- The Hershey Company faces cyclical commodity headwinds but remains a sweet long-term dividend payer.

- Investors are piling into Home Depot stock in anticipation of a revival in the housing market.

- UnitedHealth Group remains one of the best growth and income stocks for buy-and-hold investors.

On September 27, 2024, investors will get the latest reading on inflation from the Personal Consumption Expenditures (PCE) index. In August, the reading came in at 2.5%. This means that year-over-year prices were increasing by 2.5%.

It’s no wonder that many consumers, particularly low- and middle-income consumers, are still feeling the pinch from inflation. But for dividend investors, a 2.5% rate of inflation provides a good opportunity to find inflation-beating investments.

Many companies raise their dividends. However, the group of companies that raise their dividend above the rate of inflation is smaller. And finding companies that raise their dividend at more than four times the rate of inflation is rarer still.

We've found three stocks that have a history of raising their dividend at more than four times the rate of inflation. This ensures that your income stream will grow faster than prices are rising. Not only do these companies have growing dividends, they’re also in sectors that stand to benefit from lower interest rates.

This Stock Is Ready to Give Investors a Sweet Return

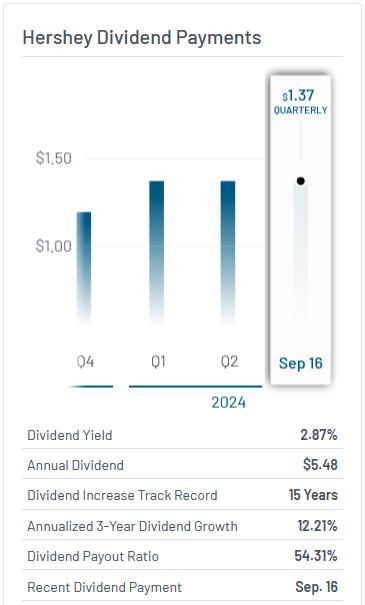

The Hershey Company (NYSE:HSY) is one for investors to watch closely as interest rates fall. In 2024, Hershey raised its dividend for the 15th consecutive year. The 15% increase from $1.19 to $1.37 per share was higher than the 3-year annualized dividend growth of 12.21%. This means that even when inflation was coming in above 9%, Hershey was rewarding investors with an inflation-beating return.

And that’s not the only reason to consider starting a position. HSY stock is up just 4.3% in 2024 and is still down 6.3% in the last 12 months. However, Hershey is on of only a handful of packaged foods companies to post a positive return in 2024.

The bearish view looks at the growth of GLP-1 drugs as a long-term threat to the confectionery industry. That’s not reflected in the company’s financials, as year-over-year revenue is still growing.

The bigger issue is lower earnings, with higher cocoa prices pressuring the company’s margins. The bottom line is that Hershey’s may not have an appetite for HSY stock, but it remains a tasty long-term investment.

A Housing Surge Will Make This a Must-Own Stock

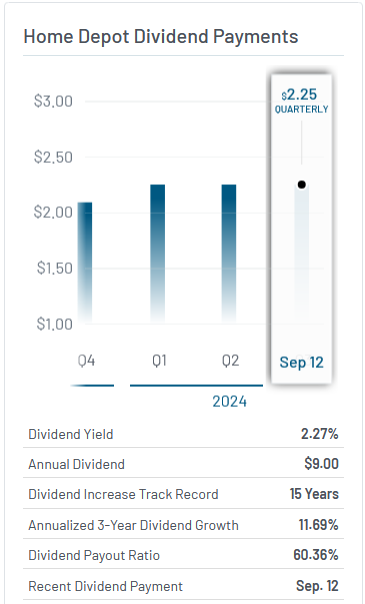

Home Depot (NYSE:HD) is up 14.6% in 2024 and 30% in the last 12 months. And at 26x forward earnings, HD stock may look fairly valued, if not slightly overvalued among retail stocks. That’s reflected in the consensus price target that indicates the stock may be due for a pullback. But much of that growth has come in the last three months, and there are reasons for that. The company is benefiting from the rotation out of technology stocks.

Investors were trying to front-run the Federal Reserve’s policy shift and housing stocks were a solid choice. If the housing market gets the anticipated bump from lower interest rates, home improvement companies stand to benefit.

That's particularly true if you’re a dividend investor. Over the last three years, HD stock has increased its dividend by an average of 11.69%. The company has increased its dividend for 15 consecutive years and the annual payout of $9 per share is attractive for long-term investors.

This Blue-Chip Healthcare Stock Is a No-Brainer Dividend Payer

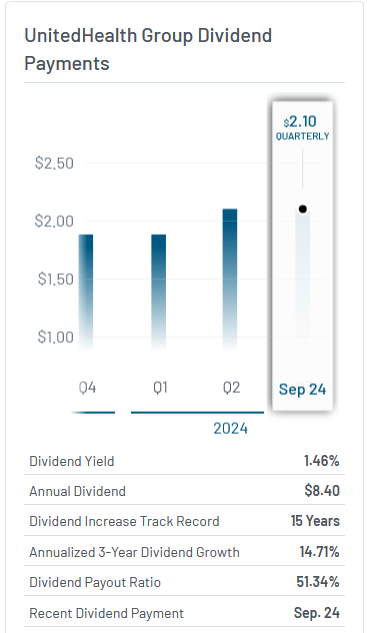

The healthcare sector is an evergreen choice for investors. And if you’re considering medical stocks with the potential for both growth and income, UnitedHealth Group (NYSE:UNH) is a no-brainer choice.

In addition to its namesake health insurance, the company owns the Optum network which provides advanced data and technology to help deliver analytics-based, affordable healthcare.

UnitedHealth is one of the nation’s largest health insurance companies, as reflected in its market cap of over $560 billion. The company’s recent acquisition of LHC Group (NASDAQ:LHCG) is expanding the company’s home healthcare business. The aging of America continues to become a present issue, and this acquisition should extend the company’s runway for revenue and earnings growth.

Over the last 10 years, UNH stock has delivered a total return of 670.94%. And part of that growth comes from the company’s dividend which has grown at an annualized average rate of 14.71% in the last three years. The company has also increased its dividend for the last 15 consecutive years.