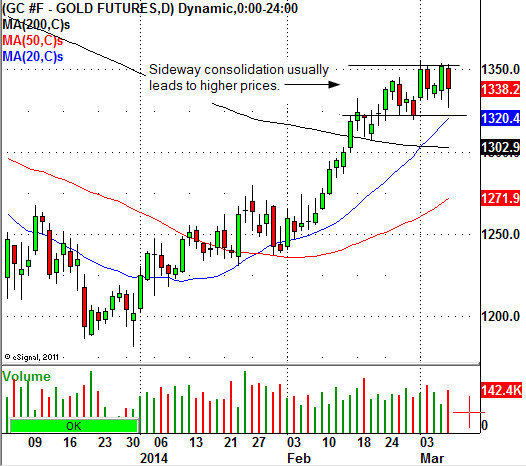

Gold has been rallying higher since the start of 2014. In late December 2013, the precious metal was trading as low as $1181.40 an ounce. Yesterday, the spot price of gold was $1342.50 an ounce. The current pattern on the daily chart of gold futures looks poised to trade into the $1400.00 level.

Here are three reasons why gold should continue to rally in the near term:

1. Gold is once again being viewed as a currency and not as a useless relic. At this time, investors are questioning all of this money printing by the central banks around the world. How long can these central bankers continue to just print money in order to inflate asset prices and boost exports? Think about it. Record money printing is taking place by the Bank of Japan, Federal Reserve, Bank of England, and other central banks around the world. The money printing by the central banks has even helped the virtual currency Bitcoin (BTC/USD) to gain traction over the past year. Remember, the reason why gold was used as a currency throughout history is because governments could not print it at will, unlike a fiat currency such as the U.S. dollar or Japanese yen.

2. The consumer sentiment for gold in 2011 was enormous as almost everyone was bullish, but that is not the case today. Currently, many analysts and financial firms are still extremely bearish on gold since it plunged from its 2011 top. As long as the sentiment remains negative for gold it should continue to hold up and trade nicely higher. When everyone gets bullish on gold again, that is probably the time to jump ship and become less bullish on the precious metal.

3. The current chart pattern on spot gold is bullish. Gold futures (GC J4) are trading sideways around the $1350.00 level. Whenever an equity consolidates and builds a sideways base it is getting poised to trade higher on the chart.