- Auto giant GM stock is up around 52% in 2021.

- Despite the robust auto demand, ongoing semiconductor shortages put pressure on auto companies’ financials, including General Motors.

- Long-term investors could consider buying the dips in GM shares, especially if they decline toward $60.

Investors in automaker General Motors (NYSE:GM) enjoyed robust returns in 2021. Year-to-date, shares of the Detroit auto manufacturer have appreciated by 51.80% while the Dow Jones U.S. Auto Manufacturers Index is up 49.6%.

On Nov. 18, GM shares went over $65 and hit a record high. But since that peak, the stock is down about 3%, trading at $63.21. The stock’s 52-week range has been $40.04-$65.18, and its market capitalization (cap) stands at $91.77 billion.

Over the past several quarters, the legacy carmaker has pushed into the electric vehicle (EV) and autonomous vehicle (AV) space—a move that investors like. Recent metrics highlight:

“Between 2020 and 2025, GM will invest $35 billion in EV and AV product development spending, exceeding GM’s gas and diesel investment.”

General Motors released Q3 metrics on Oct. 27. Revenue was $26.78 billion, compared to $35.48 billion a year ago. Diluted adjusted earnings per share (EPS) came in at $1.52 vs. $2.83 in Q3 2020.

In its recent quarterly shareholder letter, management said:

“In the third quarter, our EBIT-adjusted was $2.9 billion, with a 10.9-percent margin. The quarter was challenging due to continuing semiconductor pressures. But it also includes very strong results from GM Financial, the recall cost settlement we reached with our valued and respected supplier and JV partner LG Electronics, and $0.3 billion in equity income from our joint ventures in China.”

Despite the upbeat words, investors initially raised eyebrows at the overall report. Prior to the release of the Q3 figures, GM stock was around $58. By Oct. 29. it was below $54, after which buyers came back into the market. Then, on Nov. 18. GM shares saw an all-time high of $65.18. On Friday, Dec. 10, the stock closed out the trading week at $63.21.

What To Expect From GM Stock

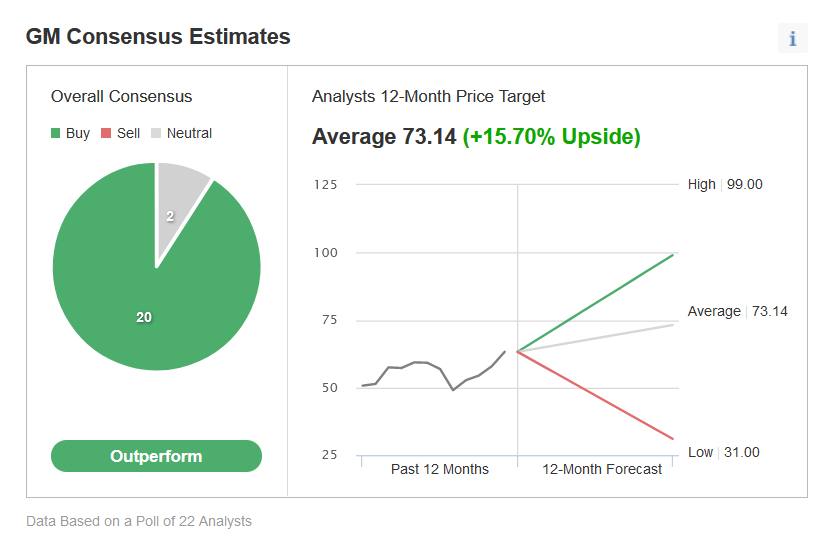

Among 22 analysts polled via Investing.com, General Motors stock has an “outperform" rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $73.14 on the stock, implying an increase of over 15.5% from current levels. The 12-month price range currently stands between $31.00 and $99.00.

Similarly, according to a number of valuation models, such as those that might consider dividends, P/E multiples or the 10-year Discounted Cash Flow (DCF) growth exit method, the average fair value for GM stock stands at $89.29, implying an upside potential of over 41%.

Moreover, we can look at the company’s financial health determined by ranking it on more than 100 factors against peers in the consumer discretionary sector. In terms of growth and profit health, General Motors scores 3 out of 5 (top score), and thus has good performance.

Trailing P/E, P/B and P/S ratios for GM stock are 8.4x, 1.7x and 0.7x, respectively. By comparison, those metrics for peers stand at 14.4x, 1.9x and 0.7x.

Given GM’s aspirations for breaking into the EV space, we should also look at the comparable valuation levels for Tesla (NASDAQ:TSLA). They are 295.1x, 37.8x and 21.8x. Put another way, those investors who believe GM’s EV efforts are likely to pay off well in the coming years, might find that General Motors offers better value.

Finally, readers who watch technical charts might be interested to know that several of GM stock’s intermediate-term indicators are cautioning investors for increased volatility and giving overbought signals.

Our first expectation is for General Motors stock to trade in a range, possibly between $58 and $62, and establish a new base. Afterwards, a new bullish move is likely to start.

3 Possible Trades On General Motors Stock

1. Buy GM Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in General Motors stock now.

On Dec. 10, GM stock closed at $63.21. Buy-and-hold investors should expect to keep this long position for several months, if not multiple quarters, while the stock makes an attempt at analysts’ price target of $73.14. Such a move would lead to a return of over 15% from the current level.

Readers who opt for this approach but are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With GM As A Holding

Readers who do not want to commit full capital to General Motors stock but would still like to have exposure to the shares could consider researching a fund that holds the company as a holding.

Examples of such ETFs include:

- First Trust NASDAQ Global Auto Index Fund (NASDAQ:CARZ): This fund is up 22.5% YTD, and GM stock’s weighting is 9.66%;

- iShares Self-Driving EV and Tech ETF (NYSE:IDRV): The fund is up 27.8%YTD, and GM stock’s weighting is 3.33%;

- Invesco S&P 500 Enhanced Value ETF (NYSE:SPVU): The fund is up 30.4% YTD, and GM stock’s weighting is 3.00%;

- Consumer Discretionary Select Sector SPDR Fund (NYSE:XLY): The fund is up 27.5% YTD, and GM stock’s weighting is 1.95%.

3. Cash-Secured Put Selling

Investors who believe GM stock could continue to reach new highs in the weeks ahead might consider selling a cash-secured put option in General Motors stock—a strategy we regularly cover. As it involves options, this set-up will not be appropriate for all investors.

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own GM shares for less than their current market price of $63.21.

A put option contract on GM stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires or the option is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy General Motors stock, but does not want to pay the full price of $63.21 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for GM stock to fall, which it might or might not do. The other possibility is to sell one contract of a cash-secured General Motors put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of 18 Feb. 2022. As the stock is $63.21 at time of writing, an OTM put option would have a strike of $60.00.

So the seller would have to buy 100 shares of GM at the strike of $60.00 if the option buyer were to exercise the option to assign it to the seller.

The GM 18 Feb. 2022 60-strike put option is currently offered at a price (or premium) of $2.85.

An option buyer would have to pay $2.85 X 100, or $285, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Feb. 18.

Assuming a trader would enter this cash-secured put option trade at $63.21 now, at expiration on Feb. 18, the maximum return for the seller would be $285, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if GM stock closes above the strike price of $60.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of General Motors stock is lower than the strike price of $60.00) any time before or at expiration on Feb. 18, this put option can be assigned. The seller would then be obligated to buy 100 shares of GM stock at the put option's strike price of $60.00 (i.e., at a total of $6,000).

The break-even point for our example is the strike price ($60.00) less the option premium received ($2.85), i.e., $57.15. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on any choppiness in General Motors stock in the coming weeks.

Investors who end up owning GM shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.