Tuesday’s a busy day for economic news, including the monthly update on Germany’s unemployment rate. We’ll also see new jobless numbers for the Eurozone and the first look at the US ISM Manufacturing Index for February.

Germany: Unemployment Report (0855 GMT): Europe may be vulnerable to another wave of deflation risk, but consumers in the currency union's biggest economy don't appear to be terribly worried. Consumer spending in Germany jumped 0.7% in January in real terms - well above the crowd’s expectations for a 0.1% gain.

Is that a sign that growth is set to accelerate in Europe's heartland? Perhaps, although the monthly comparison is noisy. Meanwhile, retail spending on a year-over-year basis slipped by 0.8% last month - the first decline in eight months.

The survey data for the services and manufacturing sectors is soft too. The Germany Composite Output Index dipped to a seven-month low in February, Markit Economics reported last week.

The slowdown in manufacturing, in other words, is starting to pinch the broad trend. As a result, job creation in Germany dipped to its weakest pace since last April. “Rises in employment were largely centered on the service sector, as manufacturing staffing levels decreased slightly for the first time in a year-and-a-half,” Markit advised.

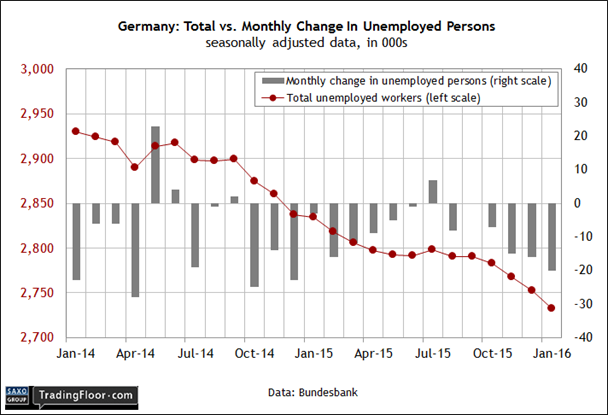

Is that a sign for expecting trouble in today’s monthly unemployment report? No, at least from the perspective of the official jobless rate, which is set to remain unchanged at 6.2%, according to Econoday.com’s consensus forecast.

The question is whether we’ll see any stress in the number of unemployed workers for January. Recent history looks encouraging on this front - the ranks of the newly unemployed fell for the fourth straight month in January, dipping the most in a single month in over a year.

Several economists are looking for a lesser decline today, but any dip at this point would be treated as good news.

Macro momentum may be slowing in Germany, but expecting anything more than a modest deceleration looks excessive at this point as long as the unemployed population continues to fade.

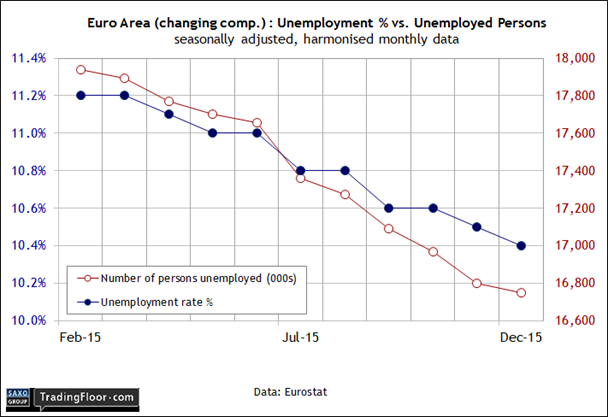

Eurozone: Unemployment Report (1000 GMT): Jobless data for the euro area is due for an update today as well. Although the February inflation report for the Eurozone reveals a return to mild deflation for the year-over-year comparison - down 0.2% in February - analysts expect that the jobless rate for January will hold steady at 10.4% — the lowest in over four years.

But with deflation again on the radar, is macro risk on the rise? The optimistic spin is that the latest dip into negative territory for consumer inflation is a function of weak energy prices. But note that core inflation, which strips out energy, food alcohol and tobacco, dipped to a 0.7% year-over-year rate.

That’s still comfortably above zero, but it’s well down from the 1.0% pace in the previous update and the slowest gain since last April.

"Deflation would be a disaster for the euro area as the burden of high debt would increase,” a Nordea economist told the BBC this week. “Therefore, the [European Central Bank] will continue easing monetary policy significantly.”

In other words, the stakes are high for seeing today’s jobless rate hold steady if not ease further. No change is the call via Econoday.com’s consensus outlook. But with “D” risk moving back into a threatening position, an upside surprise in today’s jobless data will send a clear signal that Europe’s economic recovery may be in jeopardy once more.

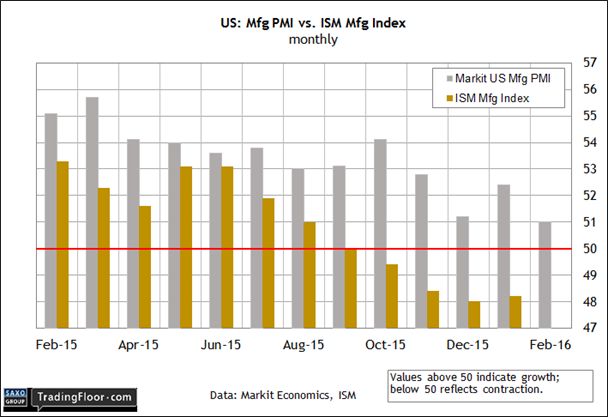

US: ISM Manufacturing Index (1500 GMT): The news for the manufacturing sector continues to deteriorate. Last week’s flash report for Markit’s purchasing managers’ index (PMI) revealed that output in February was the weakest in more than three years. “Every indicator from the flash PMI survey, from output, order books and exports to employment, inventories and prices, is flashing a warning light about the health of the manufacturing economy,” said Markit’s chief economist, Chris Williamson.

The good news: the PMI remains above the 50 mark, but just barely. The 51.0 reading for February is close to confirming the contractionary profile that’s been haunting the competing ISM Manufacturing Index in recent months. For each of the four months through January the ISM data has remained below 50. A repeat performance is expected today.

Econoday.com’s consensus forecast calls for a slightly higher reading - 48.5 for February against 48.2 for January. But the contraction in manufacturing is set to continue in no uncertain terms by way of this data.

Meanwhile, today’s revised PMI for February (due out at 1445 GMT) is projected to hold on to its thin line of optimism by ticking up to 51.3 against 51.0 in the flash data. Nonetheless, the PMI and ISM profiles are widely expected to tell a similar story: the manufacturing trend is weak and set to remain so for the foreseeable future.

Disclosure: Originally published at Saxo Bank TradingFloor.com