- The Eurozone updates its financial profile via the current account balance

- Brazil’s Economic Activity Index will point to the state of its recession

- US home builders in good shape for August update of the Housing Market Index

Monday’s a slow day for economic news, although we’ll see the monthly update of the Eurozone’s current account data for July.

Later, Brazil’s central bank publishes new data for its Economic Activity Index, a proxy for GDP. We’ll also see the August update of the US Housing Market Index, which tracks sentiment in the home building industry.

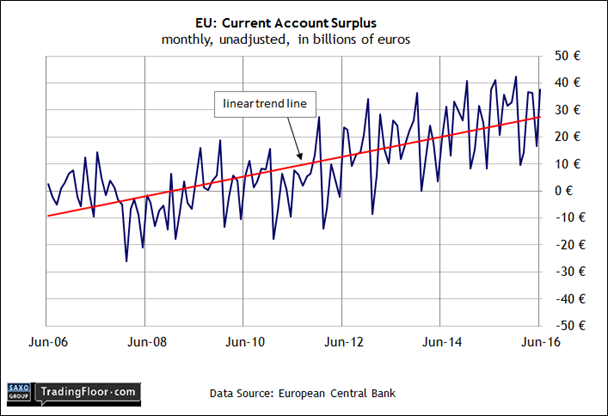

Eurozone: Current Account (0800 GMT): The European Central Bank’s efforts to reflate the economy will be in focus today with the July release of balance of payments data.

The current account numbers in particular deserve attention as the currency bloc continues to struggle with an unwelcome strengthening in the euro.

“The euro is far stronger than they want, and stronger than the economy deserves, but they don’t know how to weaken it,” Hans Redeker, head of currency at Morgan Stanley, told The Telegraph recently. “This is exactly what happened to the Japanese.”

The rising current surplus, he advised, is supporting the disinflation by strengthening the currency. If so, recent figures paint a troubling profile. In the June update, the unadjusted surplus jumped to €37.6 billion—the highest so far this year and close to a record since the euro was launched.

If the unadjusted numbers push even higher in today’s July release from the European Central Bank, the news will remind the market that the risks of deflation by way of a stronger euro continue to lurk.

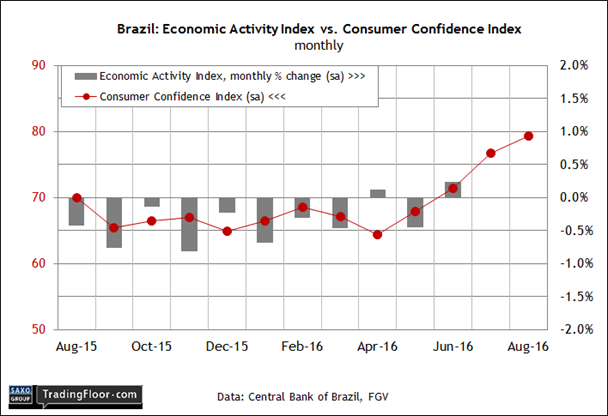

Brazil: Economic Activity Index (1130 GMT): The services sector rebounded in July, boosting expectations that Brazil’s economy may be in the early stages of emerging from its worst recession in decades.

The statistics agency IBGE on Friday reported that services activity jumped 0.7% against the previous month.

The news follows the launch of a government plan to privatise key assets in transport, energy and other sectors in a bid to revitalise growth. “We need to open up to the private sector because the state cannot do everything,” said President Michel Temer, who was sworn in last month after his predecessor, Dilma Rousseff, was forced to step down after an impeachment trial.

Today’s monthly report of the Economic Activity Index will offer another clue for deciding if Brazil’s recession is easing.

The yardstick, which is published by the country’s central bank, ticked up in June, rising for the second time in the last three updates. Considered as a proxy for the official GDP data, the index has been looking firmer lately after a run of negative readings.

The ongoing rebound in FGV’s consumer survey data, which is updated through August, implies that today’s numbers on the broad trend for July will continue to deliver a positive read. But even in the best case scenario the outlook remains challenging.

“The economy appears to have picked up from rock bottom, but economic data is still poor,” notes FocusEconomics. But given the depth of the country’s political and economic crisis, even small moves in the right direction will sustain hope that the worst has passed.

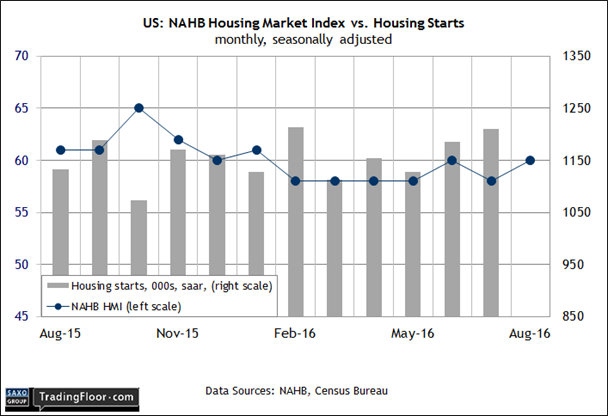

US: Housing Market Index (1400 GMT) The upbeat mood in the home building industry implies that the modestly firmer pace of residential construction activity in recent months will continue for the rest of the year.

Housing starts increased in July for the second month, reaching the highest level since February. Brighter sentiment among home builders suggests that there’s more to come.

“New construction and new home sales are on the rise in most areas of the country, and this is helping to boost builder sentiment,” said the chairman of the National Association of Home Builders (NAHB) last month in a statement.

Economists think the mood will remain upbeat in today’s sentiment update for August. Econoday.com’s consensus forecast sees the Housing Market Index holding steady at 60, which equates with a majority of builders anticipating growth.

Note, however, that tomorrow’s hard data for August housing starts is expected to dip slightly. But if builders are still optimistic, perhaps the residential construction numbers will dispense an upside surprise.

Disclosure: Originally published at Saxo Bank TradingFloor.com