- Eurozone money supply data is today’s main event for economic reports in Europe

- There are worrying signs that Eurozone inflation is slowing down

- Brazil is wallowing in a deep recession, and weighed down by political woes

- Will consumer sentiment continue to improve in South America's top economy?

- The Conference Board’s US consumer confidence data should post a modest rise

Europe will focus on money supply and lending data in today's monetary update from the central bank. Later, the monthly numbers on Brazil’s consumer confidence profile is due to be released, followed by consumer confidence data for the US as well, via the Conference Board.

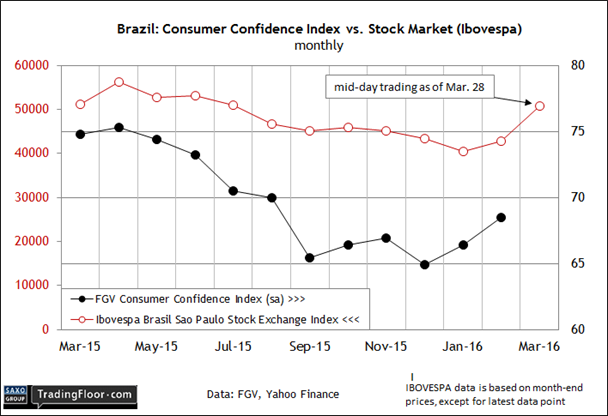

Road to recovery ... Brazil's consumer confidence has picked up recently, suggesting that the worst may have passed for South America's top economy.

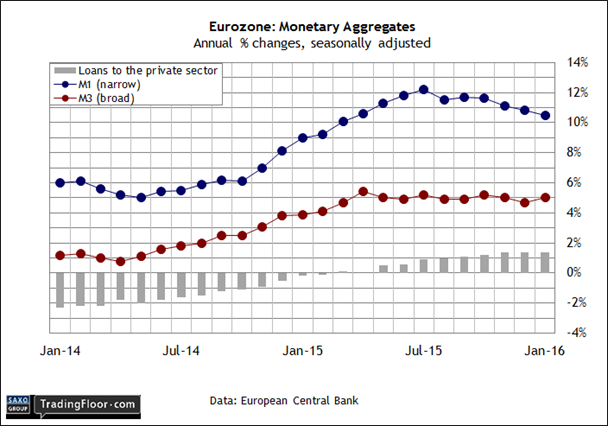

Eurozone: Money Supply (0800 GMT) The return of deflation to the euro area’s year-on-year trend in headline consumer inflation in February is sure to focus attention on today’s monthly update on money supply data.

The consumer price index fell 0.2% last month vs. the year-earlier level – the first annual slide since last September. Core inflation, which strips out energy, food, alcohol and tobacco, is still comfortably positive, but the 0.6% annual gain last month marks a sharp deceleration from January’s 1.0% pace. Is that a sign that the Eurozone is headed for trouble?

If so, there’s no immediate warning in Now-casting.com’s latest estimate of first-quarter GDP growth. The Eurozone is on track to expand by roughly 0.4% (quarter on quarter), according to Friday’s revised estimate. If the projection holds, quarterly growth will tick higher for the first time since in a year.

But if the relatively upbeat GDP outlook is due for a downgrade in the weeks ahead, we may see an early warning sign in today’s monthly report on monetary conditions. Note that while broad money supply (M3) has been holding steady near the 5% growth rate lately, narrow money (M1) has been decelerating.

Meanwhile, the year-on-year rise in loans to the private sector has stalled at the 1.4% level. Declines on one or both fronts will raise new questions for anticipating a firmer growth trend in the Q1 GDP report that’s due in early May.

Brazil: Consumer Confidence (1100 GMT) South America’s largest economy has been suffering over the past year, wallowing in its worst recession in a century. The political crisis that’s roiling the country is only making matters worse. President Dilma Rousseff faces impeachment over charges of corruption with dealings with the state oil company, Petrobras. The combination of political and economic pain has transformed this formerly high-flying emerging market into the leading basket case among the world’s big economies.

The knee-jerk reaction for looking ahead is the well-founded assumption that things will get worse before they get better. “Pretty soon we could be talking about the solvency of the federal government,” a former finance ministry official told The Wall Street Journal last week.

The odds may be slim for a turnaround any time soon, but the stock market has been looking for a silver lining. Analysts say that the rebound in recent weeks in the iBovespa Index reflects speculation that regime change is possible and, if it comes to that, may provide a boost for Brazil’s battered economy.

Meanwhile, consumer confidence has perked up recently, suggesting that the worst may have passed. Although deep troubles will persist, is there a possibility that the pessimism has gone too far? The question will resonate if today’s March data for consumer confidence ticks higher again.

Last month, FGV’s benchmark of the mood rose to 68.5, the highest since last August. There’s still a long road ahead to repair the damage, but another gain for today’s release would at least remind that crowd that even Brazil’s negative momentum will reach its limits ... eventually.

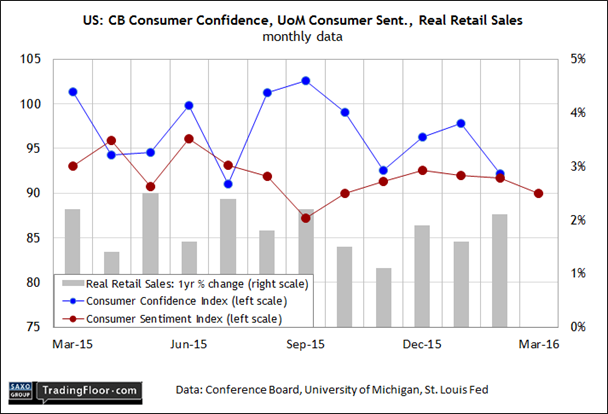

US: Consumer Confidence Index (1400 GMT) Yesterday’s February numbers on consumer spending suggests that economic growth will remain sluggish. The Commerce Department reported that expenditures increased by only 0.1% for the third month in a row.

“It speaks to the weakening in domestic economic momentum at the start of this year, further reinforcing the Fed's cautious monetary policy bias,” the deputy chief economist at TD Securities told Reuters.

Adding to the outlook for softer numbers: yesterday’s revised estimate of first-quarter growth via the Atlanta Fed’s widely followed GDPNow model. The forecast fell to a weak 0.6% (seasonally adjusted annual rate), less than half the 1.4% gain in last year's Q4.

A degree of corroborating evidence can be found in the preliminary estimate of the University of Michigan’s Consumer Sentiment Index for March, which eased for the third straight month to 90.0, the lowest since last October. The mood softened “in early March due to increased concerns about prospects for the economy as well as the expectation that gas prices would inch upward during the year ahead,” noted the survey’s chief economist.

Analysts are looking for a brighter message in today’s update from the Conference Board. Econoday.com’s consensus forecast sees the Consumer Confidence Index rising to 94.0 for this month. That’s still a middling number relative to recent history, but a slightly higher reading would offer support for thinking that the economy can muddle through the current soft patch.

Disclosure: Originally published at Saxo Bank TradingFloor.com