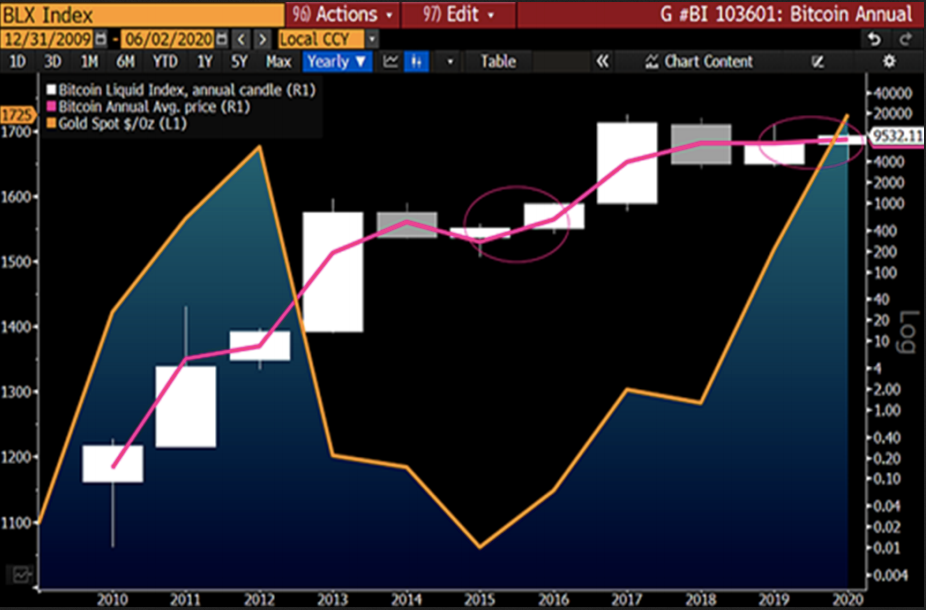

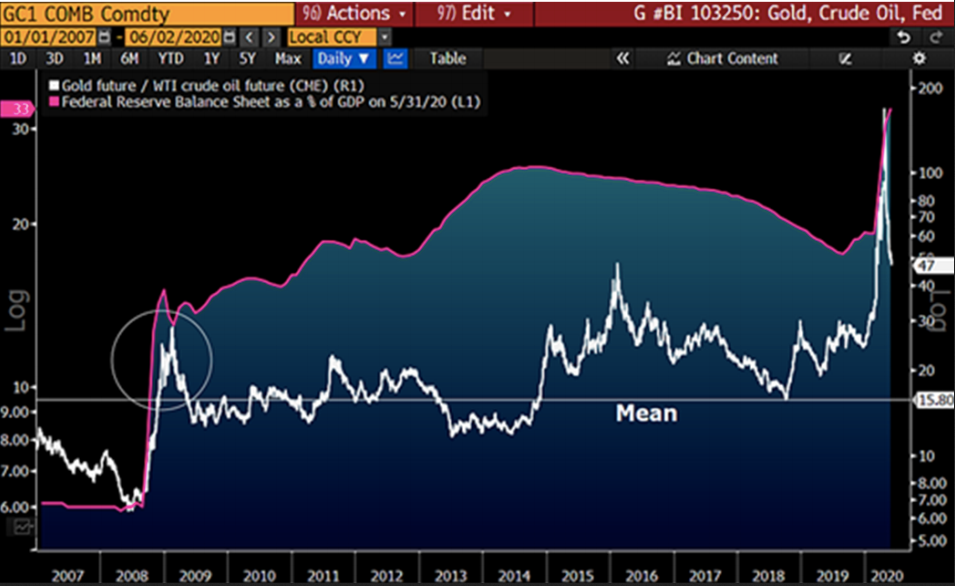

A recent analysis outlines trends in current markets that make gold and its digital counterpart, Bitcoin, highly attractive assets. Bloomberg analysts are backing Bitcoin and gold as their top candidates to perform in 2020. There are several catalysts in play for BTC that could propel the digital asset to its all-time high in the near future. Safe-haven assets like BTC and gold are expected to take precedence in investor portfolios as a global economic depression surfaces. High levels of unemployment, demand and supply shocks, and social unrest in large parts of the world are drawing attention to effective portfolio hedges. Gold has cemented its place as an economic hedge thanks to its longstanding history as a medium of exchange and store of value. Newcome Bitcoin is paving a similar path by gradually achieving that trust in the market. In a detailed report, Bloomberg outlines their thesis for the remaining half of 2020, identifying Bitcoin and gold as protective measures against “unparalleled central bank easing.” By providing its investors with portfolio protection when the stock market unravels, there is potential for Bitcoin to shoot to mainstream popularity as a better hedge than gold. Bloomberg’s report concludes that a positive year is in store for Bitcoin. Although the report observes a plethora of possible catalysts for Bitcoin, three points stand out. First, Bitcoin is an uptrend that closely resembles price action from 2016, when the network underwent its second block reward halving from 25 BTC to 12.5 BTC. “Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend,” wrote Bloomberg’s analysts. This is a popular narrative within the crypto community, especially since the third block reward halving was implemented a month ago. The supply reduction tends to skew the network’s economics into a position where demand overpowers supply and causes the price of BTC to appreciate. Second, Bitcoin has matured quicker than most expected. This maturation is signified by Bitcoin weathering mega stock market rallies and a crash in crude oil prices, while simultaneously acting as the anchor for the remaining $100 billion of the cryptocurrency market. Bitcoin derivatives have seen immense growth in the last year, too, with the emerging futures market driving some of Bitcoin’s most noteworthy moves. The rise of derivatives signals interest from institutional speculators and investors using futures and options to hedge their spot market exposure. Finally, the chain of events set forth by COVID-19 is shaping a future in which Bitcoin will thrive. People are fighting back against the authority of the state, with massive protests in Hong Kong and the United States cascading across the globe. On the economic side, COVID-19 has cornered the Fed, and now the bank is attempting to print its way out of the mess – a tactic despised by few but rendered ineffective by most. Nobody can print more gold or Bitcoin. The immutable monetary policy of digital gold may initially seem irrational, but it has redeemed itself in today’s times, receiving plaudits from the likes of Paul Tudor Jones. As the current states of affairs continue to unravel, Bitcoin and gold could be laying the foundation for a bull run.Key Takeaways

Bitcoin and Gold in 2020

Top Reasons for a Continued Bull Market

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Reasons Why Analysts Are Bullish On Bitcoin

Published 06/04/2020, 07:05 AM

3 Reasons Why Analysts Are Bullish On Bitcoin

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.