- Will deterioration in Eurozone sentiment continue?

- Solid gain projected for US private payrolls

- Is the recent rally in emerging-market stocks a bear-market trap?

Economic sentiment in the Eurozone is a key release today via the European Commission’s monthly reading of the mood for consumers and businesses. Later, ADP publishes its estimate of US private payrolls for March, offering a preview of Washington’s official data due on Friday. Meanwhile, a new report from Natixis raises doubts about the durability of the recent rebound in emerging-market equities.

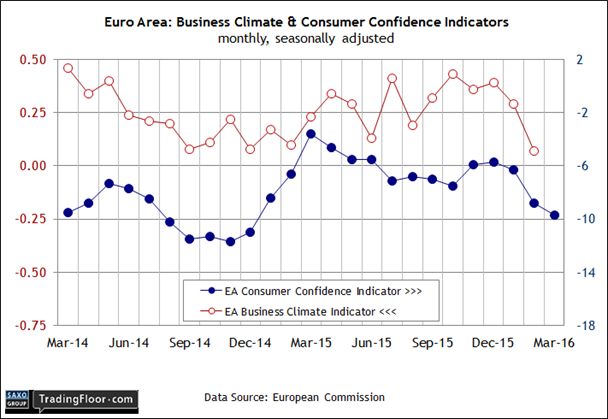

Eurozone: Economic Sentiment (0900 GMT): Consumer confidence in the Eurozone slipped to its lowest level in over a year in the flash estimate for March. Will today’s update on sentiment in the business community follow suit?

The negative momentum of late in the European Commission’s benchmarks point to a weak trend brewing for 2016. The consumer data has eased for three months in a row. Meanwhile, the Business Climate Indicator tumbled sharply in February, dipping to the lowest level since late 2013.

Clearly, the mood has soured. Curiously, the near-term outlook for growth has ticked up lately. Now-casting.com’s first-quarter estimate for GDP growth held at a 0.4% quarter-over-quarter pace in last week’s update – slightly above the 0.3% rise in last year’s fourth quarter. If the forecast holds, the Eurozone will post its first improvement in quarterly growth in a year.

Meanwhile, last week’s flash data for Markit’s Eurozone Composite Purchasing Managers’ Index for March ticked higher for the first time in three months. “The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter,” said Markit’s chief economist.

But with sentiment in the consumer and business sectors faltering, is the outlook for faster (or even stable) first-quarter growth headed for a downgrade? It’s going to be tougher to answer “no” if the mood continues to deteriorate in today’s revised profile for March.

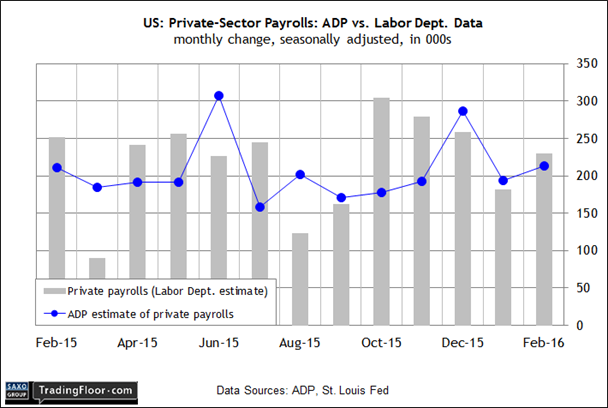

US: ADP Employment Report (1215 GMT) : The labour market has been posting respectable gains lately and economists think that today’s update for private payrolls in March will continue to support that narrative.

Econoday.com’s consensus forecast calls for a 203,000 increase in corporate payrolls this month. That’s slightly below the 214,000 advance in February, but a respectable gain nonetheless.

Numbers from other corners of the labour market offer support for thinking positively. Job openings in January, for instance, inched up to a five-month high. Meanwhile, initial jobless claims remain close to a post-recession low through mid-March.

“There’s a cautious optimism” on the hiring front, the senior economist at 4Cast Inc. said last week. “Things may slow a little as the year goes, but we’ve got a pretty healthy picture in the labour market.”

Such optimism will be tested today, but for the moment the outlook remains comfortably in the bullish column for jobs. If the crowd is right and the ADP update matches expectations, the news will reaffirm the upbeat projection for the official payrolls report that’s scheduled for Friday.

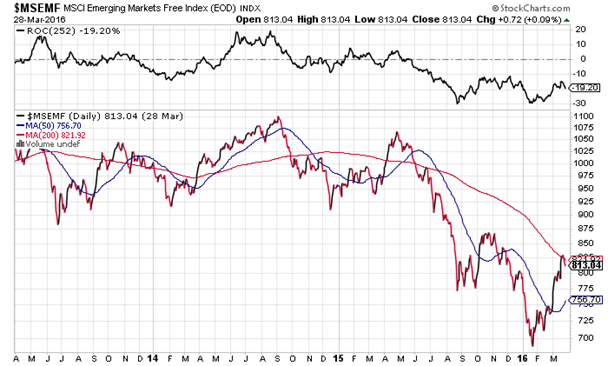

Emerging Markets Equities: The rally of late throughout emerging markets has inspired forecasts that the long-awaited rebound has finally arrived. The MSCI Emerging Markets Index (a float-adjusted benchmark), for instance, has climbed 15% since late January. Is this the start of a sustained rally for this battered corner of the world’s equity markets? Not so fast, according to a newly published research note from Natixis.

The Paris-based bank this week labelled the belief that the fundamental outlook for emerging markets has turned bullish as “irrational”. Analysing the prospects for growth, investment, debt, and several other factors suggests that “there is no change in the fundamentals to justify” a return to investing in these countries. “Altogether, all the fundamentals in emerging countries excluding China are trending negatively.”

The technical profile for MSCI Emerging Markets Free Index (in US dollar terms) looks troubling too. Although the benchmark has popped over the past month, a bearish aura prevails. For instance, the 50-day moving average remains well below its 200-day counterpart and the trailing one-return is still deeply negative.

The outlook would change, of course, if emerging markets continue to rally. But that’s a low-probability scenario based on the technical picture, with support from the fundamentals, according to Natixis.

Emerging markets index

Disclosure: Originally published at Saxo Bank TradingFloor.com