The real estate sector emerged near the top of our internal Sector Scorecard, signaling this group has been outperforming amid relatively bearish expectations -- what we like to see as contrarians. What's more, the iShares US Real Estate (NYSE:IYR) could enjoy some seasonal tailwinds, if recent history is any indicator and exchange-traded fund (ETF) components Duke Realty Corporation (NYSE:DRE) and Medical Properties Trust Inc (NYSE:MPW) stocks could be bargains right now.

IYR Tends to Shine in April

IYR has been among the best ETFs to own in the month of April, looking back 10 years. Per data from Schaeffer's Senior Quantitative Analyst Rocky White, the fund has ended the month higher 80% of the time, averaging a gain of 4.63%.

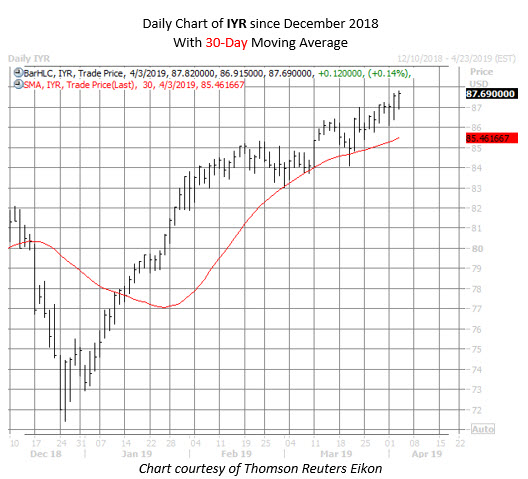

It's already been a banner year for IYR shares, which notched a fresh 12-year high of $87.84 earlier today. The ETF has rallied 17% already in 2019, with recent pullbacks contained by its 30-day moving average. Another 4.63% gain from IYR's current price of $87.69 would put the shares around $91.75 -- in territory not charted since early 2007 when the fund was exploring record highs.

Duke Realty Stock Flirts With New Highs

Currently, about 70% of real estate investment trusts (REITs) on our list are trading above their 80-day moving average, yet only 43% of covering analysts offer up "buy" ratings, per data from White. Plus, the average Schaeffer's put/call open interest ratio (SOIR) for the sector is a lofty 2.73 -- the highest of all sectors we follow, suggesting near-term options traders are pretty put-heavy right now.

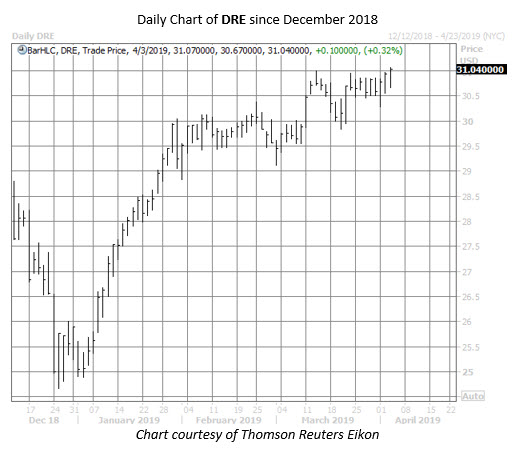

Which brings us to DRE. The security is fresh off its own decade-plus high of $31.07, tagged earlier today, and the stock has added close to 20% year-to-date. Plus, Duke Realty has been among the best stocks to own in April, ending higher eight of the past 10 years, with an average gain of more than 10%. Another 10.26% rally from DRE's current price of $31.04 would put the shares around $34.22 -- in the neighborhood, the security hasn't seen since 2007.

While absolute options volume runs light on Duke Realty, short-term options traders are more put-heavy than usual. The equity's SOIR of 1.72 is in the 84th percentile of its annual range, pointing to a bigger-than-normal put bias among open interest expiring within three months. An exodus of option bears could be a boon for DRE.

MPW Options Are Attractive

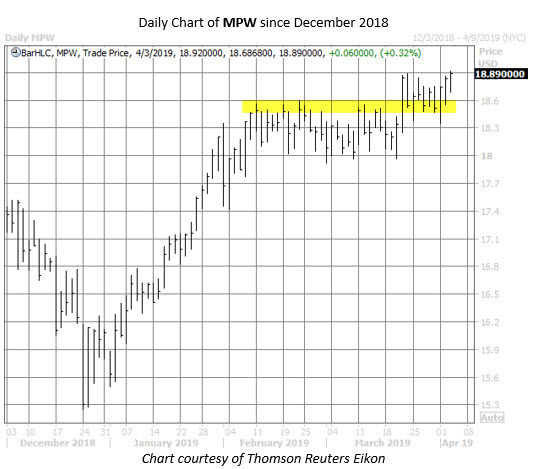

Among the other IYR components on our radar is Medical Properties Trust. The REIT just touched an all-time high of $18.92 today, after recently barreling north of resistance in the $18.50-$18.60 region. What's more, now could be an opportune time to roll the dice on higher highs for MPW.

Not only are the shares flirting with new highs, but their near-term options are attractively priced. The equity's Schaeffer's Volatility Index (SVI) of 18.1% is higher than just 19.3% of all other readings from the past year, suggesting short-term options are pricing in relatively modest volatility expectations for MPW.

Since 2008, there have been just two other times when Medical Properties shares were near an annual high while simultaneously sporting an SVI in the bottom 20% of its annual range. The REIT was higher one month later both times and averaged a gain of 7.5% over the subsequent four weeks. A similar pop would put MPW north of $20 for the first time ever.

In addition, despite MPW's outperformance in 2019, only 25% of analysts consider it worthy of a "buy" or better rating. This leaves the door wide open for potential upgrades to lure more buyers to the table.