- Cloud software heavyweight Salesforce.com shares have lost 17.5% since the beginning of 2022

- Dow-30 member, CRM stock will report Q4 earnings Mar. 1

- Long-term investors could consider buying CRM shares at current levels

Even after Salesforce (NYSE:CRM), the software-as-a-service (SaaS) giant, announced at last Sunday's Super Bowl it was partnering with Hollywood star Matthew McConaughey, committing to #TeamEarth, a global campaign aimed at inspiring businesses and individuals to build a more sustainable future, the stock has continued to languish.

So far this year, CRM is down 17.5%, and in the past 12 months the shares have lost 15.8%. Nonetheless, current fundamentals suggest the stock has significant upside potential.

By comparison, the Dow Jones Industrial Average—the 30-component mega cap index that includes CRM—is down 4.2% year-to-date. Meanwhile, the Dow Jones Software & Computer Services has lost 12.9%.

On Nov. 9, CRM shares went over $311 to hit a record high. But since then they have come under pressure. The stock’s 52-week range has been $201.51-$311.75, while the market capitalization stands at $162.1 billion.

Sales at the San Francisco-based customer relationship management (CRM) software solutions behemoth account for about one-third of the global CRM market and more than 150,000 companies use its products.

Readers will likely remember that, in July, Salesforce finalized its near-$28 billion acquisition of the enterprise chat platform Slack Technologies. Analysts continue debating whether this transaction will create or destroy value for shareholders.

The cloud-computing giant released Q3 financials Nov. 30. Revenue was $6.86 billion, implying an increase of 27% year-over-year. Adjusted earnings per share for the period was $1.27, compared with $1.74 a year ago.

On the results, co-CEO Marc Benioff commented:

“We delivered another phenomenal quarter, fueling strong revenue growth, margin and cash flow… With the tremendous strength of our Customer 360 platform and Slack, we’re on track to reach $50 billion revenue in FY26.”

In Q4, management forecasts revenue to come in between $7.22 billion and $7.23 billion, up 24% YOY. This guidance assumes a $285 million contribution from Slack. However, EPS for the December quarter will be between 72 and 73 cents, lower than analysts’ estimates.

Prior to the release of the quarterly results, Salesforce stock was around $285. But now, it is trading around $208.80. This means CRM shares have lost more than 32.5% since hitting a record high of $311.75 on Nov. 9.

As a reminder, the company is set to release its Q4 figures on Mar. 1, after the market close. Therefore, there could be further volatility between now and the earnings date.

