- US housing starts should perk up in June report for new residential construction

- The week-long slide in the 10-year Treasury yield dimming outlook for rate hikes

- Political gridlock in Washington and soft US economic data are driving up the yen

The US housing market is in focus today with the monthly update on residential construction activity for June. Meantime, keep your eye on two markets that have been surprising analysts in recent days: the 10-year Treasury yield and USD/JPY.

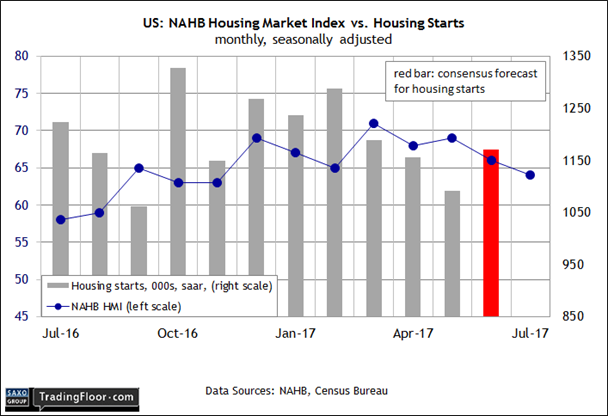

US: Housing Starts (1230 GMT): Sentiment in the home building industry unexpectedly fell in July, creating new doubts for expecting a rebound in residential construction activity in this year’s second half.

Legislative disarray in Washington and downward revisions for US economic expectations is creating new turbulence for bearish yen bets. Photo: Shutterstock

The Housing Market Index (HMI) slipped two points for July to 64, an eight-month low. Although that's still a healthy rate, economists were looking for a one-point rise to 68. “Our members are telling us they are growing increasingly concerned over rising material prices, particularly lumber,” said the chairman of the National Association of Home Builders, which publishes HMI.

“This is hurting housing affordability even as consumer interest in the new home market remains strong.”

Note, however, that today’s hard data on housing starts for June is expected to increase to 1.170 million units (seasonally adjusted annual rate), up from 1.092 million previously, according to Econoday.com’s consensus forecast.

That’s still a reasonable estimate, in part because the HMI index in June was close to a post-recession high before sliding in yesterday’s July release.

The softer sentiment in the home building industry at the start of the third quarter, however, could be a warning flag for the housing sector in the months ahead – especially if today’s report on starts falls short of expectations.

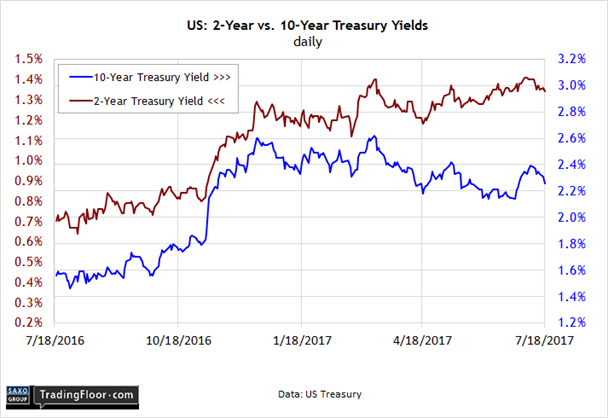

10-Year Treasury Yield: In the wake of softer-than-expected inflation and downward revisions for second-quarter GDP growth, the benchmark 10-year yield has been making a sharp U-turn lower over the past week.

Although economists still expect that growth will accelerate in next week’s “advance” GDP report for Q2, the rebound is projected to deliver a lesser bounce than previously expected.

The Atlanta Fed’s GDPNow model, for instance, sees Q2 output rising 2.4%, down from a 4% estimate in late May. The current forecast still represents a respectable improvement over Q1’s weak 1.4% increase, but the recent slide in the GDPNow forecasts mirrors downward revisions in economic surveys.

Last week’s surprisingly weak retail sales report for June doesn’t help. The crowd had been looking for a small monthly increase; instead, spending dropped for a second straight month.

Meanwhile, weaker-than-expected inflation data for June suggests that the Federal Reserve will be forced to delay plans for more interest rate hikes.

“Lower inflation expectations make it all the more difficult for the central bank to achieve its inflation objective,” noted Charles Evans, president of the Chicago Fed, last week.

Fed funds futures are pricing in low probabilities (less than 10%, as of July 18) of a rate hike at the next three scheduled Federal Reserve policy announcements, including next week’s Federal Open Market Committee meeting.

If the 10-year rate continues to slide, the crowd may decide that a December hike (currently estimated at roughly 50-50 odds) is off the table too.

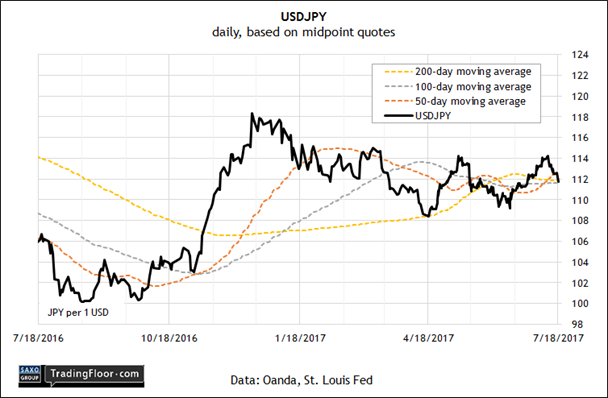

USD/JPY: Last week the Financial Times ran an article advising that there are “plenty of reasons for traders to bet against the Japanese yen.” One factor in the calculus is the expectation that the Bank of Japan won’t raise interest rates this year, starting with today’s tentative announcement from the central bank.

But more than a week after the article was published, the yen has confounded analysts by strengthening against the US dollar. What’s changed? A growing recognition that the Donald Trump’s legislative agenda is going nowhere fast.

It become clear on Tuesday that efforts by Republicans to overhaul the US healthcare system have collapsed, again. “Any hopes of dollar support from a successful vote on the Senate’s healthcare bill look to be vanishing,” a currency strategist at National Australia Bank said yesterday.

“Near term, the dollar path of least resistance is down. We still think the data - inflation in particular - will provide the Fed with enough ammunition to hike in December and boost the dollar, but this is a fourth quarter story.”

In the here and now, by contrast, the yen has been strengthening against the greenback. USD/JPY slipped below ¥112 in mid-day trading on Tuesday for the first time this month, prompting analysts to reassess the outlook for the yen.

It’s unclear if the latest yen strength is sustainable. But for the moment, legislative disarray in Washington, combined with downward revisions for US economic expectations, is creating new turbulence for bearish yen bets.

Disclosure: Originally published at Saxo Bank TradingFloor.com