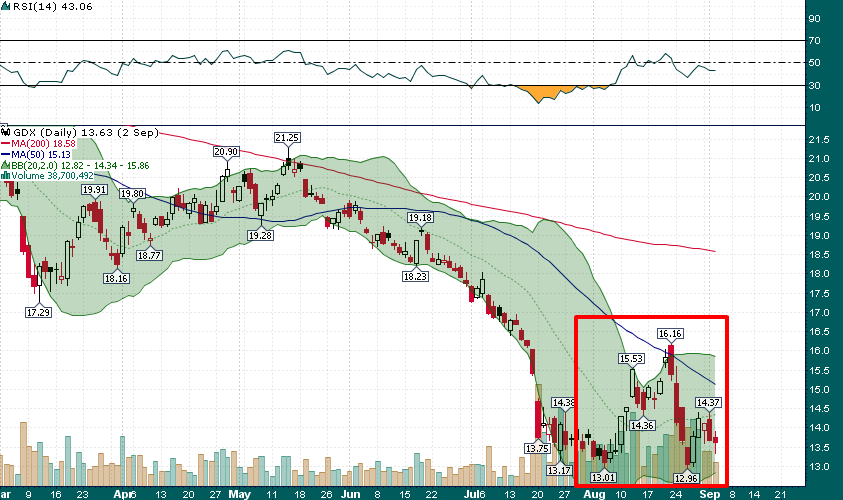

The gold miners (N:GDX) have rallied a whopping ~35% in the last month. However, we have seen this movie before and watched many rallies quickly fizzle as the goldies slump to fresh all-time lows.

In fact, just two months ago we watched GDX rally nearly 25% over a three-week stretch only to watch all of the gains evaporate within just 4 trading sessions:

While the trend has clearly been for rallies in the gold miners to quickly fizzle, there are strong signs that this time is different.

Since GDX printed the large bullish engulfing candlestick that kicked off the current rally on September 30, pullbacks have been shallow and buyers quickly took price to higher highs:

September’s fresh all-time low ($12.62) turned out to be a failed breakdown below the $13 support level. Price has not revisited this level since and as we know ‘from failed moves come fast moves’. I will also add that from failed moves at the end of extended trends (such as the downtrend in GDX since August 2011) come violent and strong reversions to the long term mean – if that's the case with GDX, the $20 area would be a very reasonable target for the current rally.

Since GDX bottomed in mid-September, volume on up days has been about 2x higher than volume on down days – a clear sign of institutional accumulation. Wednesday’s 126-million-share-day offers no indication that this trend will end any time soon.

Via Energy and Gold.com