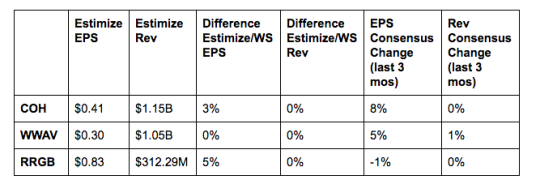

Coach Inc (NYSE:COH): Kate Spade (NYSE:KATE) kicked off earnings season for luxury brands on quite a sour note. After missing expectations the stock plunged over 20%. Unfortunately a weak quarter from KATE might bode well for Coach and other luxury brands reporting this week. Coach has only recently dug itself out of the hole. In the past 12 months shares are up 27% as comparable store sales begin to gain traction. North American comparables have steadily improved after comps declined by double digits every quarter last year. The new Disney collection along with an emphasize on lower price merchandise and e-commerce growth have helped drive sales. The problem with discounting is that it takes a toll on gross margins. Coach outlets currently account for 65% of total revenue, so it might be difficult to avoid weak margins.

Whitewave Foods (NYSE:WWAV): Last month Danone announced it would purchase WhiteWave for $56.25 per share. WhiteWave is currently trading below the buyout price but strong earnings and forward guidance could easily send the stock past that number. The shift in consumer preferences towards natural and organic food has driven demand for many of WhiteWave’s products. Revenue has steadily increased throughout the year while earnings have also shown improvement. Last quarter featured a beat on both the top and bottom line which caused the stock to pop almost 10%. This quarter might turn out differently though given the recent takeover. The conference call will shed some light on the deal and its impact on future quarters

Red Robin Gourmet Burgers (NASDAQ:RRGB): Red Robin has made a habit of missing revenue estimates and beating on earnings. The last 4 quarters have followed this trend as rising costs and softer consumer demand take their toll. Shares are down almost 46% in the past 12 months with very few signs of picking up anytime soon. Higher labor costs coupled with rising beef prices aren’t helping the burger chain hit its numbers. Nonetheless the company has taken initiatives to improve traffic and comparable store sales. They include menu innovations, renovation projects and using technology to improve the customer experience.