Britain’s economy is set for a return to the headlines with today’s update on industrial activity for January. Later, a couple of US releases will shed new light on the trend in the housing sector via mortgage applications and the state of the federal budget by way of the Treasury’s monthly statement on government outlays and receipts.

UK: Industrial Production (09:30 GMT) The possibility that Britain may leave the European Union, however remote, creates an extra layer of uncertainty for the UK economy. Neil Woodford of Woodford Investment Management, for instance, warned earlier this week in a BBC interview that so-called Brexit risk poses a threat. “It’s a gut feel that investors will definitely have to impute a higher level of uncertainty with respect to the future of the economy, [and] the currency,” he said. “All those things will have an effect on investment.”

Maybe so, but in the here and now the numbers continue to reflect a solid pace of growth. GDP in last year’s fourth quarter slowed to a 0.5% quarter-over-year gain vs. 0.7% in Q3, but that still translates into one of the stronger growth rates in the developed world. Meanwhile, the February GDP estimate from the National Institute of Economic and Social Research (NIESR) reported that the expansion picked up a bit in the rolling three-month window through January vs. the previous period: 0.7% vs. 0.5%. (For additional context, take a look at today’s monthly update on NIESR’s GDP estimate for February, which is scheduled for release at 15:00 GMT.)

Deciding how much of a threat that Brexit risk poses is unclear at this point. A possible referendum on Britain’s membership in the EU is a year away at least and a lot can happen between now and then. Meantime, today’s data will provide fresh guidance for judging how the economy is holding up in early 2015. Based on recent figures, the prospects continue to look encouraging.

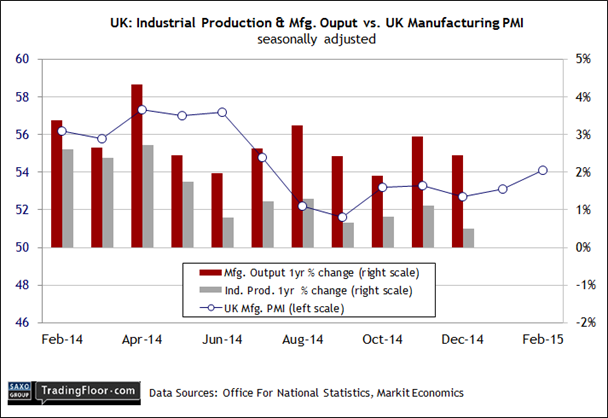

Today’s monthly update on industrial production for January is expected to show a stronger trend via the year-over-year comparison: a rise 1.3% vs. the 0.5% gain in the previous release, according to Econoday.com’s consensus forecast. Meantime, the manufacturing component of industrial activity is set to rise to a 2.6% annual increase, a bit better than the 2.4% through December. Markit's survey data implies that even stronger manufacturing numbers will arrive in the months ahead.

The potential for turbulence from Brexit risk, if it comes to that, can’t be denied. But based on the published data to date, the trend still looks strong, and that message isn't expected to change in today’s reports.

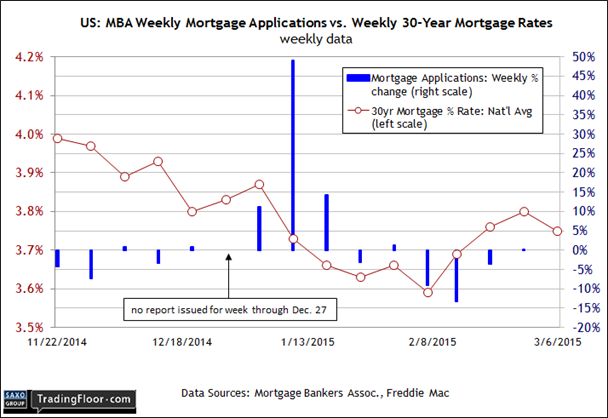

US: Weekly Mortgage Applications (11:00 GMT) The wobbly real estate market is back in focus today with the weekly update on demand for new mortgages. There’s rising anxiety about the state of housing these days in the wake of mixed numbers on sales and construction and so today’s release on the change in new mortgage applications will offer new perspective on the outlook for the spring buying season.

Looking backward certainly leaves room for doubt about the health of housing. Although sales of newly built homes perked up modestly in December and January, the much-larger market for existing sales slumped in the first month of this year to the slowest pace since last summer.

The optimistic view is that harsh winter weather has kept demand temporarily low. Relatively buoyant sentiment in the home building industry suggests that we’ll see stronger comparisons in the months ahead. “For the past eight months, confidence levels have held in the mid- to upper 50s range [for the builder sentiment index], which is consistent with a modest, ongoing recovery,” the chief economist at the National Association of Home Builders said last month. “Solid job growth, affordable home prices and historically low mortgage rates should help unleash growing pent-up demand and keep the housing market moving forward in the year ahead.”

Perhaps, then, today’s data from the Mortgage Bankers Association will provide an early clue. For the moment, however, weekly applications have been flat to negative since late-January. If there’s a spring thaw in the works, the applications data will soon announce a change in the trend. So far, however, the silence is deafening for this benchmark.

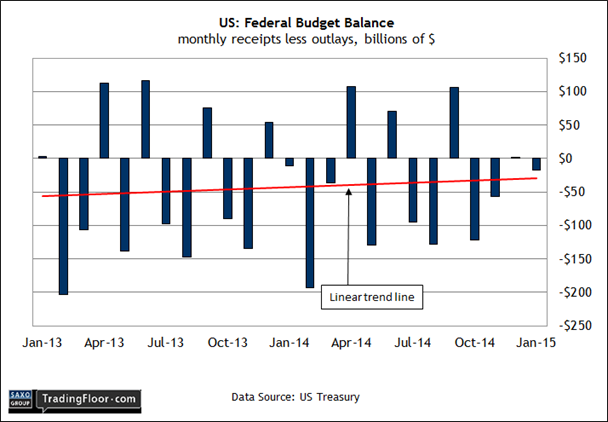

US: Federal Budget Balance (18:00 GMT) The outlook for red ink on the US government’s balance sheet was revised down slightly this week by the Congressional Budget Office, thanks largely to a modest downsizing of estimates for the growth rate in the cost of health premiums. The new forecast calls for deficits of $7.2 trillion for 2016 through 2025, which is 6% lower than the January estimate.

There’s a touch of progress in the latest round of official projections, but the politics of debt in Washington is as acrimonious as ever, and set to get worse in the weeks ahead as a number of key spending bills come up for a vote. The aura of gridlock inside the Beltway in Washington suggests that today’s monthly update on the Treasury’s budget balance will be used for partisan purposes regardless of what the numbers say.

But for those who are watching the trend, recent updates offer a glimmer of encouragement. Although the government ran a moderately bigger deficit in this year’s opening month vs. the year-earlier level, the broad trend continues to reflect a narrowing in the gap between spending and income. The linear trend for the budget balance for the past two years slopes upward, reflecting moderate but noticeable progress in paring the red ink. It’s anyone’s guess if the trend will endure, although today’s monthly statement from the Treasury isn’t expected to inspire visions of fiscal rectitude.

Econoday.com’s consensus forecast anticipates a sharp increase in red ink for February: $188 billion vs. $17.5 bn in the previous month. To the extent that a bigger deficit promotes political bickering, the roar of debate is on track to go up a few decibels with the arrival of today’s Treasury data.

Disclosure: Originally published at Saxo Bank TradingFloor.com