Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

With the recent concern of a too expensive New Zealand dollar and a dovish tone from the RBNZ, our bias remains bearish on the kiwi. Conversely, with the continued improvement in the economic performance from the US, and the possibility that there might still be a rate hike in 2016, we are looking to buy the dips in the dollar.

Looking at the technical chart on NZD/USD, price has recently broke through the key support level at 0.7240. A retracement back to this area would present a decent opportunity to short the NZD/USD.

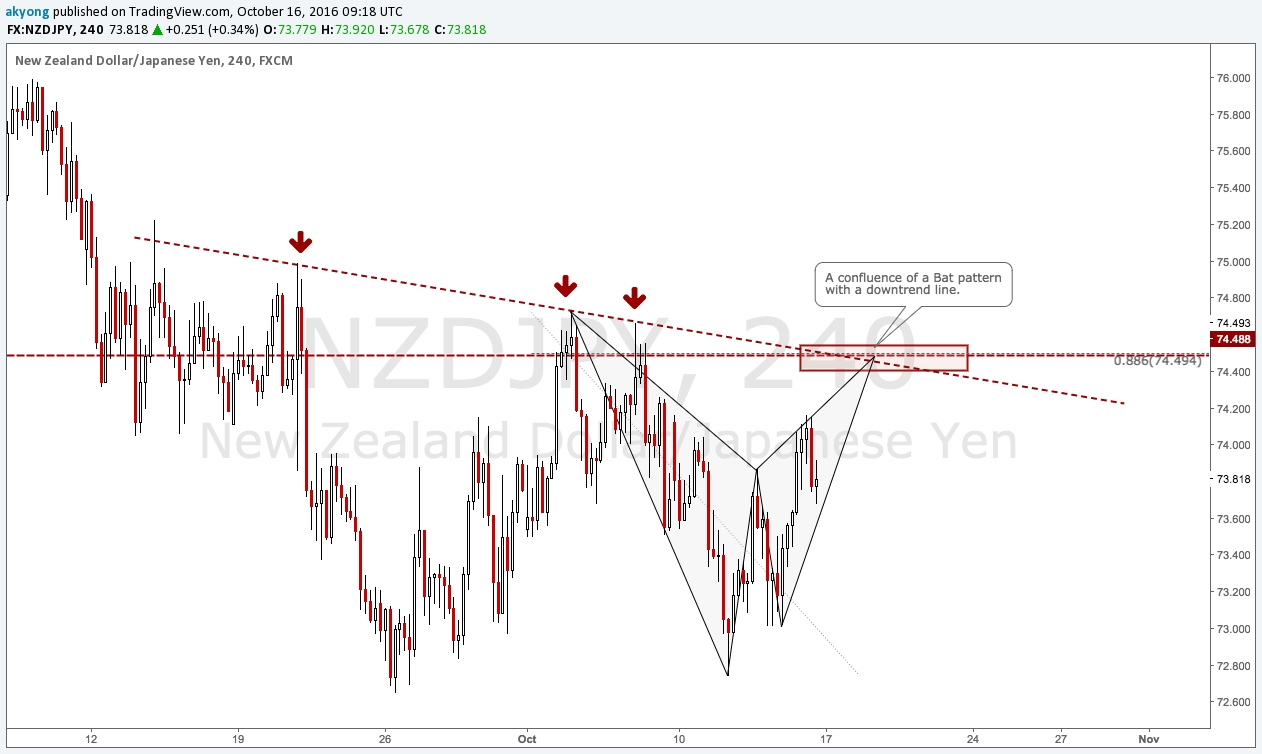

Another potential to sell the kiwi is against the Japanese yen. 2 key events that can potentially drive the yen stronger are (1) the US presidential election debate and (2) the companies earnings releases next week. These might cause uncertainty in the market which in turn cause the yen to strengthen.

Looking at the technical chart on NZD/JPY, we have a potential sell opportunity at 74.50, with a confluence of the down trend line, and a completion of an advanced price pattern.

The CHF/JPY trade idea is purely a technical play, trading off the upper and lower boundary of the price range - selling at 106.00, at the top of the range; and buying at 103.25, at the bottom of the range.