History tends to punish bull markets when speculative frenzies hover around a narrowing list of stand-outs (e.g., Netflix, First Solar, etc.), an increasing number of initial public offerings (e.g., Twitter, Container Store, etc.) and/or a dramatic rise in margin debt. Perhaps ominously, all three circumstances currently exist, with margin debt at an all-time peak and IPOs at their highest level since 2007.

Clearly, one could add dozens of reasons why the stock market might burst like an unchecked water heater. An extremely overvalued cyclically adjusted P/E near 25, an unsustainable price-sales ratio of 1.5 and companies like Tesla being valued at roughly 1/2 the price of General Motors are unsettling. (Does anyone even think about the reality that the revenue at General Motors is 75x greater than sales at Tesla?)

The truth of the matter is that investing success requires participation regardless of whether the exuberance is rational, irrational or somewhere in between. You cannot achieve gains without being in markets that are rising. On the other hand, you will not be able to soften the blow of bearish losses on a diversified prayer; that is, successful investors understand the mathematical necessity of reducing one’s allocation to asset classes that are breaking down. In essence, you have to a plan to minimize the risk of downtrends.

For the time being, however, the stock uptrend remains intact. Should you keep buying the broader U.S. market? Or might there be a sector investment with greater upside potential?

From my vantage point, ETF investors with cash on the sidelines might consider the transportation sector via iShares DJ Transportation (IYT) or SPDR S&P Transportation (XTN). Shipping, trucking, freight train transporting, air — a healthy economy requires the efficient movement of goods.

Here are 3 reasons why transportation ETFs are worth a look right now:

1. Crude Oil Prices are Slip-sliding Away. Commodities may be weak across the board, but oil weakness is particularly worthy of note. The 10% price depreciation may be a function of rising production, modest demand and absence of hurricanes in the summer. Meanwhile, forecasters believe oil is set to drop even further. Bottom line? Fuel for trucking as well as air transport figure prominently in the success of corporations like United Parcel Service (UPS), FedEx (FDX) and Alaska Air (ALK). These corporations and others are large contributors to the price movement of funds like iShares DJ Transportation (IYT).

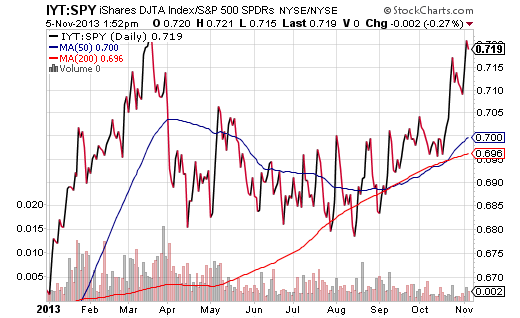

2. The Relative Strength for the Transportation Sector Continues to Climb. Funds like IYT and XTN handily outpaced the S&P 500 in the first quarter, but they weakened considerably in the second quarter; both failed to pick up ground on the big time benchmark until September. Suddenly, transports became a hot ticket item, charting a path higher over the next eight weeks. At present, the IYT:SPY price ratio demonstrates significant momentum for the transportation sector, as the 50-day moving average of the price ratio has climbed back above the 200-day moving average.

3. The Fed May Talk Up “Tapering,” Yet They are Stuck with Slow Economic Growth. Today, the EU Commission revised its 2014 economic forecast for the region from 1.2% to 1.1% growth. I expect to see additional downward revisions for countries around the world. When it comes to economic well-being, do we really need much more evidence than a bellwether like FedEx (FDX), which reported a meager 2% growth in revenue? Fortunately for investors, a continuation of slow economic growth means a continuation of central bank rate manipulation. Strong management teams at blue chips like FedEx (FDX) know how to buy back shares to boost profits as well as cut costs; ergo, FDX offered up 7% earnings growth. In sum, transporters can get the most juice from the fruit, as long as oil prices remain subdued.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Reasons To Consider Transportation ETFs

Published 11/06/2013, 01:39 AM

3 Reasons To Consider Transportation ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.