The best time to buy cheap is when you are afraid to mention your ideas around the water cooler for fear of being mocked by your colleagues. Our work centers on looking for oversold conditions and crowd behavioral anomalies that can give us better low-risk entries with good upside potential. A combination of fundamentals and technicals, combined with Elliott Wave Theory patterns can lead to nice profits with low risk.

For just a few quick ideas that would make sense in this area, we point out 3 ETFs that you could consider entering now as they are way out of favor and very oversold.

Gold Stocks: GDXJ

The Junior Miners index is high risk, high reward. However, if you time the entry right at the opportune moment the upside is very high with low downside risk. With Gold out of favor, we have been pounding the table the last 10 days or so, saying that there are only 4-5 weeks left to buy quality miner names. Instead of picking through them one at a time, you can pick up the high beta play via the Market Vectors Junior Gold Miners ETF (GDXJ).

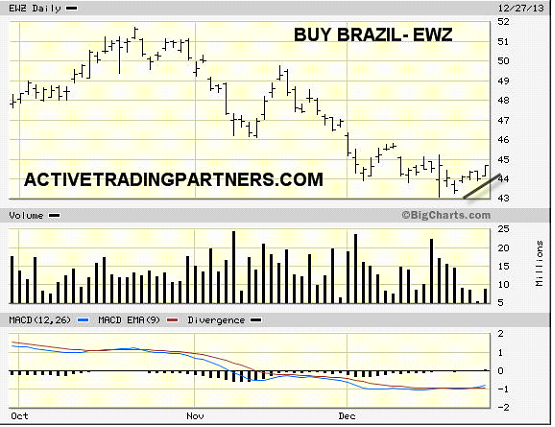

How about Brazil?

Everyone hates Brazil stocks now, but they have some of the most valuable natural resources in the world, and Brazil almost always bounces back strong off bear cycle lows. Here is a way to play the commodity rebound we see coming in 2014: The iShares Brazil Index, (EWZ):

It’s not too late to eat some Turkey:

Turkey, the country, also often is a very volatile play in which to invest, but going in during very oversold conditions often plays out to the upside for gains later on. The iShares MSCI Turkey ETF, (TUR) is beaten up, which means it’s time to buy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Out-Of-Favor ETFs With Potentially Huge Upside In 2014

Published 12/31/2013, 12:14 AM

Updated 07/09/2023, 06:31 AM

3 Out-Of-Favor ETFs With Potentially Huge Upside In 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.