US economic data is the main event for today’s macro numbers as the crowd’s attention focuses ever more closely on tomorrow’s policy announcement from the Federal Reserve. Three reports will provide more insight for deciding if a rate hike is likely: consumer inflation, the New York Fed’s regional manufacturing survey, and the monthly update on sentiment for the home building industry via the National Association of Home Builders.

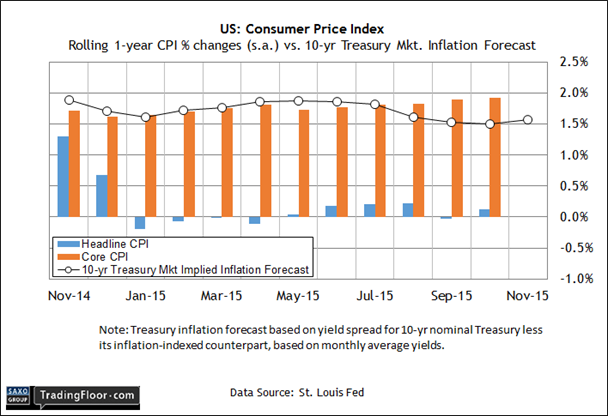

US: Consumer Price Index (1330 GMT): Consumer inflation ticked higher in October after two straight months of decline. The mildly positive reading for pricing pressure inspired some economists to consider the possibility that inflation is firming, and thereby offering support for the Federal Reserve to start raising interest rates at tomorrow’s monetary policy meeting.

Today’s report on the consumer price index for November, however, is not expected to be all that helpful for policy hawks. The year-over-year trends for headline and core CPI haven’t changed much recently, although if you look closely you’ll see a slight upward bias in the annual pace of inflation after stripping out energy and food. But that's a thin reed for arguing that monetary policy should be tightened before the year is out.

In fact, the numbers du jour are projected to show fresh weakness for last month’s profile. Econoday.com’s consensus forecast sees no change for headline CPI’s monthly comparison, down from October’s 0.2% rise. Meanwhile, core CPI — considered a more reliable measure of the trend — is expected to rise 0.2% for November in monthly terms, matching the previous gain.

In other words, no big changes are expected for today’s inflation update relative to the previous release. Soft inflation persists. The Fed's 2% inflation goal is a near-term possibility based on core CPI's 1.9% annual rise, although headline CPI's year-over-year pace is close to zero. Using this data as a guide, there’s still a weak case for a Fed rate hike and it's unlikely that the November release will offer a different view.

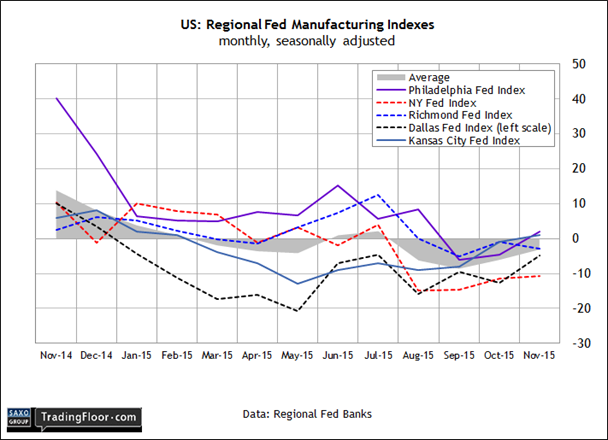

US: New York Fed Manufacturing Survey (1330 GMT): Today’s report will be widely read in search of an early clue on US economic activity for December. Recent data from various regional Fed indices — including the New York numbers — suggest that the contraction is easing. Four of five benchmarks showed varying degrees of improvement last month. It’ll be useful to see if the healing continues in today’s update.

National numbers paint a mixed picture for the cyclically sensitive manufacturing sector. Markit’s US Manufacturing Purchasing Managers’ Index (PMI) continues to show a modest pace of growth, albeit at a slower rate in November versus the previous month. By contrast, the ISM Manufacturing Index dipped below the neutral 50 mark last month for the first time in three years.

Today’s New York Fed report will help the crowd sort out the conflicting messages. Briefing.com’s consensus forecast calls for another step in the right direction. The Empire State Manufacturing Index is expected to rise to a negative 5.9 reading for this month. That’s still a sign of contraction, but if the forecast holds it’ll mark the highest reading since July. In that case, the news will offer support for thinking that manufacturing's climbing out of its hole.

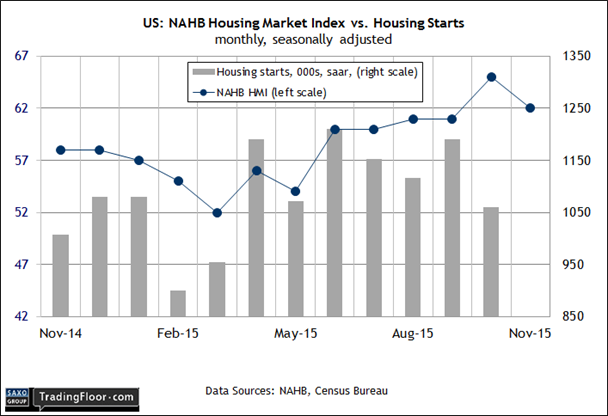

US: US Housing Market Index (1500 GMT): Sentiment in the home building industry has been bullish recently. The hard data, however, has pointed to substantially softer conditions. Nonetheless, today’s update on the mood via the National Association of Home Builders is expected to deliver another dose of optimism.

Econoday.com’s consensus forecast calls for an uptick in NAHB’s Housing Market Index to 63 in December, up a point from last month’s 62. Recent readings in the low-60s mark the highest levels in a decade. “Even with this month’s drop, builder confidence has remained in the 60s for six straight months — a sign that the single-family housing market is making long-term headway,” NAHB’s chairman said last month.

If today’s report falls in line with expectations, the upbeat outlook in the home building industry will send a message that the recent weakness in residential housing construction is due for a rebound. Is that a viable forecast? We’ll have the answer tomorrow, when the government publishes new numbers on housing starts for November.

Disclosure: Originally published at Saxo Bank TradingFloor.com