- Analysts are looking for a fresh round of monetary stimulus from the ECB today

- The mystery is about the stimulus detail and its impact on the real economy

- Initial jobless claims in the US are expected to show a welcome tick lower

- Bloomberg’s Consumer Comfort Index should point to solid consumer spending

Monetary policy for the Eurozone is the main event for Thursday, starting with the European Central Bank’s policy announcement and followed by the central bank’s press conference. Later, two weekly numbers will bring new perspective on the state of macro in the US: initial jobless claims and Bloomberg’s Consumer Comfort Index.

Eurozone: ECB Announcement (1245 GMT) and Press Conference (1330 GMT) The market is expecting another round of policy stimulus and it’s a safe bet that the ECB will deliver the goods. The mystery is about the details and whether the crowd will be satisfied that yet another phase of monetary stimulus will have an impact on the real economy.

The data on US jobs looks encouraging, but the low unemployment rate could mask a decline in the working-age population of male workers and soft productivity.

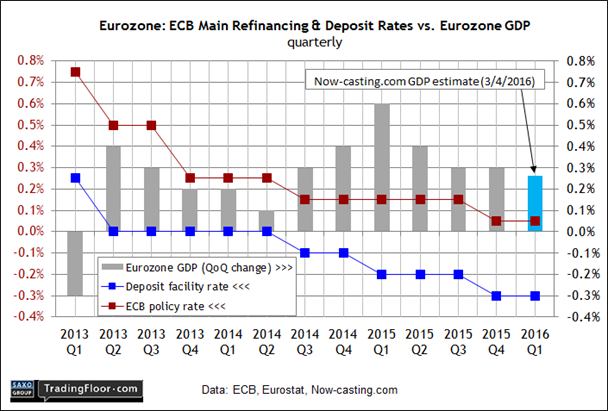

The main refinancing rate is widely expected to remain unchanged at 0.05%, although analysts see the potential for adjustments in several other areas.

“The ECB has set the bar high again, fuelling expectations about significant policy measures,” Natixis advised earlier this week. The bank is expecting that the ECB will cut its deposit rate by 10 basis points to negative 0.40%, with an eye on the possibility for future cuts in the months ahead. Raising the size of the current QE programme (buying assets with newly printed money) and extending it six months through September 2017 are also viable options, according to Natixis.

For additional thoughts on what the ECB might do, Simon Fasdal—Saxo’s head of fixed-income trading—considers the possibilities. For example, he thinks that the central bank may start buying corporate bonds in the marketplace, which could have a “big impact” on riskier asset classes.

Meantime, the weak inflation data for February adds to the case for easing. Eurostat late last month reported that its flash February estimate for headline consumer prices fell back into deflation, dipping 0.2% vs. the year-earlier level. Core inflation is still positive, but here too the flash February trend eased, dipping to a 0.7% annual rate from the previous 1.0% rise through January.

The euro area’s economic trend is expected to stay positive, although Now-casting.com’s current estimate for first-quarter GDP growth projects a whiff of deceleration vs. last year’s 0.3% rise for Q4.

“Since the ECB’s January meeting, the case for further stimulus appears to have increased appreciably,” said the chief UK and European economist IHS Global Insight.

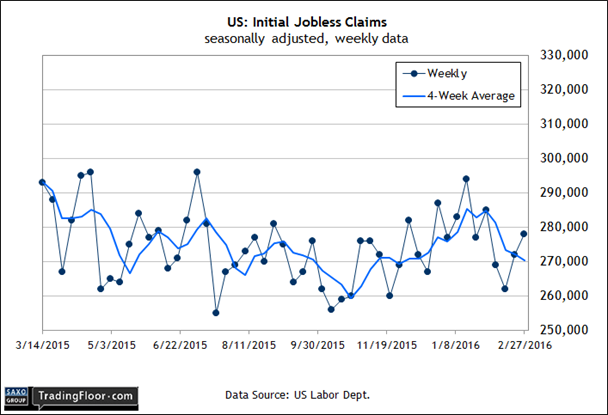

US: Initial Jobless Claims (1330 GMT) Today’s weekly update on new filings for unemployment benefits is on track to reaffirm last week’s upbeat estimate on payrolls for February. Briefing.com’s consensus forecast sees jobless claims ticking lower in the first week of March to 275,000 (seasonally adjusted). The expected decline of 3,000 translates into another bullish update for this leading indicator that points to continued growth for the labour market. Indeed, as long as claims remain well under the 300,000 mark, it's hard to argue that the labour market is stumbling.

The hard data looks solid, but former Fed governor Kevin Warsh this week said that there’s still trouble when you look behind the headlines. In particular, he warned that the low unemployment rate—4.9% in February, an eight-year low—masks weakness in the state of US payrolls. As Warsh sees it, the slide in the jobless rate is less about growth vs. a decline in the working-age population of male workers, soft productivity and a modest rate of economic growth.

“I’d suggest that is why the politics of 2016 seem quite at odds with the official government statistics, which the Fed describes in meeting after meeting as nearing full employment,” Warsh said on Tuesday.

Maybe so, but a modest recovery still beats a contraction and the crowd’s still looking for another positive clue in today’s report on new claims. Until or if we see claims rising persistently—particularly on a year-over-year basis—this leading indicator is poised to signal that economic growth will roll on.

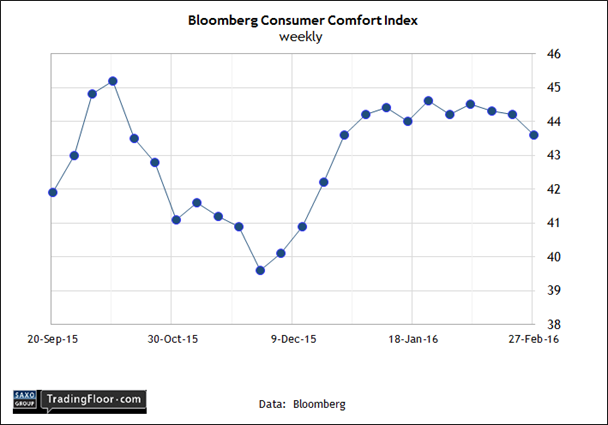

US: Consumer Comfort Index (1450 GMT) Bloomberg’s weekly measure of consumer sentiment has eased lately, but the benchmark is still holding on to the lion’s share of its gains from late 2015. A repeat performance in today’s update will strengthen the view that the mood on Main Street is still aligned with moderate growth for the US economy.

Another survey on sentiment from Gallup reported last week that “Americans' confidence in the US economy has held steady since July.” Meanwhile, the University of Michigan’s monthly Consumer Sentiment Index in February remained roughly unchanged from levels in recent months, which is to say close to the highest readings for the past year.

It all adds up to support for thinking that the solid 0.5% advance in personal consumption expenditures in January—the best monthly gain in seven months—is a prelude to ongoing spending growth in the months ahead.

Disclosure: Originally published at Saxo Bank TradingFloor.com