Germany’s monthly update on retail spending in January will set the tone for eurozone economic analysis today. We’ll also see the initial estimate for the eurozone's consumer inflation in February, followed by the release of pending home sales numbers for the US for the first month of 2016.

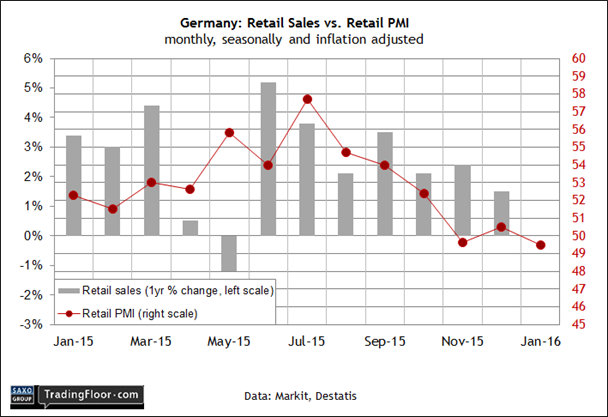

Germany: Retail Sales (0700 GMT) Europe’s industrial heart is pumping slower these days, but the pace of growth remains solid and steady for the services side of Germany’s economy. That, at least, is the profile via Markit’s survey data for February. Will today’s hard numbers on retail spending for January fall in line with that review?

The stakes are a bit higher in the wake of recent numbers that show Germany’s industrial sector faltering. Industrial output declined for the second month in a row in December, raising concerns that the slowdown in global economic activity is pinching Europe’s biggest economy.

Another headwind is the return of deflation in Germany. For the first time in five months, the EU harmonised estimate for consumer prices in February slipped below zero, according to preliminary numbers from DeStatis, Germany’s statistics office.

Today’s update on last month’s consumer spending will provide fresh context for deciding how Germany’s macro trend is faring in the new year. For the moment, the outlook is biased to the downside. “The German economy appears to be in the midst of a slowdown, according to February’s flash PMI results,” a Markit economist said last week. “Although the [Composite] PMI is still signalling an overall expansion in economic activity, the rate of increase slowed for the second month running and was the weakest since last July.”

Today’s report will help the crowd decide if Markit’s outlook for a softer trend for Germany is reasonable. One reason for thinking positively on the consumer front: last week’s Gfk Consumer Climate Index is showing signs of a modest rebound in the first quarter after tumbling in last year’s second half.

The consultancy projects a two-percent rise in consumer spending this year, on par with last year’s gain. “There is a noticeable rise in income expectations but hardly any change in the economic outlook, Gfk advised. “The propensity to buy remains stable.”

But as the chart below shows, Markit's retail PMI data hints at a stumbling trend. Will today's hard numbers for spending confirm the survey data's warning?

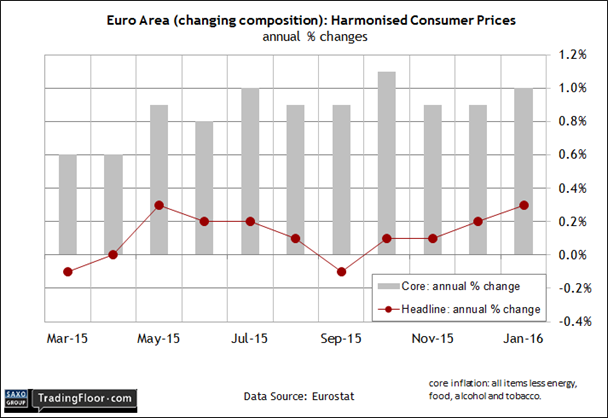

Eurozone: Consumer Price Index (1000 GMT) Eurozone inflation in January was weaker than initially estimated, according to last week’s revision. Consumer prices increased 0.3% last month against a year ago, slightly lower than the preliminary 0.4% estimate. Is that a sign that disinflationary forces are set to accelerate in the months ahead? Today’s flash estimate for February will be widely read in search of new clues.

Inflation at the headline level has been running well below the European Central Bank’s target of just below 2% for several years. Meantime, the latest downtick on inflation comes after several weeks of downward revisions in estimates of first-quarter eurozone GDP. Now-casting.com on Friday projected growth at 0.25%, slightly below last year’s fourth quarter 0.3% rise.

Nonetheless, it’s unclear if inflation is decelerating. Even after last week’s downward revision, consumer prices continue to show a gentle but steady drift higher, albeit at unusually low levels for the headline data.

January’s 0.3% advance marks the highest rate since last May. In addition, note that core inflation continues to run at a substantial higher and relatively steady pace– 1.0% for the year through last month.

In other words, there’s still a cautious argument for expecting that inflation will hold its ground. All bets are off, however, if today’s flash data for February reflects a sharply lower print.

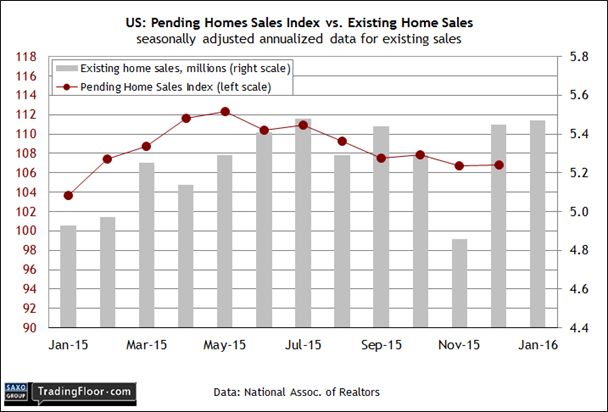

US: Pending Home Sales (1500 GMT) Sales of existing homes inched higher in January, holding on to the dramatic rebound in December that reversed the sharp tumble in the previous month. The latest increase, although modest, eases fears that the real estate sector is headed for trouble in 2016.

Today’s monthly numbers on pending sales, viewed as a leading indicator for demand, will bring deeper perspective for deciding if the residential real estate market will continue to recover.

“The housing market has shown promising resilience in recent months, but home prices are still rising too fast because of ongoing supply constraints,” the chief economist at the National Association of Realtors (NAR) said last week.

Is firmer pricing a potential headwind for housing? Perhaps, although today’s report on NAR’s pending sales data is expected to post another increase for January. Econoday.com’s consensus forecast projects a solid 0.5% monthly increase in pending sales.

If the prediction holds, this leading indicator will post two consecutive monthly advances for the first time since last spring. In that case, the outlook for the housing market will continue to brighten.

Disclosure: Originally published at Saxo Bank TradingFloor.com