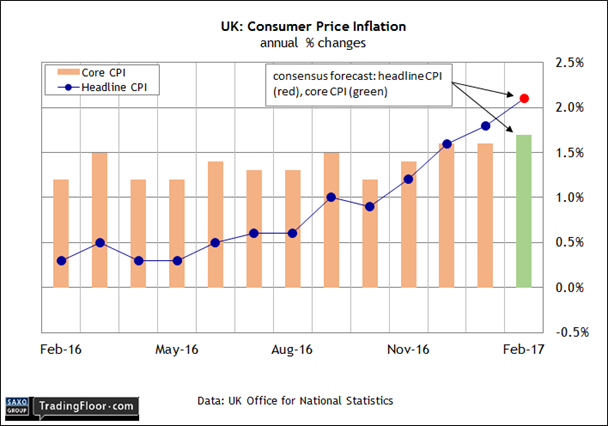

- UK consumer price index is projected to rise above 2% for the first time since 2013

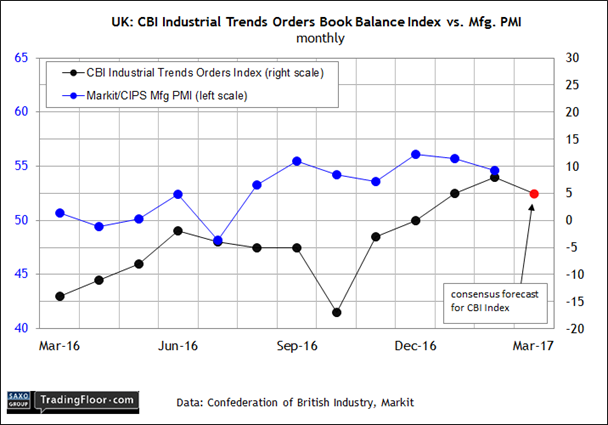

- UK Industrial Trends Orders headed for mild setback after four months of rises

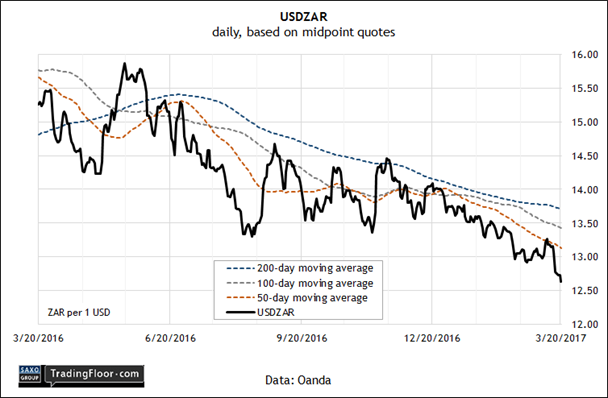

- South African rand's bullish trend is picking up speed against the US dollar

The UK economy will be under scrutiny today with a pair of updates, starting with the February report on consumer inflation, followed by this month’s CBI Industrial Trends Survey data. Meantime, keep your eye on the South African rand, which is one of the strongest currencies at the moment relative to the US dollar.

UK: Consumer Price Index (0930 GMT): The Bank of England (BoE) decided to hold its policy interest rate at a record low of 0.25% last week while inflation is expected to edge up to a three-year high in today’s update for February.

Economists expect that consumer prices at the headline level will increase 2.1% for the year through February, topping the two-percent mark for the first time since late 2013, according to TradingEconomics.com’s consensus forecast.

Is that a sign that the BoE is losing control of inflation? By the bank’s reckoning, the uncertainty over Brexit is a factor that provides cover for delaying a rate hike. “The committee expects a slowdown in aggregate demand over the course of this year, as household demand growth declines in reaction to lower real income growth,” the BoE explained.

Another factor that reduces pressure to tighten: the relatively steady pace in core inflation, which is running modestly below headline inflation. Core CPI is considered a more reliable measure of future inflation and this yardstick implies that there’s still a case for leaving rates unchanged. Core increased 1.6% in January vs. the year-earlier level, or moderately below the central bank’s 2% target.

Core CPI is expected to tick up in February, rising 1.7% in year-over-year terms. That’s still comfortably below the BoE’ target. But with inflation beginning to bubble, a substantially stronger-than-expected pace in today’s release will provide the hawks with new evidence to argue that the central bank can no longer afford to stand pat.

UK: CBI Industrial Trends Survey (1100 GMT): The unclear path of Brexit in the months ahead may worry the monetary mavens at the Bank of England, but the top brass at large financial institutions expect that the UK economy will continue to expand at a solid pace this year.

A new survey by Lloyds Bank shows that more than half of the executives polled think that growth will keep pace if not beat the average for the G7 nations in 2017. A bit more than a fifth are looking for a pickup in growth this year relative to 2016.

Survey data from other sources paint an upbeat outlook too. The UK Manufacturing PMI for February continued to align with a brisk rate of economic growth. “The latest PMI signals that the UK manufacturing sector continued its solid start to the year,” a senior economist at IHS Markit said earlier this month.

The CBI Industrial Trends Orders Index has also been rising lately too, reaching the highest level last month since 2015. “Stronger demand and production is good news for UK manufacturers, though the weaker pound continues to push up input costs and this is now feeding through to output price inflation expectations,” CBI’s chief economist explained last month.

A degree of disinflation in orders activity is expected in today’s update for March, however, according to TradingEconomics.com’s consensus forecast. The CBI index is on track to ease to +5 today, the first decline since November. Nonetheless, the crowd thinks that a positive reading will prevail for the third straight month, marking the best run for the benchmark in two years.

Brexit could still create headwinds for the UK economy in general, and manufacturers in particular, but today’s update isn’t expected to offer much of a warning.

USDZAR: The economic and political outlook for South Africa is mixed, but the bulls have the bears on the run when it comes to trading the rand.

The currency has been gaining ground against the US dollar this year, a trend that strengthened in the wake of last week’s “dovish” US rate hike by the Federal Reserve. Since March 15, when the Fed lifted its target rate by 25 basis points, USD/ZAR has tumbled more than 3% through mid-day trading on Monday (a decline for USD/ZAR equates with a rise in the rand vs. the greenback).

One factor behind the rand’s strength: rising demand for South African bonds this year. According to Bloomberg, offshore investors have recently purchased the country’s debt at the strongest rate since last September. The firmer appetite has helped transform the rand into one of the strongest-performing currencies vs the dollar over the past year.

The technical profile for USD/ZAR suggests that the bullish momentum has room to run. Indeed, the spot price for the currency pair was well below key moving averages and the 50-day average was far below the 200-day counterpart, based on daily prices at midday on Monday. The strong trend implies that USD/ZAR will continue to slip in the near term.

Disclosure: Originally published at Saxo Bank TradingFloor.com