February kicks off with a busy day of economic news, including numerous updates on the manufacturing trend via purchasing managers’ indices. Most of the numbers will be revisions to the previously published flash data for January, although today's Spain Manufacturing PMI offers the first look at last month's figures.

The US ISM Manufacturing Index for January also makes its debut today. In addition, the US profile for personal income and spending in December is scheduled for release.

Spain: Manufacturing PMI (0815 GMT): Spain is still Europe’s growth leader among the major economies, but deflationary risks continue to lurk. GDP growth in the fourth quarter of 2015 printed at a healthy 0.8% for last year’s Q4, the government reported last week – matching Q3’s gain.

But deflation is a threat in the fourth-largest economy among the nations that share the euro. Consumer prices in Spain fell 0.3% year-on-year in January, extending a run of flat to negative inflation that’s persisted for over a year.

Is the ongoing decline in the broad price trend an early warning sign for Spain and perhaps the Eurozone’s modest recovery? Today’s first look at sentiment in Spain’s manufacturing sector in January will help sort out the signal from the noise.

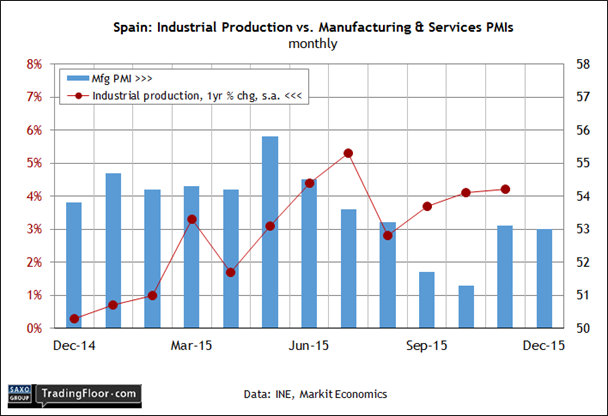

For the moment, the numbers for manufacturing still look encouraging. Markit’s purchasing managers’ index ticked down a notch to 53.0 in December, but that’s still comfortably above the neutral 50.0 mark and close to the best levels in recent months.

“The latest Spanish manufacturing PMI data signalled a solid end to 2015 for the sector as growth rates for output and new orders continued to accelerate following a brief slowdown around the end of Q3,” a Markit economist noted last month.

The numbers on industrial production look healthy too. Seasonally adjusted year-over-year output increased 4.2% through November – a four-month high. Growth was solid in the services sector as well at last year’s close, based on the PMI data.

Spain’s forward momentum, in other words, is intact. Deflation is still a problem and a potential risk factor down the road. But the expansion is ongoing and so it would be surprising if today’s January PMI numbers reveal that the manufacturing trend is stumbling.

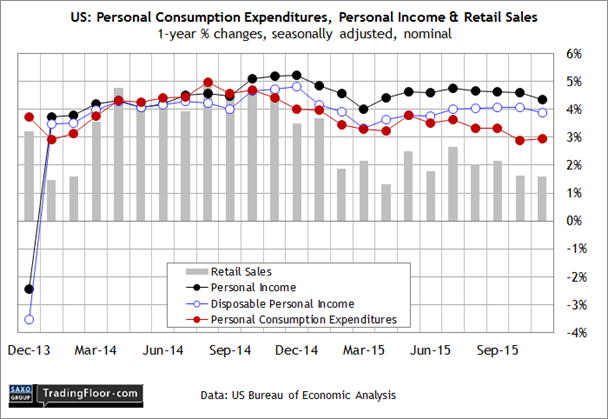

US: Personal Income and Spending: (1330 GMT) Last week’s “advance” report on fourth-quarter GDP confirmed what had been expected for weeks: growth slowed sharply in the final quarter of last year. Output was ahead by a weak 0.7%, less than half the 2.0% increase in Q3, based on seasonally adjusted annual rates. The good news is that consumer spending and income suffered only modest degrees of deceleration.

Today’s December update on consumption and income will provide more detail on the economic slowdown at last year’s close. No major revelations are likely, given that we already know the quarterly figures. Nonetheless, the release will provide more insight and provide fresh talking points for deciding what to expect in the 2016 numbers.

A crucial metric to watch: the year-over-year numbers. Note that the annual pace has weakened lately for both income and spending through November. The question is whether the previously released news of modestly stronger year-on-year retail sales data for December is a sign that we’ll see firmer annual comparisons in today’s report.

Economists are expecting that personal income will continue to grow at a monthly rate of 0.3%, but consumer spending is on track to decelerate to 0.1% in December from 0.3% previously, based on Econoday.com’s consensus data.

Those monthly changes translate into a steady trend for the respective one-year changes. For the moment, that’s enough to keep the outlook for modest economic growth alive until or if we see darker updates in the weeks ahead.

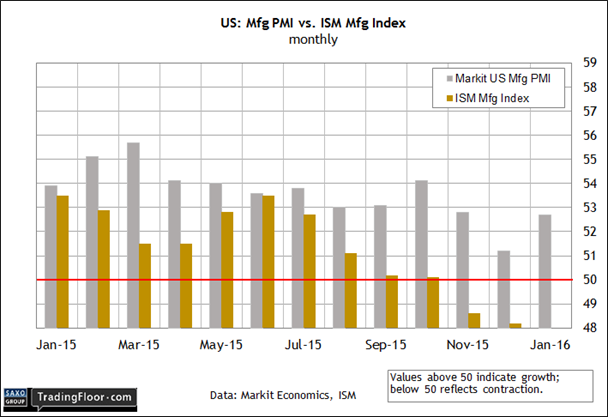

US: ISM Manufacturing Index (1500 GMT): The manufacturing sector is in recession, according to the ISM data. Markit’s PMI numbers, however, still leave room for doubt. We’ll see updates for both benchmarks today, which may resolve the diverging signals.

Indeed, the flash estimate of the PMI for January still paints a comparatively upbeat profile. In fact, the preliminary estimate for last month rebounded slightly after touching a 38-month low in December. The current 52.7 print for the kick-off to 2016 is modest, but there's enough distance over the neutral 50.0 mark to provide cover for arguing that manufacturing’s broad trend remains positive.

“The US manufacturing sector found a new lease of life at the start of the year, with growth of factory output and orders both picking up after the slowdown seen late last year,” said Markit’s chief economist on January 22.

The ISM figures, by contrast, beg to differ. The December reading continued to sink deeper into contractionary territory, dipping to 48.2 – the second straight month of below-50 data. Will today’s first look at the January ISM numbers make it three months in a row?

The first clue arrives with the revised PMI report at 1445 GMT, followed by the ISM update at 1500 GMT. Economists think that the PMI revision for January will tick down fractionally relative to the flash data: 52.6 vs. 52.7 via Econoday.com. Meanwhile, the first reading on the ISM Manufacturing Index for January is expected to inch up to 48.3 from 48.2 previously, but remain well below the neutral 50 level.

In short, more of the same. One indicator signals recession, while another points to moderate if challenged growth.

Disclosure: Originally published at Saxo Bank TradingFloor.com