath 1.0230 and parity unlocks bearish setbacks into the long-term 200-day MA at 0.9851 and 0.9726 (31st Aug low).

EUR/CAD remains beneath its 200-day MA, still within a large multi-month trading range. The strong multi-month distribution pattern is likely to breakdown further into support levels at 1.3570 and 1.3380.

CHF/CAD has also broken back beneath its 200-day MA at 1.1372, while maintaining a multi-week trading range. This follows the dramatic price slide lower (which was triggered by the SNB intervention). The cross-rate has retraced more than half of its 2011 gains.

AUD/USD

Minor recovery capped at 1.0080.

AUD/USD’s minor recovery has been capped at 1.0080 (38.2% Fib-28th Oct decline). A new short position is being activated, with a sell stop at 0.9940. The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. However, near-term price activity is mean reverting back into the 200- day MA. Expect a sharp setback to ensue over the multi-day horizon.

The Aussie dollar has triggered a mild recovery against the Japanese yen and is now trading back above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of risk appetite.

GBP/JPY

Over 121.77 may trigger a further recovery leg higher.

GBP/JPY may be entering a corrective phase higher following the break out of hourly bear channel resistance. With this in mind, a higher low is anticipated ahead of 119.38, should a short-term pullback take place. This is also supported by the minor recovery seen in equities globally and in particular in the S&P500.

Yesterday has also seen a push over 121.77, thus breaking the sequence of lower highs that had been witnessed from 127.32. This also increases the probability of a further leg higher to complete the corrective phase from 119.38.

A failure to hold over 119.38 will warn of a return to 116.84. Over a longer period of time a substantial recovery higher is favoured, initially towards 163.09.

EUR/JPY

Further leg higher anticipated.

EUR/JPY appears to have completed an initial corrective phase higher, with scope now for a further swing to the upside. We view the fall that has taken place since 111.60 as being corrective in nature, suggesting potential for a further leg higher. The break out of the hourly falling channel that has taken place during recent sessions is now suggestive of a larger corrective phase higher.

However, the EUR component of this pair is highly affected by the movement in EUR/USD. As the yields in Spanish and Italian government bonds continue to rise, this puts more downside pressure on the EUR. A break under 1.3146 in EUR/USD will end the rising phase seen since 2010. This would likely be associated with a fall back down to 100.76 and potentially lower.

Given the above clash between the structure and the deterioration in the Euro-Zone, we prefer to wait on the sidelines.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Hourly structure warns of a re-test of the recent low at 0.8486.

A push under 0.8528 will negate the strategy given below.

EUR/GBP continues to frustrate, failing to garner any momentum, following the recent break of the key 0.8530/31 lows. However, the evolution of shortterm structure is suggestive of a re-test of 0.8486, under which will open up extensions near 0.8420 and 0.8340.

Given the precarious situation in the Euro-Zone, it is anticipated that if yield curve deterioration continues then Sterling could be viewed as a safe haven. Thus focus remains on the Italian and Spanish government bond markets.

Our bias remains mildly bearish with trade continuing under both the 200 day and 50 week moving averages. We keep an eye on the 1.3146 level in EUR/USD. A push under this level will mark a clear breakdown of confidence in the EUR, which would then likely have a knock on effect on all EUR crosses.

EUR/CHF

Under 1.2251 to weaken outlook further.

EUR/CHF continues to trade in a tight range just under the 1.2500 level. Downside pressure is favoured to resume as yields on Italian and Spanish sovereign debt remain elevated. Over time, this may lead to a renewed desire for a safe haven, with downside pressure returning to EUR/CHF.

Our strategy remains to trade opportunistically from a momentum perspective, awaiting a return to the 1.2000 region. Should a re-test of the 1.2000 region take place with a fall under 1.1973 also following, this would warn of the end of the recovery seen since 1.0075, increasing the probability of a return to this level.

Near-term, a break back under 1.2251 will warn of a failure to re-test the 1.2500 region, suggesting an earlier return to 1.2123/31. In any case, a retest of the base of the recent trading range is anticipated over coming sessions.

The failure of this pair to break over the 50 week moving average over recent weeks is also an initial warning that the prior downtrend may not be over. The large cluster of stops that is likely to be placed around the 1.2000 level is also anticipated to aid any short positioning, questioning the ability of the SNB to hold back the possible flow of funds into Swiss Francs.