- UK industrial production data unlikely to boost the manufacturing outlook

- US Redbook Index to provide guidance on consumer spending

- US job openings for July will be a clue to the state of the labour market

Wednesday’s a busy day for economic news, starting with the monthly UK report on industrial activity for July. Later, two US releases will offer fresh insight on how the economy’s faring and whether the recent stock-market tumble is a genuine sign of macro distress or just noise.

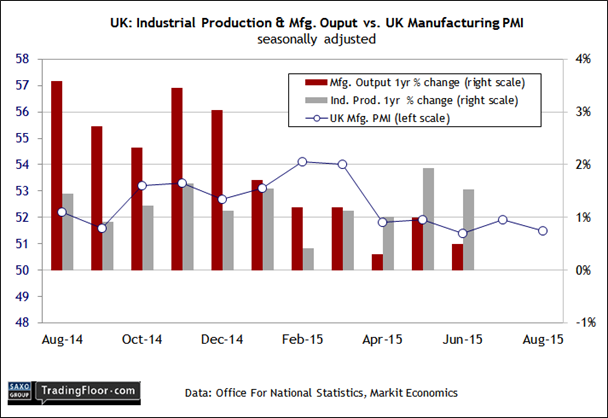

UK: Industrial Production (0830 GMT): The manufacturing sector in the UK faces a “roller-coaster of risks”, the trade group EEF warned this week. The potential for trouble inspired EEF to cut its forecast for manufacturing growth this year to 0.7% from the previous 1.5% estimate.

Looking backwards, by contrast, reveals a relatively stable, albeit moderate, expansion for manufacturing. Is that about to change for the worse? Today’s monthly update on industrial production may offer a clue.

Economists aren’t anticipating any big shifts in the trend. Output on a year-over-year basis for headline industrial production is projected to tick down to a 1.3% advance in July from 1.5% in June, according to Econoday.com’s consensus forecast. Meanwhile, the manufacturing component of the report is still on track to rise at a sluggish annual rate of 0.5%, unchanged from the previous month.

Recent survey data for the manufacturing sector also points to weak growth for the near term. “The UK manufacturing sector remains in a holding pattern, with production growth hovering around the stagnation mark and marginal job losses reported for the first time in 26 months," a senior economist at Markit Economics noted in last week’s August update of the sector’s Purchasing Managers’ Index.

In short, the EEF’s call for managing expectations down is reasonable advice in the wake of recent data. Today’s hard numbers for industrial activity probably won’t offer a convincing case for arguing otherwise.

Keep in mind that the broad macro trend for the UK economy overall still looks encouraging, as today’s monthly estimate of GDP (1400 GMT) from the National Institute of Economic and Social Research (NIESR) is expected to reaffirm. Manufacturing, however, will likely remain one of the economy’s weakest corners.

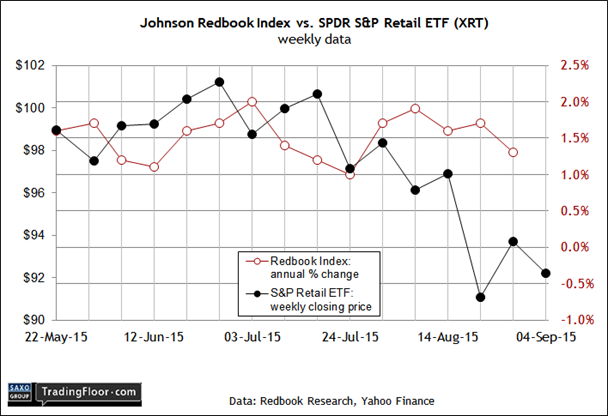

US: Redbook Store Sales Index (1255 GMT): The outlook for the US economy remains clouded thanks to the recent turmoil in global markets and new concerns that China’s growth engine may be sputtering. It’s still debatable if the US will suffer in a meaningful degree, although last week’s weaker-than-expected jobs report for August doesn’t inspire confidence.

Nonetheless, deciding if there’s more than noise in the latest round of US numbers will take time. Today’s weekly update of the Redbook Index, which measures spending for national retail chains, will offer some new perspective. The year-over-year data has been decelerating lately, a bias that’s also reflected in retail stocks (based on the S&P Retail ETF (NYSE:XRT)). The Redbook benchmark is still in positive territory, climbing 1.3% for the year through August’s final week, although that’s the slowest advance in five weeks.

If today’s annual pace slides further in today’s Redbook update, the case for optimism will suffer another blow.

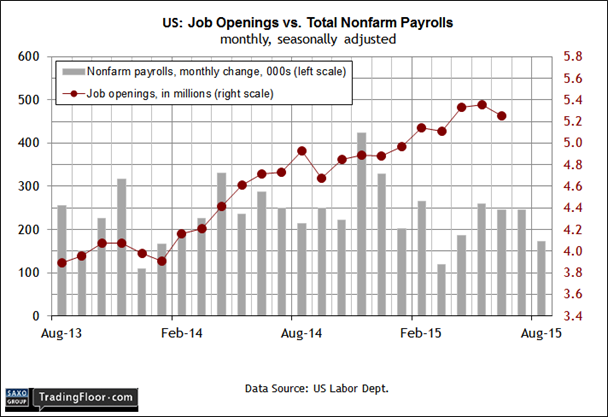

US: Job Openings and Labor Turnover (1400 GMT): Yesterday’s monthly update of the US Federal Reserve’s Labor Market Conditions Index (LMCI) was surprisingly firm in August. The moderately strong increase lifted this multi-factor measure of the labour market to a seven-month high in August.

That 2.1 reading for LMCI is still a relatively soft level relative to last year’s data. Nonetheless, the release suggests that the all-important job market is still poised to grow.

The upbeat release from the Fed also implies that today’s figures from the Labor Department on job openings will also deliver an encouraging signal. A steady if not higher number would certainly be welcome at this stage, when the crowd is struggling to get a firm read on the broad macro trend.

In the previous update, the government’s estimate of job openings slipped to 5.249 million positions for June, a three-month low. Another slide for July would mark the first back-to-back monthly declines in a year-and-a-half. That’s hardly a definitive sign of trouble for the labour market, although in the current climate a new setback would stir more questions about the US outlook.

Disclosure: Originally published at Saxo Bank TradingFloor.com