What To Expect From Salesforce.com Stock

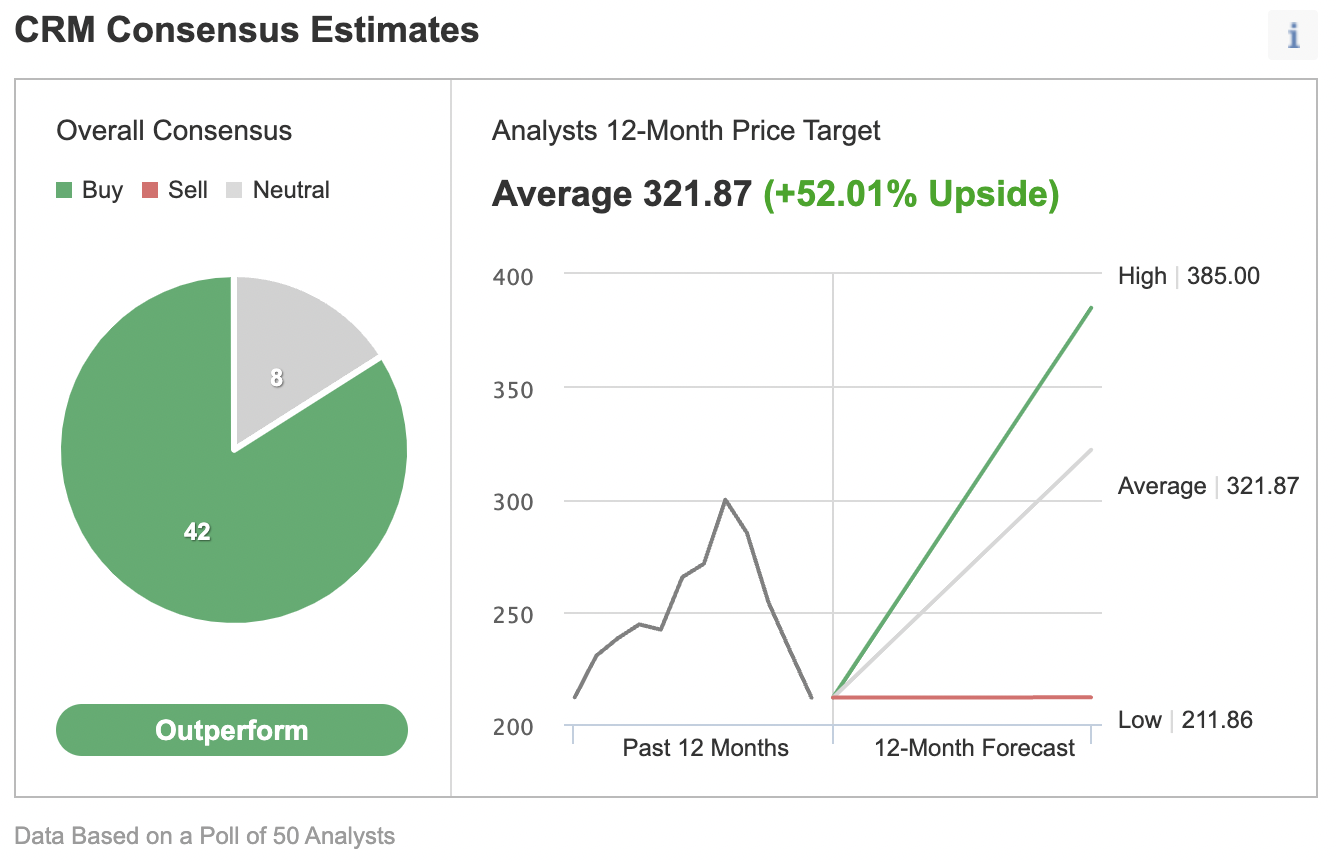

Among 50 analysts polled by Investing.com, CRM stock has an "outperform" rating.

Wall Street also has a 12-month median price target of $321.87 for the stock, implying an increase of more than 53% from current levels. The 12-month price range currently stands between $211.86 and $385.

Source: Investing.com

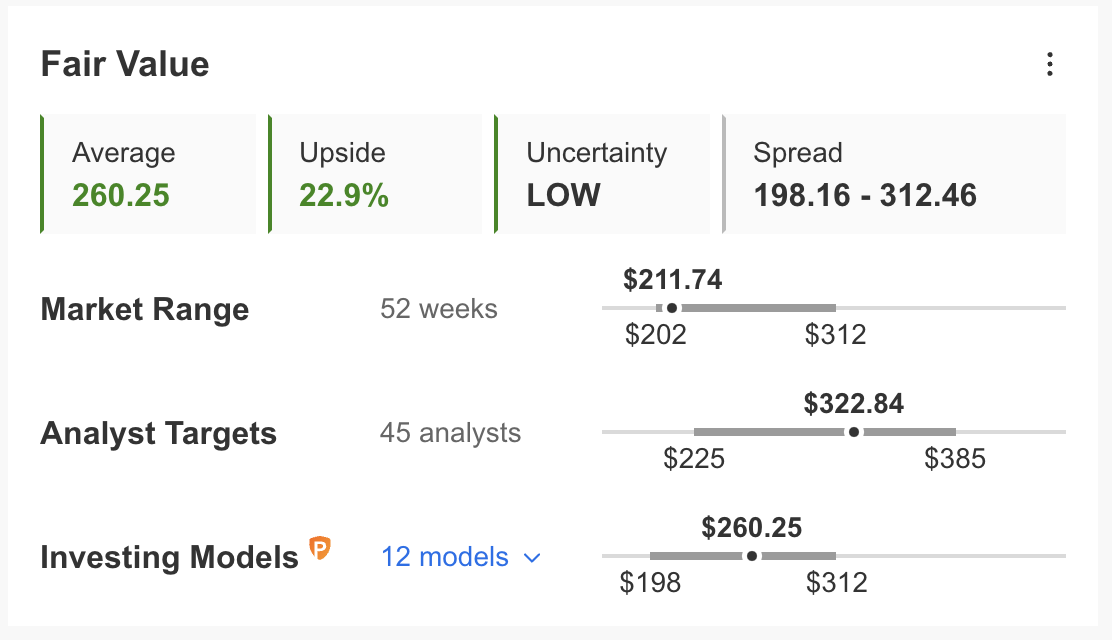

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Salesforce.com stock via InvestingPro stands at $260.25.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase about 24%.

We can also look at Salesforce’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

For instance, in terms of cash flow, growth and profit, it scores 3 out of 5. Its overall score of 3 points is a good performance ranking.

At present, CRM’s P/E, P/B and P/S ratios are 118.5x, 3.6x and 8.2x. Comparable metrics for peers stand at 14.4x, 2.3x and 2.8x. These numbers show that despite the recent decline in price, the fundamental valuation for CRM stock is still on the rich side.

Our expectation is for Salesforce stock to build a base between $195 and $205 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding CRM Stock To Portfolios

Salesforce bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $260.25, the fundamental value forecast by InvestingPro.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has CRM stock as a holding. Examples would include:

- iShares Expanded Tech-Software Sector ETF (NYSE:IGV)

- First Trust Dow Jones Internet Index Fund (NYSE:FDN)

- SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA)

- Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ)

Finally, investors who expect Salesforce.com stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on CRM stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Salesforce Stock

Intraday Price At Time Of Writing: $208.80

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Salesforce) and the same expiration date.

The trader wants CRM stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the June 17 expiry 210 strike call for $18.60 and selling the 220 strike call for $14.00.

Buying this call spread costs the investor around $4.60, or $460 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the CRM stock price at expiration is below the strike price of the long call (or $210 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($10 – $4.60) x 100 = $540.

The trader will realize this maximum profit if the Salesforce stock price is at or above the strike price of the short call (higher strike) at expiration (or $220 in our example).

Bottom Line

Since November, Salesforce.com stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors who could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of CRM stock.