The fact that X (Twitter) continues to run equally well with 80% reduced staff has been a turning point for shareholder pressure. In 2023, tech companies laid off 262,595 employees. In January 2024, this trend not only continued with nearly 30k reductions but also spread to the non-tech sector.

From PayPal (NASDAQ: NASDAQ:PYPL) and United Parcel Service Inc (NYSE:UPS) to Citigroup Inc (NYSE:C) and Goldman Sachs Group Inc (NYSE:GS), companies are united in saving costs and integrating AI as the main reasons for layoffs ahead of a potential recession. While this suggests greater operating margins in the future, it may also indicate that many companies are overbought.

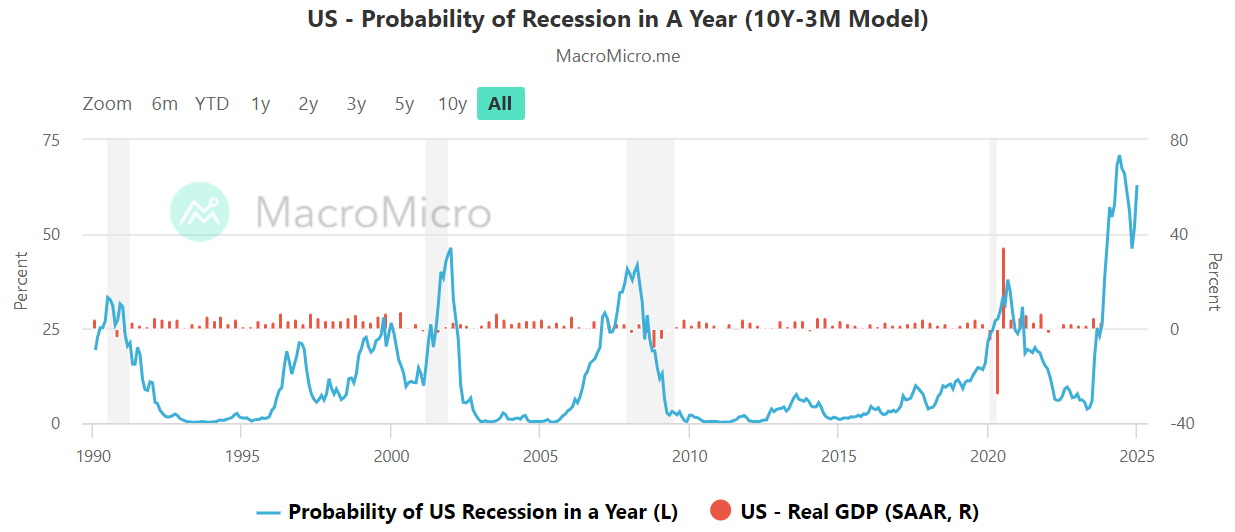

Recession Probability Not Going Down

A similar dynamic happened nearly 24 years ago when the dot-com bubble burst in March 2000. With Nasdaq losing ~78% points, rapid gains during that period were erased due to overinvestment and failure to deliver. Recession followed suit in 2001, the same year of the 9/11 attacks.

This time around, the heavily indicated recession will likely unwind company valuations. After all, both consumer spending and business investments go down during these periods.

Presently, the Buffett indicator, as the ratio between the total value of publicly traded stocks and GDP, is drastically more elevated than during the dot-com bubble. Which stocks are the most likely to lose most of their gains in this scenario?

Apple Inc

It is no secret that this $2.86 trillion company relies heavily on stock buybacks to boost earnings per share (EPS) for shareholders. Over the last decade, Apple Inc (NASDAQ:AAPL) has been the stock buyback king, having spent an astronomical $573 billion.

For FY2023 alone, Apple spent $77.5 billion on share repurchases. Bloomberg called this strategy central to Apple’s “safe haven” investment thesis. Because stock buybacks reduce the pool of outstanding shares, investors gain both a portfolio and confidence boost.

However, this strategy is likely unsustainable, eventually forcing Apple to tap into debt to generate the same level of boost. In a recessionary environment, Apple’s core business model is also threatened, as there are few incentives to buy slightly different yet expensive phones.

In the last earnings report, Apple’s earnings stalled, down 3% from 2022. The company’s next report is scheduled for February 1st. For 2023, Apple’s price-to-earnings ratio (P/E) is 30.68, measuring the current share price to its EPS.

Such a high P/E ratio indicates that investors are highly optimistic about Apple’s future growth. They are reliant on stock buybacks and uncertain demand in the heavily saturated and mature smartphone market, which has limited space to grow for value investors.

