- April's UK Leading Index offers an update on the macro outlook ahead of Brexit

- Will the benchmark 10-year Treasury yield continue to slide this week?

- Politics look set to keep pressure on USDJPY

The Conference Board publishes its monthly update of the UK Leading Index for April, offering a fresh estimate of Britain’s macro trend. Meanwhile, the crowd will be watching the 10-year Treasury yield with renewed focus in the wake of last week’s slide that left the benchmark rate at a four-month low. USD/JPY will also attract attention as traders weigh the prospects for continued yen strength after a strong rally in this year’s first half.

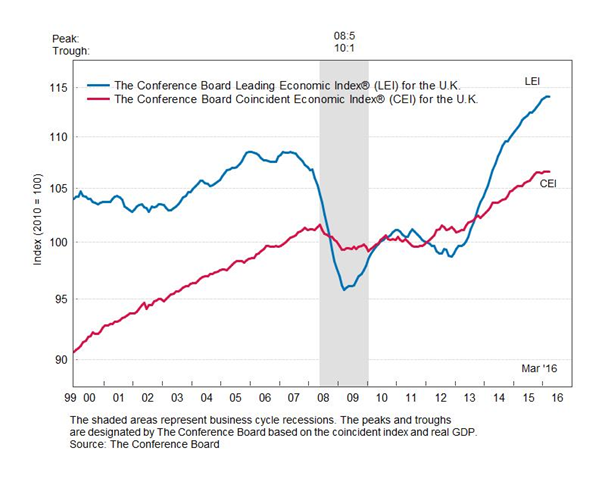

UK: CB Leading Index (1330 GMT): Economic hazards may be lurking if the UK votes next week to leave the European Union, but the latest run of numbers suggest that moderate growth endures.

Last week’s monthly estimate of GDP, for instance, ticked higher for the three months through May, according to the National Institute of Economic and Social Research. The consultancy reported that UK output expanded 0.5%, up from 0.4% for the three months through April. “A rebound of the production sector output has supported reasonable GDP growth in the three months to May 2016,” a spokesman for NIESR said.

Meanwhile, the UK trade deficit fell to a seven-month low in April, thanks to a jump in exports that was close to a three-year high, the government reported. “Along with the jump in industrial production in April and decent retail sales growth, the trade data suggest that UK GDP growth could be holding up better in the second quarter than has been thought, despite the heightened uncertainty,” said the chief UK economist at IHS Global Insight.

Today’s monthly update of the Conference Board’s UK Leading Index will offer a clue on the outlook for the near-term future. Note that this benchmark has held on to recent gains lately, remaining unchanged in March vs. the previous month. If the index is relatively steady in today's update, the news will reaffirm the view that Britain’s economy has a tailwind going into the June 23 Brexit vote.

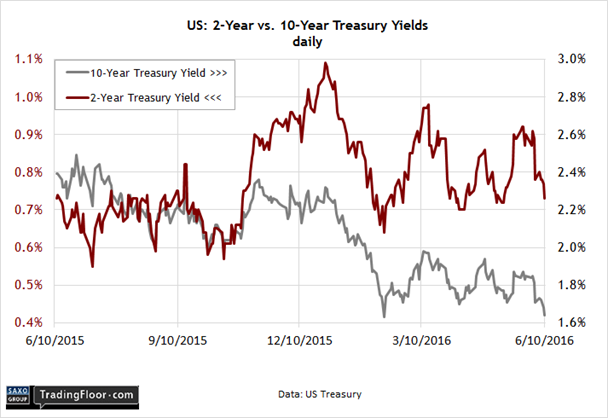

US: 10-Year Treasury Yield: Is it Brexit worries that has unleashed a fresh wave of foreign buying? Or maybe the dramatic slowdown in US employment growth is the catalyst. Perhaps it’s a general concern that global economic momentum is slowing. Whatever the cause, the risk-off trade has been driving the Treasury yields lower … again.

Last week’s slide left the benchmark 10-year yield at 1.64%, based on daily data via Treasury.gov. That’s the lowest rate since early February. The tumble is hardly limited to the US. The German 10-year yield, for instance, has resumed its descent in recent weeks and is now close to zero. Between uncertainty linked to Brexit and expectations for soft growth overall, the crowd is inclined to favour safe assets.

In a sign of the times, the World Bank last week cut its global growth forecast for 2016 to 2.4% from its 2.9% forecast in January. The reduced estimate “is due to sluggish growth in advanced economies, stubbornly low commodity prices, weak global trade, and diminishing capital flows,” the bank explained.

Although the 10-year Treasury’s yield is near its record low of just above 1.40%, the rate still looks relatively rich from the perspective of German and Japanese government bonds. “The surge in foreign demand for Treasuries speaks as much to a lack of ‘safe’ assets as fear of recession,” noted a strategist at {{|Société Générale}}.

The question today – and in the days to come – is whether the 10-year Treasury yield is headed for a new low?

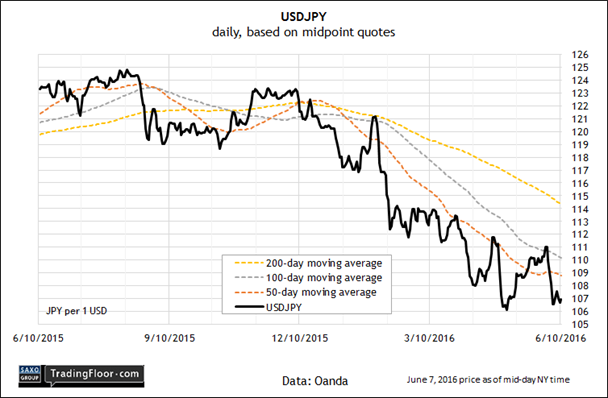

USD/JPY: Has the bull run this year for the Japanese yen run its course? It’s too soon to say, but USD/JPY’s second attempt this year has failed at convincingly piercing the 106 level on the downside. But with the global appetite for safety still coursing through world markets, the bulls may mount another charge.

Momentum signals still favour a stronger yen. USD/JPY continues to trade below its 50-, 100-, and 200-day moving averages, based on daily data using midpoint quotes. Politics look set to keep pressure on USD/JPY in the days ahead of the UK’s June 23 vote on EU membership. “The closer we get to the 'Brexit' vote, the more people will put on cautious positions,” the global head of FX strategy at Deutsche Bank told Reuters last week.

As for USD/JPY, last week was relatively quiet with trading confined to a narrow range. Traders will be watching to see if USD/JPY will fall below last week’s intraday low of roughly 106.33. If that floor gives way, the breach may signal a new phase of yen strength.

But first, let’s see what the Federal Reserve decides on June 15, when the central bank releases a new monetary policy statement. The crowd’s expecting the Fed to punt on a rate hike, which suggests that USD/JPY trading will be quiet until the Federal open Market Committee statement arrives.

Disclosure: Originally published at Saxo Bank TradingFloor.com