Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup July 31, 2019

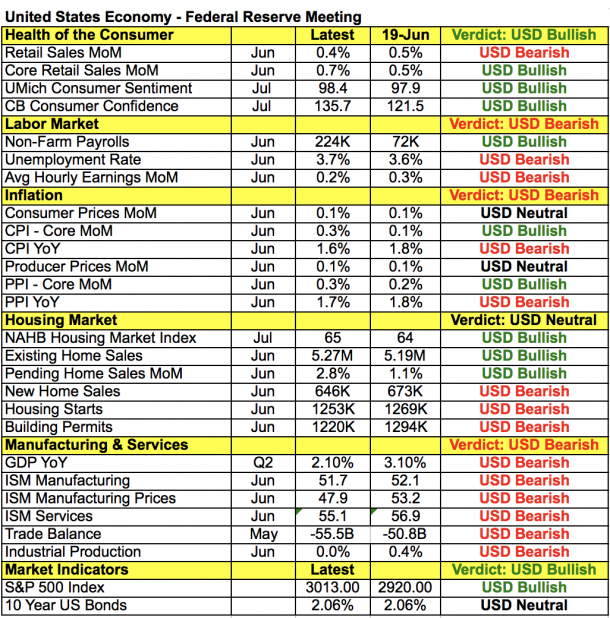

For the first time since the global financial crisis the Federal Reserve lowered the interest rate by 25bp. The rate cut itself wasn't a surprise as the market fully discounted the move weeks ago after the June monetary policy announcement. The Fed has given us zero reason to expect anything except a quarter point rate cut so the change in interest rates will be the least market moving part of the FOMC announcement. Instead, US dollar traders should be focused on the votes and forward guidance. We have a number of reasons to believe that the Fed will signal that this week’s preventive cut is all that is needed this year. When the central bank met in June they made it clear that their monetary policy actions will depend on incoming data. Taking a look at the table below, activity in the manufacturing and service sectors slowed but non-farm payrolls rebounded strongly in June, core retail sales increased at a faster pace and stocks hit a record high. A number of US policymakers vocalized their support for a 25bp rate cut but many of them are also describing the move as preventive and insurance against risk. If insurance is all they are looking for, there’s no need to set the stage for another round of easing especially since the Fed doesn’t know if additional easing is needed at this stage.

The argument can also be made for leaving the door open to another quarter point cut. According to last month’s dot plot forecast at least 7 policymakers favored 50bp of easing. With inflation running at 1.6% and job growth likely to slow in July, a quarter point rate cut is what the economy needs right now. But all of the uncertainty that led to this move remains a threat to the economy. China and the US are no closer to a trade deal, business investment continues to slow and Chinese foreign direct investment is down 90%. Manufacturing activity hit a 32 month low amid weakening demand and service sector activity is faltering. The chance of a trade deal being reached in the next 2 or 3 months is slim and this ongoing uncertainty will continue to deter trade and investment activity. While a complete breakdown in trade talks will mandate another rate cut, this slow bleed could also lead to further action. The reality is that the door needs to remain open to additional easing and Fed Chairman Powell may choose to make that clear on Wednesday.

If you are trading FOMC, the most important parts of the monetary policy announcement will be the votes and Fed Chairman Powell’s press conference.

Scenario 1 – If the decision to cut by 25bp is unanimous (with no dissents for a smaller or larger move) and Powell keeps a tight lip on further action, the US dollar will soar. The biggest beneficiaries should be USD/JPY, USD/CHF and EUR/USD. In this case, we would not be surprised to see USD/JPY break 109.50.

Scenario 2 – If 2 or more FOMC voters favor a more aggressive move and Powell leaves the door open to further action, the dollar will tank with USD/JPY set for a move below 107.50.

Scenario 3 – And in the event that there’s a dissent but Powell is noncommittal about further easing, the dollar’s reaction will hinge on whether there’s more dissent in favor of no change or a bigger cut. Since the outlook is uncertain and the Fed’s mind hasn’t been set, the July non-farm payrolls report on Friday will also be market moving.