Europe’s labour market is in focus today with unemployment updates scheduled for Germany and the eurozone. Later, US auto sales for January will provide a hard-data review of consumer spending habits at the start of 2016. US auto sales are expected to have ticked higher in January.

Germany: Unemployment (0855 GMT) The outlook for growth in Europe’s largest economy was trimmed slightly in last week’s update of the government’s forecast. Berlin now expects that GDP will rise 1.7% in 2016, down a touch from the previous 1.8% outlook. Nonetheless, the current prediction suggests that growth is stable: the 1.7% forecast matches last year’s pace, based on data published by the Federal Statistical Office.

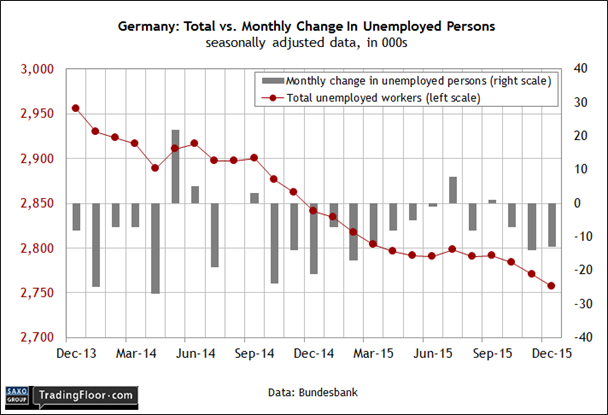

Today’s monthly unemployment report will likely provide support for expecting the broad macro trend of moderate growth is sustainable. The last two updates revealed an acceleration in the slide in the population of newly unemployed workers. November and December posted monthly declines in excess of 10,000 – the strongest back-to-back decreases in jobless persons since the first quarter of 2015.

Today’s release is on track to show that the official unemployment rate will remain steady at a relatively low 6.3% in January, according to Econoday.com’s consensus forecast. Keep your eye on how the monthly change in the jobless population compares for another perspective, and one that’s arguably superior for judging the trend in the labour market.

Even if the data du jour is encouraging, there are still headwinds for Germany courtesy of the slowdown in global economic activity that’s been pinching the country’s export machine. Yesterday’s report on sentiment in the manufacturing sector showed that growth slowed a bit last month. “Although the headline [purchasing managers’ index] signalled further growth in the sector, the pace of expansion was relatively sluggish,” noted an economist at Markit Economics. A key factor: subdued demand in foreign markets.

Nonetheless, slower growth is manageable as long as the labour market continues to post encouraging numbers, which is probably what we’ll see in today’s update.

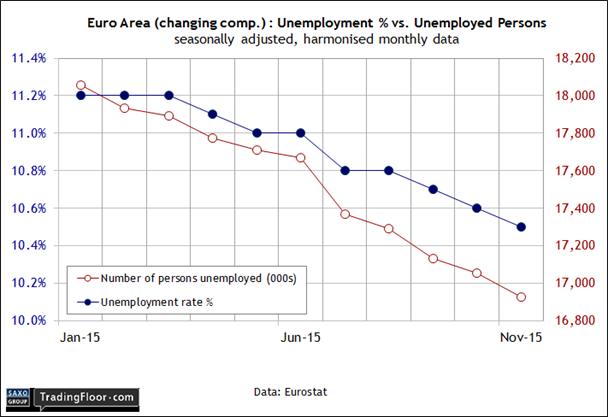

Eurozone: Unemployment (1000 GMT) The jobless profile for Europe still looks quite weak when compared with Germany, but the good news is that there’s ongoing progress overall with paring the damage across the countries that share the euro. The 10.5% unemployment rate for the eurozone in November remains painfully high, but there’s a clear downward bias over the last several months.

The worry is that today’s data may reveal that the recent progress slowed or even stagnated in December. Econoday.com’s consensus outlook sees the unemployment rate for the euro area holding at 10.5%. If so, today’s update will mark the first time since last August that the jobless rate in the eurozone didn’t tick lower.

But there may be a silver lining if we see the population of unemployed workers continue to drop. Recent updates show a comparatively brisk fall on this front. The rate of decline continued to pick up in the data through November, which posted a 7.8% year-over-year decrease in unemployed workers – the third straight month with a slightly bigger year-on-year slide.

If the rate of descent for the unemployed population deepens a bit more in today’s release, the news will offer some tangible evidence that Europe’s modest recovery remained intact at the close of 2015 – even if it's not obvious in the jobless rate.

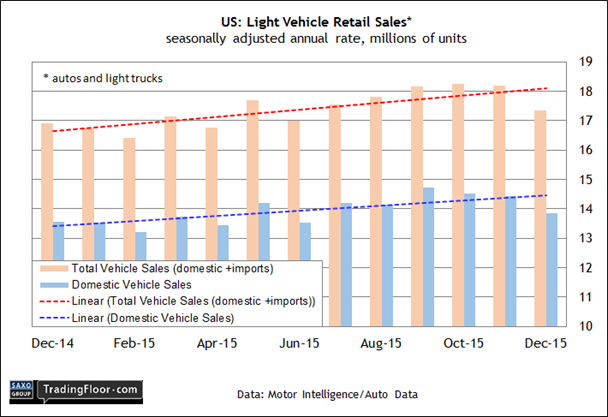

US: Auto Sales (TBD) Yesterday’s update on consumer spending and income for December painted a mixed picture for the monthly comparisons, although the year-over-year data shows that modest growth remains stable on both counts. Today’s numbers for January auto sales will offer an early look at how retail spending compares in the new year.

As single purchases go, auto purchases are a key bellwether for gauging the state of mind in the consumer sector. Second only to house purchases, buying a new car – or not – imparts quite a lot of information about the appetite for spending.

By that standard, recent history reflects an upbeat mood. Auto sales have trended higher through most of 2015. But December revealed a break in the trend with total vehicle sales (for cars and light trucks) dipping sharply to 17.34 million units (annualised) – the lowest since last June. Is that an early warning that consumption growth generally is heading lower in this year's first quarter?

Yesterday’s news of flat performance in personal consumption expenditures for last month certainly fuels the idea that demand is waning. The good news is that the unchanged state of December spending vs. the previous month appears to be a choice rather than a necessity. Indeed, personal income rose a healthy 0.3% last month and is higher by 4.2% vs. the year-earlier level – roughly in line with the previous year-over-year rise.

Today’s update on auto sales will dispense valuable insight on whether the penchant to save more and spend less is carrying over into 2016.

Analysts think we’ll see a slight rise for today's release. Econoday.com’s consensus forecast calls for total vehicle sales to tick up to 17.5 million units in January, modestly ahead of December’s level. The bullish trend in this corner may have peaked, but the crowd anticipates a relatively stable start for auto sales for the year.

Disclosure: Originally published at Saxo Bank TradingFloor.com