- Economists see jobless claims falling in the last 2016 US labour market update

- While the holiday season could skew the numbers a little, the trend is positive

- The Bloomberg Consumer Comfort Index is approaching a two-year high

- US junk bonds look immune (so far) to rising interest rates. Can this last?

US data releases are the main event for Thursday, starting with the weekly update on jobless claims. Later, there’s a new release on consumer sentiment via Bloomberg’s weekly Consumer Comfort Index. Meantime, keep your eye on the US high-yield bond market, which has been climbing despite the headwind of rising interest rates.

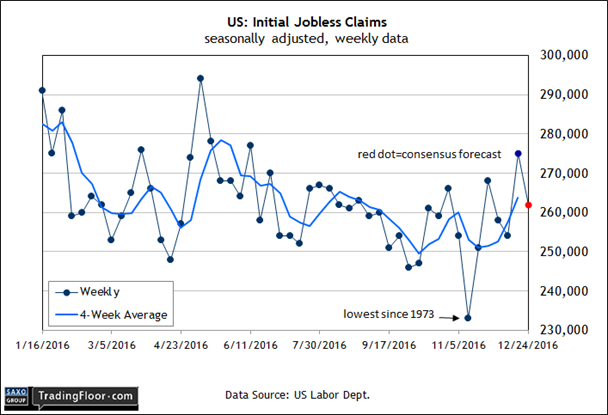

US: Initial Jobless Claims (1330 GMT): The last release of the year for the US labour market is expected to reconfirm the growth bias that’s been (mostly) conspicuous throughout 2016.

Today’s update on new weekly filings for unemployment benefits is on track to close out the year with another encouraging signal.

Econoday.com’s consensus forecast sees jobless claims falling 13,000 to a seasonally adjusted 262,000 for the week through Christmas eve.

Are the holidays skewing the numbers? Perhaps, but the big-picture trend is all that matters and on that score this leading indicator for payrolls has been telling a consistently upbeat story by posting low readings.

The message was loud and clear in mid-November, when claims dropped to a 43-year-low of 233,000. The crowd expects that today’s number will remain close to that trough. Watch out for the upside-surprise factor.

Despite the low readings of late, the year-over-year change for claims increased in the last update – the first annual advance in five months.

It’s probably noise, but another year-on-year increase will inspire bearish chatter as the crowd begins to focus on 2017.

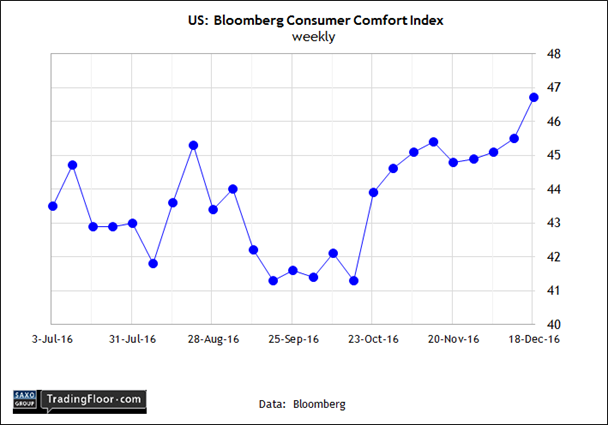

US: Bloomberg Consumer Comfort Index (1450 GMT): A new wave of optimism has swept over the consumer sector since Donald Trump’s election last month, according to recent updates from several sources.

Will the good cheer continue in Bloomberg’s weekly measure of confidence? The previous update certainly looks promising. The Consumer Comfort Index increased in the week through December 18, approaching a two-year high.

Monthly benchmarks that track consumer sentiment are telling a similar story. This week’s December release of the Consumer Confidence Index, for example, climbed to the highest level since 2001.

“The post-election surge in optimism for the economy, jobs and income prospects, as well as for stock prices which reached a 13-year high, was most pronounced among older consumers,” said the Conference Board’s director of economic indicators.

If the Bloomberg index today can at least hold near the current 46.7 reading, the news will reaffirm that the American public is thinking positively about the year ahead.

The question, of course, is whether reality will match the outlook. For the moment, consumers are betting that there's more than hope driving the bull market in sentiment indexes.

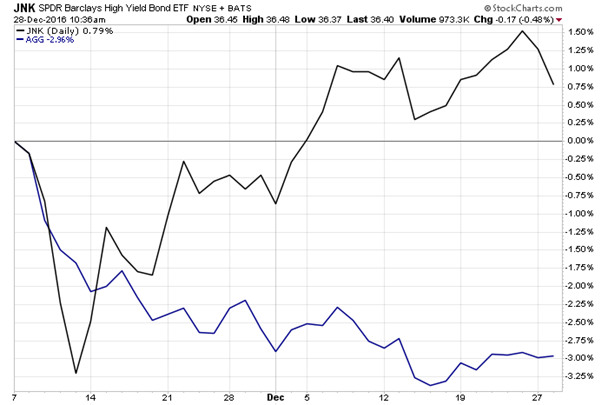

US: High Yield Bonds: Interest rates are rising, dispensing red ink to bond markets far and wide… with one exception – US junk bonds.

Consider how two widely held US-listed ETFs stack up in the weeks since Donald Trump’s election.

On the one hand, the iShares Core US Aggregate Bond (NYSE:AGG), which tracks investment-grade corporates and Treasuries, is off by roughly 3% since November 8.

The culprit: Rising yields. The benchmark 10-year Treasury rate, for instance, has been trading just below 2.6% this week - sharply above the roughly 1.8% yield on Election Day.

Rising interest rates have yet to pinch SPDR Bloomberg Barclays High Yield Bond (NYSE:JNK) in the post-election period. The ETF is ahead nearly by 1% since Trump's political upset.

What accounts for the rise in US junk bond prices? And at a time when nearly every other corner of fixed income has slumped?

Some analysts explain that high-yield bond prices are rising for the same reason that the stock market has popped since last month’s election: Expectations that growth will pick up during a Trump administration.

Junk bonds, after all, are considered proxies for equities and so it’s no surprise that both markets are moving higher.

Can Trump deliver on his promise of a stronger economy? No one really knows at this point, but equity and junk markets are willing to give the President-elect the benefit of the doubt as the year comes to a close.

Disclosure: Originally published at Saxo Bank TradingFloor.com