The world of bond funds is generally split along two distinct lines: active and passive. You either own the benchmark or you place your bets with the fund manager who is proactively trying to beat it. Both strategies offer numerous benefits and risks depending on your investment objectives.

With a passive index, you know exactly what you own and that you are going to get every tick of associated price movement from the portfolio. There are strict rules on what securities can be admitted and when they are rebalanced. These funds also offer the lowest costs in terms of direct investment expenses.

With active funds, you are going to be subject to the discretion of the fund manager and their positioning variances versus the benchmark. Active funds are typically focused on higher yields, risk management, or other differentiated bond strategies to achieve their goals. This hands-on management style has historically meant higher embedded costs for shareholders as well.

The third dynamic that is rarely talked about in the fixed-income world are smart beta funds. ETFs that marry an active philosophy with the rules-based criteria of an established index. This relatively new category is attempting to create the alpha of an active manager with reasonable fees and dependable guidelines that investors can rely on.

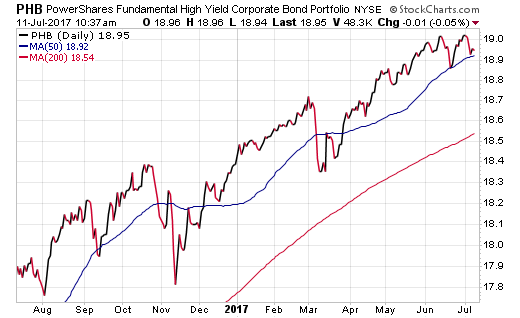

One of the pioneers in this arena is PowerShares amental High Yield Corporate Bond Portfolio (NYSE:PHB). As its name implies, this exchange-traded fund takes a variant approach to security selection by weighting junk bonds according to fundamental criteria of the issuers. The index looks at company size, cash flow, dividends, and book value to select holdings based on the issuer’s ability to service its debt.

This potentially allows PHB to decrease exposure to companies with the heaviest levels of debt, while still retaining fixed-rate high yield bond exposure. PHB also distinguishes itself with a monthly rebalancing schedule to continually stay within the bounds of its index mandate. The fund currently has $1.15 billion in assets under management and charges an expense ratio of 0.50%.

This type of smart beta ETF would compete against the likes of the iShares iBoxx $ High Yield Corporate Bond ETF(NYSE:HYG), which has nearly $18 billion in assets and charges an expense ratio of 0.49%.

Another clever fund in this category with a focus on yield is the WisdomTree Barclays (LON:BARC) Yield Enhanced US Aggregate Bond (NYSE:AGGY). This ETF takes the original Barclay’s U.S. Aggregate Bond Index and re-weights the underlying components to enhance the monthly income of the portfolio. The goal is to adjust the sub-groups without substantially altering the risk criteria of the original benchmark.

AGGY currently carries a 30-day SEC yield of 2.78% versus 2.27% in theiShares Core US Aggregate Bond ETF (NYSE:AGG). That half percent pickup in yield may not seem like much, but can be appreciable over time for those who want the familiarity of a highly diversified core fixed-income fund. It’s also notable that AGGY charges a very reasonable 0.12% net expense ratio for access to this strategy.

Lastly, the IQ Enhanced Core Plus Bond US ETF (NYSE:AGGP) sets itself apart from the pack by owning a unique mix of underlying bond ETFs that shift based on momentum. The index-based AGGP seeks to capitalize on the hottest trends in the bond market by overweighting or underweighting corporate, treasury, and mortgage-backed securities. The fund can own up to 25% high yield debt and up to 5% in emerging market bonds as well.

This type of fund may appeal to those who admire trend following or active rotation strategies. The “fund of funds” strategy allows AGGP to quickly pivot the underlying portfolio while still retaining a high degree of liquidity and diversification. The rules-based criteria is designed to serve as a core holding without the steadfast bounds that most aggregate indexes are accountable to.

AGGP charges a management fee of 0.20% and adds another 0.15% in acquired fund fees of the underlying positions. It recently celebrated its one-year anniversary and has managed to accumulate over $250 million in that short period.

The Bottom Line

Bond investors are continually faced with managing factors such as credit and interest rate risk, while attaining a suitable yield and return profile to satisfy their needs. These smart beta funds and others like them may help achieve those goals with more manageable costs than traditional active alternatives.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.