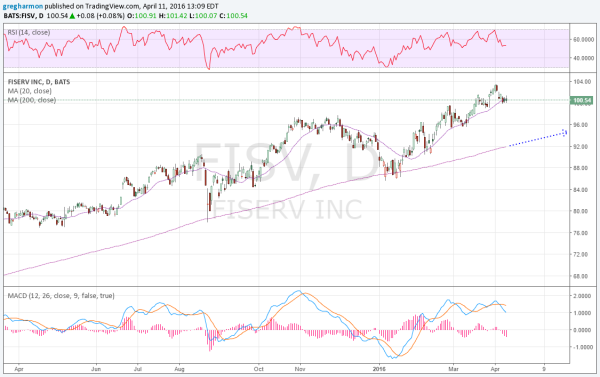

Some of the best stocks seem to always prevent a good lower entry. or at least that is what many traders will tell you. Fiserv (NASDAQ:FISV) is one of those stocks. This stock has been steadily moving higher for 4 and a half years. So what do you do if you want to get into this stock? Here are three ways to do it.

1. Forget about getting cute and just buy the stock. If you had bought that outrageous peak at 59 at the beginning of 2014 and suffered through a 10% drop you would be up 80% from that buy. Or the August 2015 peak over 90, you would be up 10%. Or even that peak at 97 in November you would be up after suffering a better than 10% fall.

If you want to watch more closely though then lets study the price action a bit. Fiserv has been above the 20 day SMA for nearly the entire run higher. When it has broken down it has found support at the 200 day SMA and recovered quickly. This gives the other two trades.

2. Buy a 1×2 Put Spread. With the stock back at the 20 day SMA and momentum still not reversing to the upside, there may be more downside in store for Fiserv. By buying a May 100/95 Put Spread for about $1.55 you can capture a move lower. But you have laid out $1.55 in capital to do so. If it bounces then you will lose that money. So sell another lower Put, either the may 95 for about $1.10 or the June 95 for $1.55 and your cash outlay can be reduced to zero.

If the stock bounces then you use margin until the short put expires, but hey interest rates are zero right? If the stock does fall lower then you may be put the stock. With the 200 day SMA climbing it should be around 94-96 by May expiry. If that holds up as support again then you would be put the stock but with a $90 basis. Instant equity.

3. Buy the stock and add a collar. The third method is somewhere in the middle. By the stock and immediately protect it with the collar. A collar is buying a put for protection and then selling a covered call to lower the cash outlay. For Fiserv you can buy the stock for about $100 and add a May 100 Strike Put for $2.75. Selling a September 110 Covered Call for $1.75 cuts the cash outlay for the collar to $1.

If you limit your downside protect to 95, by selling the May 95 Put and making it a Put Spread collar, then you cut your cash outlay to zero. You are protected down to the 200 day SMA in may and still have about 10% upside without getting called away.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.