It is back to the grind, but at lest it is a short tail to the week. The fireworks celebrations Wednesday were incredible, but they are over now. You will have to wait until next year for that magnificence, unless you follow the markets. As we round out this holiday week Friday morning sees the first tariffs put in place against Chinese imports and retaliation from the Chinese. A different type of fireworks, that hopefully does not crescendo into the full blown shows from Wednesday night.

Meanwhile in a sneaky way my Indians baseball team built a sneaky 11½ game lead over Minnesota in the American League Central Division. As my mind shifts to baseball and the upcoming All-star game, it also recognizes a baseball phenomenon in the markets. Treasury Bonds ($TLT) have also been surging over the last two weeks. Friday morning sees the Bond ETF back at resistance. In fact it is the third time at resistance. Will it be 3 strikes and you’re out for Treasuries?

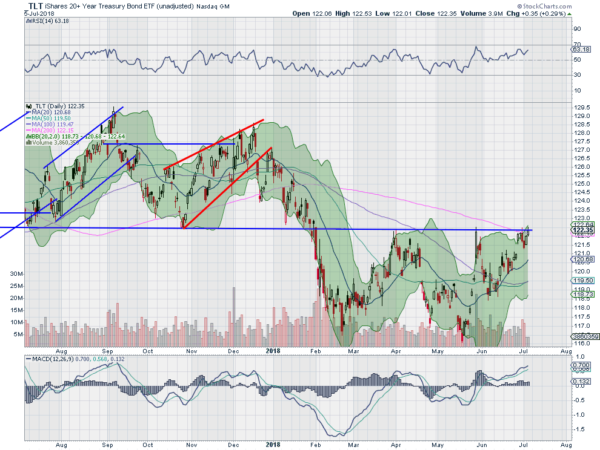

The chart above shows the break of support in January, and continued drop to a low in February. The bounce from there met resistance at prior support and pulled back, Strike One. It fell back to the prior low and then reversed higher. Again it stopped out at the prior resistance, once support, Strike Two. No Double Bottom confirmation as it reversed lower. It found support at a higher low this time though and reversed back higher. Where has it met resistance? Yup, the same area. Will this be Strike Three with another reversal lower? Or will the “W-v” pattern confirm with a breakthrough to a new higher high?

Momentum supports more upside. The RSI is rising in the bullish zone. The MACD is rising and positive. Neither indicator are at extreme levels. The price is right at the 200 day SMA though. Below that remains bearish for many, so Friday’s close carries a lot of weight. An overshoot often accompanies moves that drive to important levels. If the ETF can hold over 123 into next week and continue higher then buyers may start to flock in. A failure again and subsequent break below the June low will bring calls for the end of bonds again.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.