Carvana Co

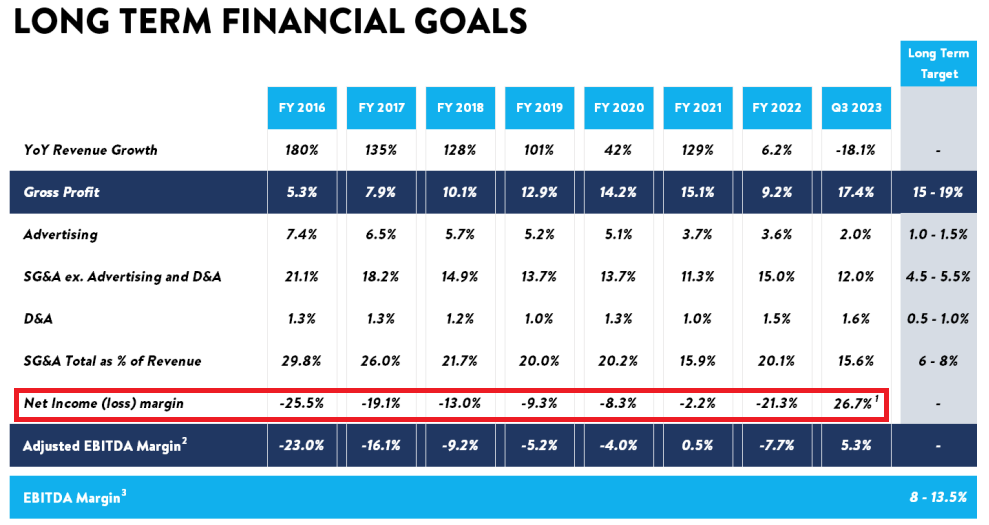

Over one year, this online car retailer Carvana Co (NYSE:CVNA) for used cars has increased by 334%. Over the last three months, the company gained a 60% stock valuation. By plugging into multiple sources to find cars that are reconditioned and listed, the company either delivers them or has pick-up locations for customers.

During this process, customers gain competitive financing, guaranteed value, and a comfortable online experience that doesn’t waste time. Carvana churns revenue via car sales, extended warranties, interest on financing, and other plans.

However, as previous recessions showed, the demand for used cars decreased. Carvana’s innovative business model may weather the likely demand suppression by offering auctions, but the company has yet to deliver consistent profits.

Only in the Q3 2023 earnings report did Carvana deliver its first large net income of $741 million after consecutive net income losses.

Although Carvana’s business model is innovative, it is also unproven, especially in a recessionary environment.

Uranium Energy (NYSE:UEC)

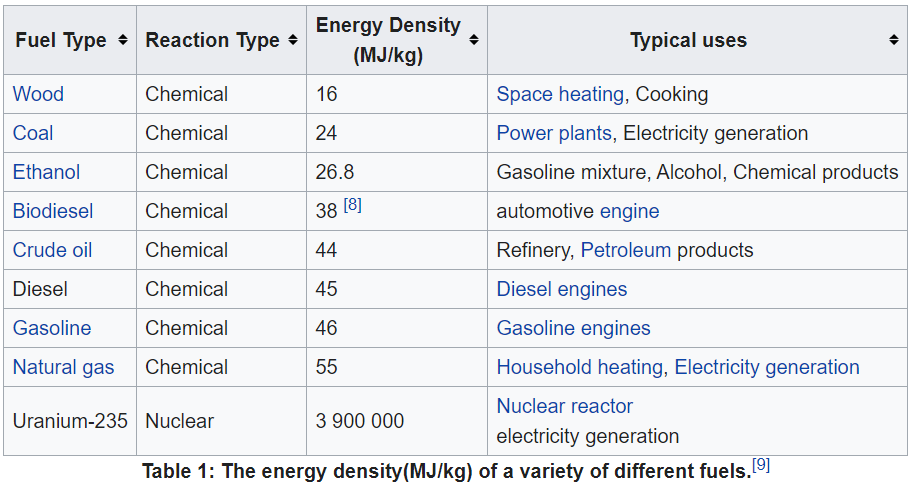

Both solar and wind power alternatives have gained a reputation for being unreliable, material intensive, wasteful, acreage-hungry, and delivering low energy density. In contrast, nuclear power has the highest energy density of all power sources, while also being “green”.

In February 2023, even the European Commission proposed that nuclear energy, fueled by hydrogen, be considered green and “low-carbon. ” Most recently, the EU has been pushing to deploy small modular reactors (SMRs) as an alternative to large nuclear power plants.

This translates to a higher demand for uranium. In turn, uranium mining stocks have skyrocketed. Over one year, UEC gained an 87% valuation boost, up 726% since 2020. Uranium Energy’s latest financial report submitted in December shows an 11.6% decline in net income compared to a year-ago quarter.

While still a long-term play if current trends continue, the company’s 794.3 P/E ratio suggests overvaluation due to investor exuberance based on a sound thesis.

Disclaimer:

The author does not hold or have a position in any securities discussed in the article. Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.