The week begins with early estimates of economic activity in February on both sides of the Atlantic, including flash PMI data for the services and manufacturing sectors in the eurozone. Later, the focus turns to the US and the initial estimate of sentiment data for manufacturing via Markit’s purchasing managers’ index. We’ll also see a big-picture update of the hard data in January via the Chicago Fed National Activity Index.

Eurozone: Manufacturing and Services PMIs (0900 GMT) The outlook for first-quarter GDP growth in the eurozone slipped again in last week’s revised estimate from Now-casting.com. The firm’s update on Friday marked the fifth straight decline for Q1 output. As a result, the consultancy now projects that GDP will rise at a slightly slower quarterly pace—0.24%—in the first three months of this year vs. the 0.3% gain in last year’s Q4.

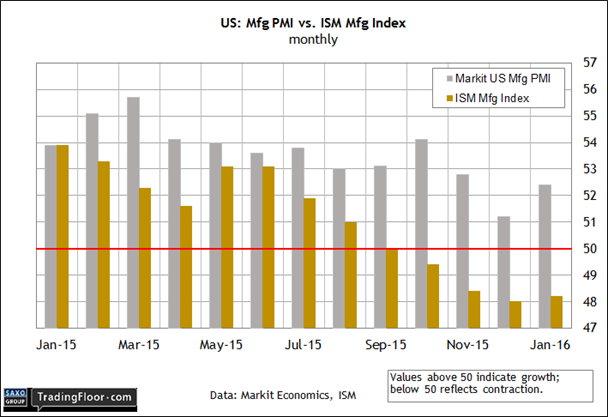

On the mend? ISM numbers point to weakness in US manufacturing, but the initial PMI estimate for February should hint at better days ahead for this embattled sector.

That’s not terrible, but it’s a sign that a sluggish macro trend is again moving in the wrong direction. If so, the margin for disappointment is getting squeezed, which implies a higher risk of blowback from the next shock.

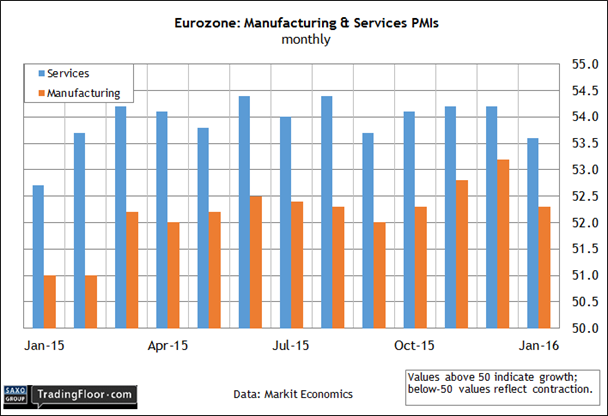

Perhaps that’s an overly pessimistic reading of current conditions. If so, we’ll see the evidence in today’s initial estimate of sentiment data for the eurozone in February via Markit’s PMIs for manufacturing and services. These benchmarks revealed a modest slowdown in January, although it’s unclear if the softer data for last month is noise or a genuine warning.

The good news: both PMIs are still comfortably in positive territory—above the neutral 50 mark that separates growth from contraction. The manufacturing PMI’s deceleration looks a bit worrisome, but much depends on how today’s flash numbers for February compare.

Economists are looking for fractional declines for both PMIs, based on the median of analysts polled by The Wall Street Journal. In other words, another round of data is set to tell us that slow growth is on track to slow a bit more, but the smoking gun—if there is one—will have to wait for another day.

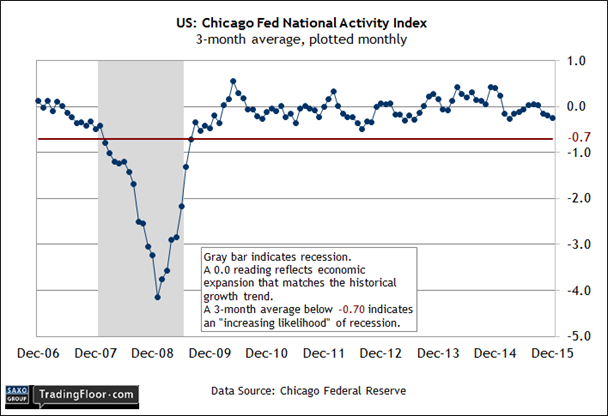

US: Chicago Fed National Activity Index (1330 GMT) The macro trend for the world’s biggest economy has wobbled lately, but last week’s data offers support for thinking that recession risk for the near term is still low. The weak stock market this year suggests otherwise. But a broad reading of economic indicators proper continue to point to growth.

Today’s update of the Chicago Fed National Activity Index will probably reaffirm that a moderate expansion prevailed in the first month of this year. In particular, the three-month average of this business-cycle benchmark (CFNAI-3MA) will remain well above its tipping point—negative 0.7—that marks the start of new contractions. My average econometric estimate projects a slight improvement for January's three-month average: negative 0.15, which marks a mild increase over December’s negative 0.24.

A slightly negative print for CFNAI-3MA reflects economic activity that’s below trend, relative to the historical record. By that standard, today’s update will probably reaffirm what’s already obvious: growth is still plugging along at a moderate rate. But there’s still enough forward momentum to keep the US out of the business-cycle ditch.

The Atlanta Fed’s GDPNow model projects a solid rebound in growth in the first quarter to 2.6% vs. just 0.7% in final three months of last year, based on the February 17 estimate. Macro bears looking to challenge that upbeat outlook probably won’t find much aid or comfort in today’s January release from the Chicago Fed.

US: Manufacturing PMI (1445 GMT) If there’s room for doubt about the near-term prospects for the US economy, the manufacturing sector is ground zero. Several metrics from this corner reflect weakness in varying degrees. But in a field of negatively skewed numbers, the PMI data for manufacturing is a bullish outlier. In fact, the January data hints at the potential for a firmer trend in the months ahead.

Markit’s headline sentiment index for the sector turned up in January, rising to 52.4. The level still reflects moderate growth, but it’s important to note that the PMI data has remained above the neutral 50 mark—in contrast with the competing ISM Manufacturing Index, which has been signalling a recession in this sector for several months. By contrast, last month’s PMI data pointed to a “moderate improvement in overall business conditions” in January, Markit advised.

The question is whether today’s initial PMI estimate for February will continue to hint at better days ahead for the embattled manufacturing sector. Perhaps. Econoday.com’s consensus forecast sees this month’s flash PMI reading ticking up to 52.5 from 52.4. In other words, slow growth is still the best guess according to this data. But that’s still an improvement over the substantially weaker signal in the recent ISM numbers. One of these indicators is wrong, but for the moment the duelling messages for the manufacturing sector are set to roll on.

Disclosure: Originally published at Saxo Bank TradingFloor.com