With the market pulling back in let’s take a look at a few charts that may be the next breakouts in play.

Inspire Medical Systems Inc (NYSE:INSP) is a recent IPO (from May 2018) that is trading in a tight range on the weekly chart just below its all-time high. Note that volume was well above average when $INSP cleared resistance at $48 and closed above the downtrend line, which is a bullish sign.

$INSP lacks earnings but does have four quarters in a row of +80% revenue growth.

A move through the highs of the current three-week trading range is the obvious buy point, though the daily chart can be monitored for a lower entry on partial size with the idea of adding on strength. Look for a significant pick up in volume on the move out to confirm the technical pattern.

Reports earnings Feb. 26

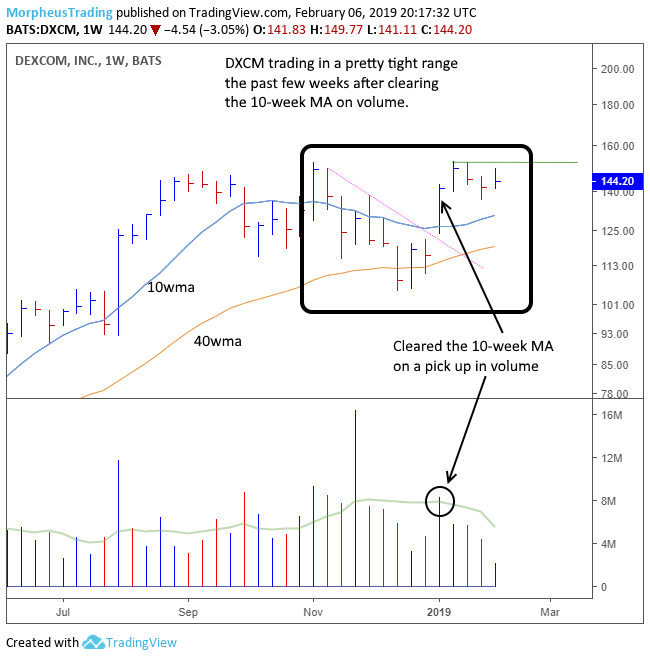

DexCom Inc (NASDAQ:DXCM) gapped above the downtrend line and the 10-week moving average on a pick up in volume a few weeks ago and has since been trading in a tight range. The current tight range is a handle (short term and tight consolidation), which should be monitored closely for a buy point. The obvious entry is over the recent swing high but an earlier entry could develop such as a break of the downtrend line connected from the high of 1/22 to 2/6.

$DXCM also lacks earnings but has impressive revenue growth at +40% the past two quarters and over eight quarters in a row of +20%.

Reports earnings Feb. 21

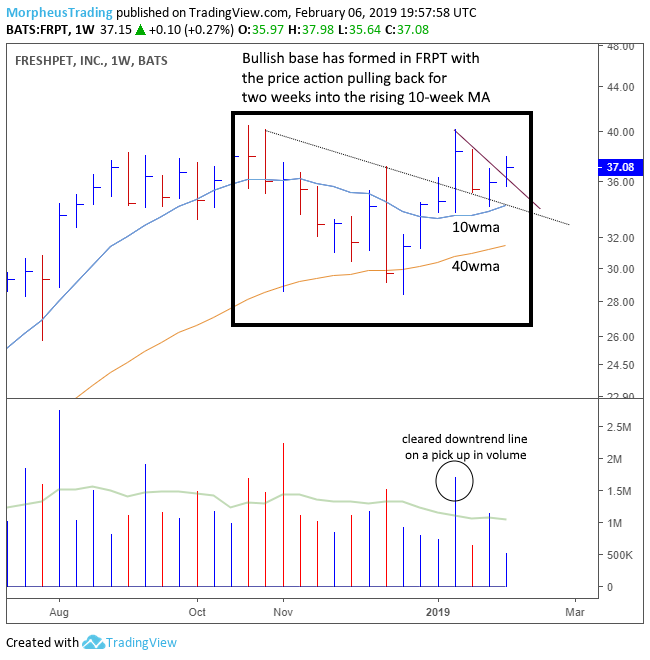

Freshpet Inc (NASDAQ:FRPT)broke out to new all-time highs in 2018 after clearing the prior high at $26. The prior high was set in 2015 just a few months after its IPO in November 2014. Like the two setups above, $FRPT also cleared the downtrend line on a pick up in volume. The pullback off the recent swing high is deeper in $FRPT than in $INSP or $DXCM, but the pullback did find support above the rising 10-week moving average.

The price action surged above the short-term downtrend line this week, which is a positive sign if the price holds above $36.

Reports earnings Feb. 26.

The analysis above is part of what we do in our nightly report The Wagner Daily, which is focused on small and mid-cap growth stocks that have explosive potential.