Many investors like to look for momentum in stocks, but this can be very tough to define. There is great debate regarding which metrics are the best to focus on in this regard, and which are not really quality indicators of future performance. Fortunately, with our new style score system we have identified the key statistics to pay close attention to and thus which stocks might be the best for momentum investors in the near term.

This method discovered several great candidates for momentum-oriented investors, but today let’s focus in on Craft Brew Alliance, Inc. (NASDAQ:BREW) as this stock is looking especially impressive right now. And while there are numerous ways in which this company could be a great choice, we have highlighted three of the most vital reasons for BREW’s status as a solid momentum stock below:

Short Term Price Change for Craft Brew Alliance

A great place to look for finding momentum stocks is by inspecting short term price activity. This can help to reflect the current interest in a stock and if buyers or sellers have the upper hand right now. It is especially useful to compare it to the industry as this can help investors pinpoint the top companies in a particular area.

With a one week price change of 4.5% compared to an industry average of 0.4%, BREW is certainly well-positioned in this regard. The stock is also looking quite well from a longer time frame too, as the four week price change compares favorably with the industry at large as well.

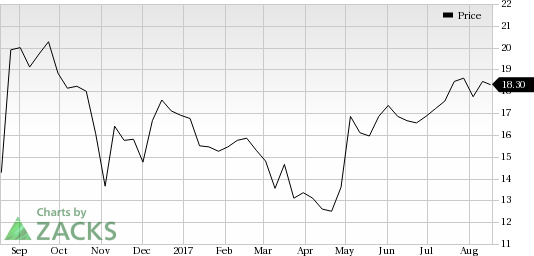

Longer Term Price Change for Craft Brew Alliance

While any stock can see a spike in price, it takes a real winner to consistently outperform the market. That is why looking at longer term price metrics—such as performance over the past three months or year-- and comparing these to an industry at large can be very useful.

And in the case of BREW, the results are quite impressive. The company has beaten out the industry at large over the past 12 weeks by a margin of 19.2% to 1.4% while it has also outperformed when looking at the past year, putting up a gain of 35.2%. Clearly, BREW is riding a bit of a hot streak and is worth a closer look by investors.

Craft Brew Alliance, Inc. Price

BREW Earnings Estimate Revisions Moving in the Right Direction

While the great momentum factors outlined in the preceding paragraphs might be enough for some investors, we should also take into account broad earnings estimate revision trends. A nice path here can really help to show us a promising stock, and we have actually been seeing that with BREW as of late too.

Over the past month, one earnings estimate has gone higher compared to none lower for the full year. This revision has helped to boost the consensus estimate as a month ago BREW was expected to post a loss of 5 cents per share for the full year, though today it looks to have EPS of 9 cents for the full year, representing an increase which is something that should definitely be welcomed news to would-be investors.

Bottom Line

Given these factors, investors shouldn’t be surprised to note that we have BREW as a security with a Zacks Rank #1 (Strong Buy) and a Momentum Score of ‘A’. You can see the complete list of today’s Zacks #1 Rank stocks here.

So if you are looking for a fresh pick that has potential to move in the right direction, definitely keep BREW on your short list as this looks be a stock that is very well-positioned to soar in the near term.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

Craft Brew Alliance, Inc. (BREW): Free Stock Analysis Report

Original post

Zacks Investment Research