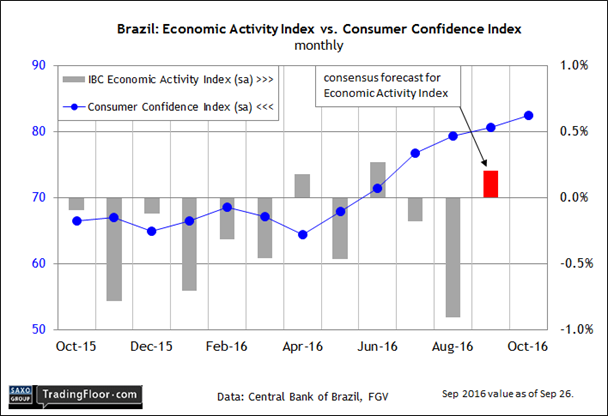

- Rebound expected for the September read on Brazil’s Economic Activity Index

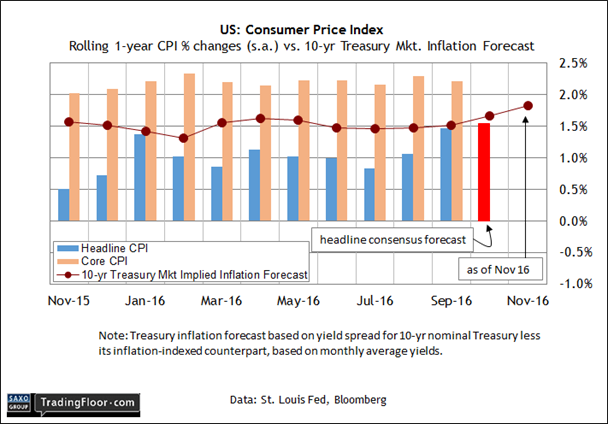

- US headline consumer inflation projected to rise at fastest annual pace in 23 months

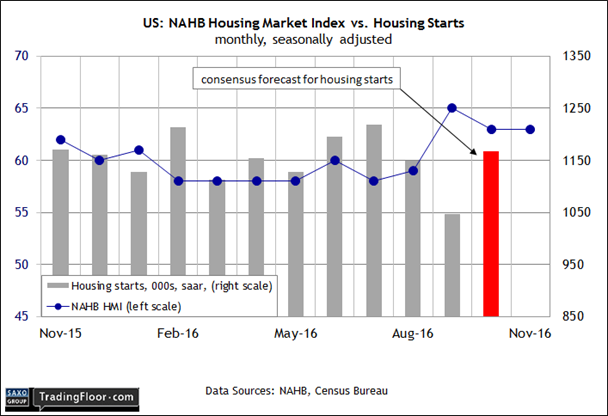

- Housing starts in the US on track to rebound to a three-month high for October

A busy day of economic news awaits for Thursday, including a fresh look at the prospects for Brazil’s economic recovery via the central bank’s September update of its Economic Activity Index. Later, two US numbers for October will grab the market’s attention: consumer inflation and housing starts.

US annual CPI is expected to rise by the most in nearly two years. Photo: iStock

Brazil: Economic Activity Index (1030 GMT): South America’s largest economy still appears to be in the early stages of emerging from a deep recession, although recent data suggests that the rebound will be slow and prone to setbacks. Nonetheless, the International Monetary Fund this week advised that: “A gradual recovery is expected to start in the second half of 2016, assuming that reforms continue, political uncertainty diminishes, and that other economic shocks run their course.”

That’s a hefty load of caveats, but perhaps today’s monthly update of the macro trend from the central bank will reaffirm that the outlook is still encouraging. Unfortunately, the Bank of Brazil’s Economic Activity Index, a proxy for the country’s GDP, fell sharply in August. The 0.9% slide is the biggest monthly setback in nearly a year-and-a-half.

Is Brazil’s nascent recovery at risk? Maybe, although the ongoing revival in consumer sentiment suggests otherwise. FGV’s index of consumer confidence increased in October to its highest level since December 2014. Meanwhile, the group’s leading index of economic activity advanced for the eighth consecutive month in September.

Perhaps, then, it’s no surprise that the consensus forecast sees a 0.2% rise for today’s September release of the Economic Activity Index, according to TradingEconomics.com. If the forecast is right, this benchmark will post its first monthly increase since June and thereby revive the view that Brazil’s recovery, although wobbly, remains intact.

US: Consumer Price Index (1330 GMT): The election of Donald Trump as US President has prompted a new round of forecasts that inflation is set rise via expectations that a big fiscal stimulus (higher government spending) is a high priority for the incoming administration. Today’s update on consumer prices for October looks set to provide support for thinking that pricing pressure was already inching up before last week’s electoral upset.

Although the datadu jourwill reflect economic conditions under the Obama administration, the question is whether there was a whiff of reflation bubbling in October? Economists think that’s a reasonable assumption.

Econoday.com’s consensus view sees the monthly change in the consumer price index ticking up by 0.4%, the biggest rise in six months. The implied projection for the year-over-year comparison lifts the trend for headline CPI to a touch over 1.5% – the highest in nearly two years.

Expecting headline inflation to rise at this point should come as no great shock. Core CPI, which strips out food and energy, has been running moderately hotter for some time – a sign that headline inflation is set to rise. In addition, the Treasury market’s implied inflation forecast has been inching up lately.

Meanwhile, the yield spread on the nominal 10-year Note less its inflation-indexed counterpart was 1.86% in mid-day trading yesterday – a conspicuous premium over headline CPI's annual pace of just below 1.5% through September. If the crowd is right, the gap’s set to narrow in today’s update for October.

US: Housing Starts (1330 GMT): Confidence in the home-building industry held steady at an elevated level in November, according to yesterday’s release from the National Association of Home Builders. The news suggests that the recent slowdown in residential housing construction is due to rebound.

“With most of our members responding before the November elections, confidence levels remained unchanged as they awaited the results,” NAHB’s chairman said. “Still, builder sentiment has held well above 60 for the past three months, indicating that the single-family housing sector continues to show slow, gradual growth.”

Analysts are looking for a degree of confirmation in today’s hard data on home-building activity. Econoday.com’s consensus forecast calls for a robust improvement in the number of new residential projects underway for last month. The projected jump to 1.168 million units (seasonally adjusted annual rate) marks a three-month high.

The post-election rise in interest rates could be a new headwind down the road, but for the moment it appears that housing activity is due to post firmer numbers at the start of the fourth quarter.

Disclosure: Originally published at Saxo Bank TradingFloor.com