- Berkshire Hathaway shares increased more than 18% since the beginning of 2022

- In Q4, share buybacks totaled $6.9 billion

- Long-term investors could consider buying BRKb stock at current levels

Shareholders in well-known and much followed investor Warren Buffett’s conglomerate, Berkshire Hathaway (NYSE:BRKb) have seen the value of their investment go up roughly 33% over the past 52 weeks, and 18% year-to-date (YTD).

By comparison, Apple (NASDAQ:AAPL), the largest holding in the Berkshire Hathaway portfolio, is down 4.2% so far in 2022, but still up 27.9% in the past year.

On Mar. 29, BRKb shares went over $362, hitting a record high. The stock’s 52-week range has been $261.91–$362.10, while the market capitalization (cap) stands at $779.8 billion.

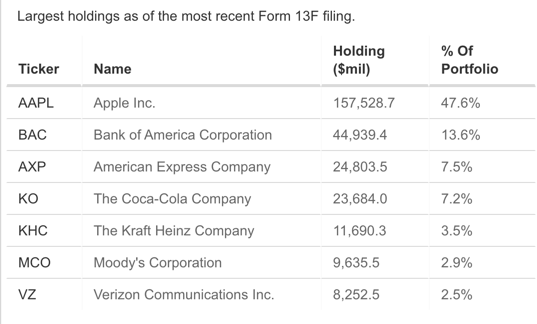

Investors wishing to get more information on the Omaha, Nebraska headquartered company's portfolio can study the latest filings with the US Securities and Exchange Commission (SEC). In addition, InvestingPro provides a detailed overview of publicly traded shares in the conglomerate.

Source: InvestingPro

For instance, aside from Apple, other leading stocks on the roster include Bank of America (NYSE:BAC), American Express (NYSE:AXP) and Coca-Cola (NYSE:KO).

Meanwhile, those shares that are trading below estimates of intrinsic value are StoneCo (NASDAQ:STNE), General Motors (NYSE:GM), RH (NYSE:RH) and United Parcel Service (NYSE:UPS).

Finally, portfolio holdings that have the greatest upside potential based on analysts’ price targets include General Motors, Floor & Decor (NYSE:FND), Liberty Latin America (NASDAQ:LILAK), Snowflake (NYSE:SNOW), StoneCo and RH.

How Recent Metrics Came In

Berkshire Hathaway released Q4 2021 figures on Feb. 26 when shareholders paid close attention to operating earnings. In Q4, the metric came in at $7.29 billion, up about 45% year-over-year (YoY). And for 2021, operating earnings reached $27.45 billion, up over 25% from almost $22 billion in 2020.

Investors were also pleased to see that the board spent $6.9 billion on share buybacks. For the year, stock repurchases reached a record $27 billion.

On the results, CEO Warren Buffett said:

“Many people perceive Berkshire as a large and somewhat strange collection of financial assets. In truth, Berkshire owns and operates more U.S.-based “infrastructure” assets—classified on our balance sheet as property, plant and equipment—than are owned and operated by any other American corporation. That supremacy has never been our goal. It has, however, become a fact.”

Prior to the release of the Q4 results, BRKb shares were trading around $317. But on Apr. 8, they closed at $353.10. This means BRKb stock has gained around 11% since the earnings announcement.

What To Expect From BRKb Stock

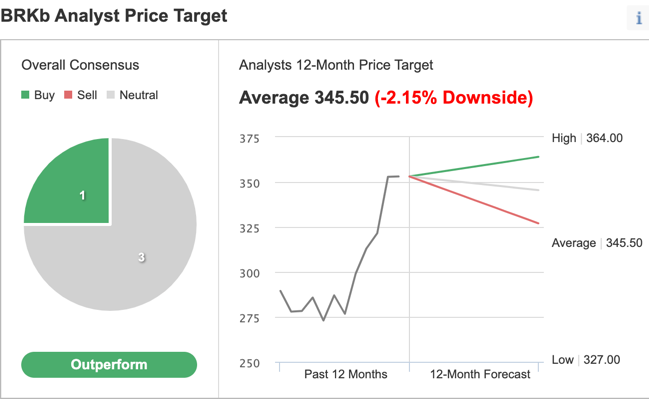

Among analysts polled via Investing.com, BRKb stock has an "outperform" rating.

Source: Investing.com

Yet, Wall Street has a 12-month median price target of $345.50 for the stock, implying a decrease of about 2% from current levels. The 12-month price range currently stands between $327 and $364.

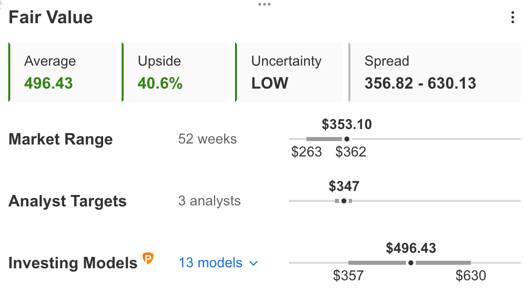

However, according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for BRKb stock on InvestingPro stands at $496.43.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase about 40%.

We can also look at BRKb’s financial health as determined by ranking more than 100 factors against peers in the financials sector.

For instance, in terms of cash flow and growth, it scores 3 out of 5. Its profit health as well as overall score of 4 points is a great performance ranking.

At present, BRKb stock’s P/E, P/B and P/S ratios are 8.7x, 1.5x and 2.8x. Comparable metrics for the sector stand at 8.2x, 1.0x and 2.6x.

Our expectation is for BRKb stock to trade in wide range between $340 and $360 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding BRKb Stock To Portfolios

Berkshire Hathaway bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $496.43, as suggested by valuation models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has BRKb stock as a holding. Examples include:

- Financial Select Sector SPDR® Fund (NYSE:XLF)

- Davis Select US Equity (NYSE:DUSA)

- iShares US Financials ETF (NYSE:IYF)

- Absolute Core Strategy (NYSE:ABEQ)

- Invesco S&P 500® Momentum ETF (NYSE:SPMO)

- Blackrock Future US Themes ETF (NYSE:BTHM)

Finally, investors who expect Berkshire Hathaway stock to see new highs in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on Berkshire Hathaway stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On BRKb Stock

Price At Time Of Writing: $353.10

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., BRKb) and the same expiration date.

The trader wants Berkshire Hathaway stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the Sept. 16 expiry 360 strike call for $16.25 and selling the 370 strike call for $12.10.

Buying this call spread costs the investor around $4.15, or $415 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the BRKb stock price at expiration is below the strike price of the long call (or $360.00 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($10 – $4.15) x 100 = $585.

The trader will realize this maximum profit if the BRKb stock price is at or above the strike price of the short call (higher strike) at expiration (or $370 in our example).

Bottom Line

Berkshire Hathaway has had an impressive run in the past 12 months. Yet, despite potential volatility in the coming weeks, we expect the shares to perform well in future quarters as well.

Thus, buy-and-hold investors could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of BRKb stock.