The schedule for economic releases picks up on Tuesday, although US numbers will dominate the headlines. First up is the weekly estimate on retail spending via Redbook. Later, Markit Economics publishes the flash estimate for its US Services Purchasing Managers’ Index in January, followed by the Conference Board’s report on the Consumer Confidence Index for the first month of the new year.

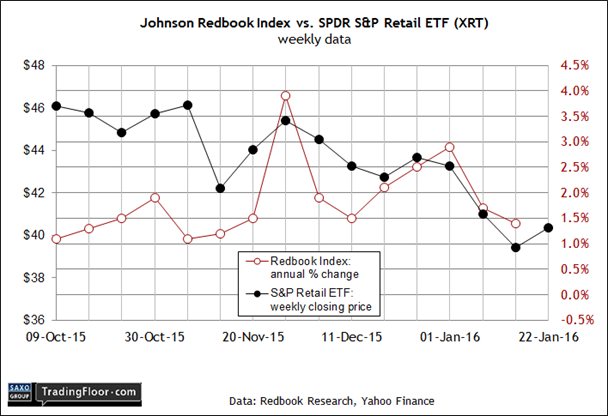

Just looking? A dip in the year-on-year trend in today’s Redbook update will raise new concerns about retail spending.

US: Redbook Retail Sales Index (1355 GMT) The hard numbers on retail sales through the end of last year tell a story of decelerating growth. Today’s weekly update via Redbook will publish a new chapter in this saga and provide fresh context for deciding how the plot is unfolding so far in the new year.

Meanwhile, here’s where the narrative stands at the moment. Consumer spending in 2015 increased 2.2% in nominal year-over-year terms, based on headline retail sales. That’s close to the slowest pace since 2009. Some of this is due to the bear market in energy, which is depressing the value of gasoline sales.

Stripping out this activity reveals that spending increased at a respectable rate of near 4.0% over the past year. Putting more cash in consumers’ pockets via lower gas prices is probably a pro-growth development, although it's still unclear how much of a benefit we’ll see in the broader economy in the immediate future.

As for today’s update from Redbook, my first read will be the year-over-year change. Note that the previous update showed that retail spending was ahead by 1.4% at this month’s midway point vs. the year-earlier level. That’s close to the slowest pace in recent history. Not surprisingly, retail equities have also been trending lower, based on weekly numbers for the SPDR S&P Retail (N:XRT) through last week.

Bottom line: another dip in the year-over-year trend in today’s Redbook update will raise new concerns about retail spending and whether the expected boost from lower energy prices will materialise any time soon.

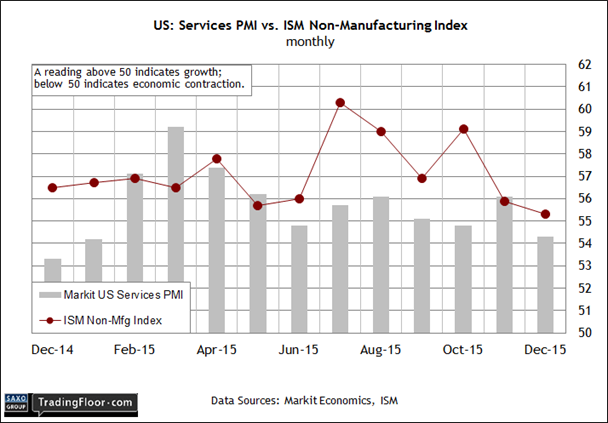

US: Services PMI (1445 GMT) The manufacturing sector may be in a recession, but that alone doesn’t mean the broad US economy will follow suit. Manufacturing, after all, is a relatively small slice of macro activity. The services sector, by contrast, is a substantially larger influence.

Given the recent worries about the US economy, today’s initial estimate on services activity for January will offer an early hint of how the broad trend is holding up – or not – in the kick-off to 2016. In the previous update for December, the Services PMI ticked lower, although the 54.3 reading was still firmly above the neutral 50.0 mark that separates growth from contraction. Nonetheless, last month marked the slowest pace of growth in nearly a year via the PMI numbers.

“The weakness seen in the final month of the year raises concerns that growth is losing momentum, possibly quite markedly,” Markit’s chief economist noted earlier this month.

If today’s initial estimate for January stumbles by more than a trivial degree, the slide will stoke recession fears for the US overall. By contrast, a relatively stable reading will suggest that the economy will continue to expand.

Given the size and scope of the services sector, the PMI data on this front is a key bellwether for the broad trend. As such, it’s unlikely that we’ll see a new recession without a clear warning sign from this corner of the economy.

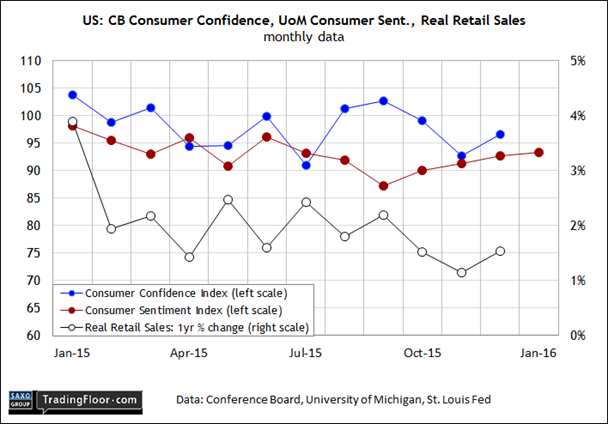

US: Consumer Confidence Index (1500 GMT) Although the hard data on retail activity reflects a softer trend lately, the mood on Main Street still paints an upbeat profile. Today’s figures from the Conference Board will offer more context for deciding if optimism is holding on to recent gains in 2016.

One reason for thinking that today’s release will look pretty good is that the previously released figures for the University of Michigan’s Consumer Sentiment Index ticked higher in January. In the preliminary estimate for this month, this benchmark inched up for the fourth straight month.

But in a note of caution, the press release noted: “Personal financial prospects have remained largely unchanged during the past year at the most favourable levels since 2007 largely due to trends in inflation rather than wages.”

It’ll be useful to see how today’s January data via the Conference Board’s index stacks up. The crowd expects a mild dip to 96.0 from 96.5 in December, based on the consensus forecast via Econoday.com. The projection still leaves this benchmark at a relatively elevated level.

If the estimate holds, we’ll have another clue for thinking that consumer confidence remains resilient despite the recent turmoil in the financial markets and the wobbly economic numbers.

Disclosure: Originally published at Saxo Bank TradingFloor.com