After eight consecutive weeks of U.S. stock dominance, a few days of selling pressure should not come as a shock to anyone. In fact, it does not matter if the profit-taking is due to the worst retail report for Black Friday revenue since 2006 or if it is due to record-setting purchases on Cyber Monday; it does not matter if investors are turning skittish on fears of the Federal Reserve tapering in December or fears that they won’t. Simply put, stocks are due for a pullback.

How deep will the pullback be? Regardless of whether stocks are nearing bubble territory or whether they remain fairly valued, money flow statistics at WSJ.com show that block trading institutional investors are still buying heavily into weakness. The data suggest that money managers are either playing catch-up and/or unwilling to wait very long to buy the proverbial dip. In other words, it would be silly to anticipate much in the way of genuine weakness.

In client accounts where I have excess cash, I am still adding some shares of broader market ETFs. I have been acquiring shares of funds like iShares Russell 1000 (IWB), iShares S&P MidCap (IJH) as well as Vanguard Dividend Growth (VIG). I have also picked up some shares of several long-standing favorites, PowerShares Pharmaceuticals (PJP) and First Trust NASDAQ Dividend (TDIV). That said, early birds who look forward to potentially surprising trends in 2014 may want to examine the discount bin.

1. iShares MSCI Canada (EWC). One of the remarkable growth stories in the previous decade occurred in Canada, as the world’s thirst for crude oil benefited the North American exporting giant. Over the least few years, however, the emerging market slowdown and the eurozone credit crisis altered the trajectory for Canadian equities. Worse yet, Canadian dollar devaluation wreaked havoc on this unhedged tracker; SPY is up more than 40% to EWC 10% over the previous 24 months.

On the other hand, investors may be failing to consider how the battered Canadian dollar makes Canadian crude oil super cheap. The cheaper the crude, the more that Canadian companies will be able to export. Additionally, Bloomberg’s recent ranking of the world’s 10 strongest banks include four of Canada’s “Big 5.” All of those banks are in iShares MSCI Canada (EWC). Best of all, the top two sector weightings for EWC are energy and financials. Lastly, the Bank of Canada is keeping an eye on deflation, and may provide the same sort of stimulus that has been the lifeblood for U.S. and Japanese stock appreciation.

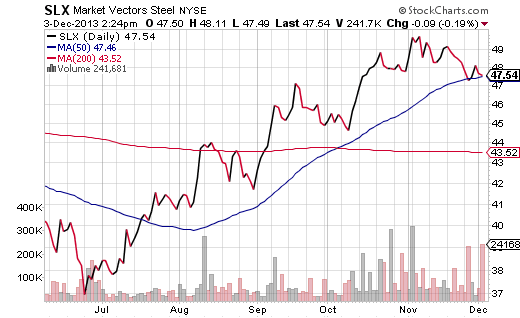

2. Market Vectors Steel (SLX). Virtually all of the Morningstar-rated ETFs currently carry the moniker of “Fairly Valued” or “Overvalued.” There are exceptions, of course. Market Vectors Steel (SLX) sports a price-to-Morningstar-fair-value ratio of 0.83. That alone portends the possibility of 20% upside before even reaching a fairly valued ratio of 1.00.

Equally compelling, the technical picture is serving up several upbeat trends. The 50-day climbed above the 200-day in early October. The price has enjoyed strong support at the 50-day moving average since the June lows — the same lows where most global assets suffered during the rising rate, “taper tantrum” of the May-June period. Lastly, Goldman Sachs recently upgraded the sector in November.

3. WisdomTree’s Hedged German Equity Fund (DXGE). The broader U.S. market is trading at a nail-biting price-to-sales (P/S) ratio level of 1.6. In the sixty year period between 1940 and 2000, P/S ratios typically traded between 0.50 and 1.50; rare was the case when the ratio between stock price and revenue moved much higher. On the flip side, WisdomTree’s Hedged German Equity Fund (DXGE) offers exposure to some of the most heralded German brands (e.g., Daimler, Siemens, Bayer, Allianz, etc.) with a combined price-to-sales of just 0.60. And for those who are worried about currency fluctuations, DXGE hedges against fluctuations between the value of the greenback and the euro. If you believe that German equities will benefit from European Central Bank rate cuts and stimulus — if you believe that German stocks may have the most potential upside for the region — then DXGE may be the means by which the early bird gets its worm.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Potential Surprises To Tempt The “Early Bird” ETF Investor

Published 12/03/2013, 11:53 PM

Updated 03/09/2019, 08:30 AM

3 Potential Surprises To Tempt The “Early Bird” ETF Investor

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.