Finding a great growth stock can be a tough task. Not only are there a wide range of choices, but the space can be extremely volatile and fraught with risk as well. But thanks to our new style score system we have been able to identify a few growth stocks which have incredible potential in the near term.

One such company that stands out in this regard is undoubtedly Korea Electric Power Corp. (NYSE:KEP) . Not only does this company have a favorable growth score, but it is ranked as a buy too. And while there are numerous reasons why KEP is so attractive right now, we have highlighted three of the most important—and pertinent to growth investors—below:

Cash Flow Growth for KEP

Cash is the lifeblood of any business, but especially so for growth oriented companies. A positive figure here indicates that cash is flowing into the business (obviously a good thing), while a negative reading here means that net cash is exiting the company.

Right now, KEP’s current cash flow growth is an impressive 84.4%, a level that is far higher than many of its peers, and the industry average. In fact, the industry average sees cash flow growth of just 2.03% in comparison, suggesting that KEP is a better pick from a cash flow look.

Sales/Assets Ratio is Impressive for Korea Electric Power Stock

The sales/asset ratio is often overlooked by investors, but it can be an important indicator in growth investing nonetheless. This metric—also known as S/TA for short—shows us how much sales are generated from the company’s assets which can indicate that a firm is using its assets effectively.

Right now Korea Electric Power has a S/TA ratio of 0.37 which means that the company gets 37 cents in sales for each dollar in assets. Compare this to the industry average which is a ratio of 0.26 and you can say that KEP is a bit more efficient than the industry at large.

KEP Earnings Estimate Revisions Moving in the Right Direction

If the metrics outlined above weren’t enough investors should also consider the positive trends that we are seeing on the analyst estimate revision front. Analysts have been raising their estimates for Korea Electric Power lately, and now the earnings picture is looking a bit more favorable for the company.

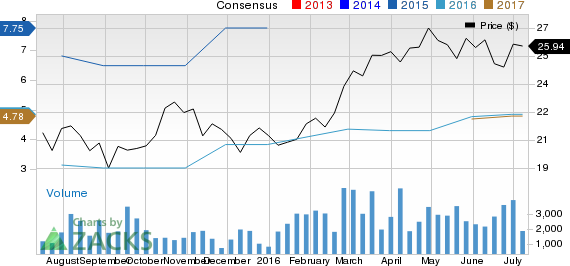

Over the past 30 days, 1 EPS estimate has been revised higher compared to none lower, at least for the current year time frame. And the magnitude of these revisions has also been impressive, as the consensus estimate for the full year has surged from $4.76 per share to $4.84 per share today.

Bottom Line

For the reasons outlined above, investors shouldn’t be surprised to note that Korea Electric Power has earned itself a growth score of ‘B’ as well as a Zacks Rank #2 (Buy). This means that we believe Korea Electric Power stock is a potential outperformer that is an impressive choice for growth investors, making it a security that you need to keep on your radar in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

KOREA ELEC PWR (KEP): Free Stock Analysis Report

Original post

Zacks Investment Research