The US certainly dominates proceedings today with both PPI and jobless claims on tap, not to mention a couple of regional Fed surveys and TIC flows. Furthermore we have both Spain and France selling bonds at 09:30 and 10:00 GMT, respectively. Spain will attempt to sell 3-, 4- and 6-year bonds while France will try to sell 2-, 4- and 5-year bonds.

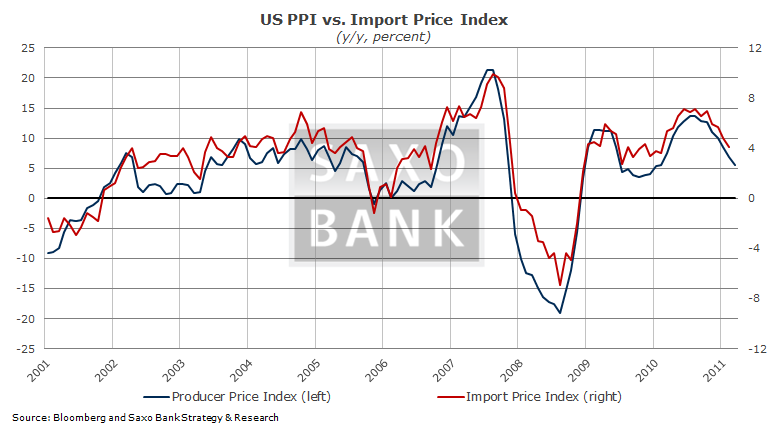

Feb. US producer prices (12:30) to rise short-term, but trend is down: Yesterday's report on the Import Price Index showed a deceleration in inflation to 5.5% y/y from 6.9% a month earlier and a peak of 13.7% in July 2011. Given our expectation that the US will continue to muddle through to the tune of 2% GDP growth this year and fading effects from temporary price shocks last year we see inflation headed somewhat lower from here. The correlation between import prices and the PPI is understandably high and points to a deceleration today even if consensus looks for a robust +0.5% m/m. US Jobless Claims (12:30) to improve again? While momentum has subsided somewhat, this year's improvements in Initial Jobless Claims have so far proved sustainable, with the 4-week moving average hovering around 360,000; down from 400,000 just four short months ago. This has also been reflected in the US Employment report, which beat expectations yet again last Friday. Nevertheless we still would like to see a couple of months' more worth of data to determine to what extent - if at all - seasonal factors have made data look better during the winter months than it really is. We have won a battle, but not yet the war. Consensus looks for 357,000 from 362,000 last week.

US Jobless Claims (12:30) to improve again? While momentum has subsided somewhat, this year's improvements in Initial Jobless Claims have so far proved sustainable, with the 4-week moving average hovering around 360,000; down from 400,000 just four short months ago. This has also been reflected in the US Employment report, which beat expectations yet again last Friday. Nevertheless we still would like to see a couple of months' more worth of data to determine to what extent - if at all - seasonal factors have made data look better during the winter months than it really is. We have won a battle, but not yet the war. Consensus looks for 357,000 from 362,000 last week.

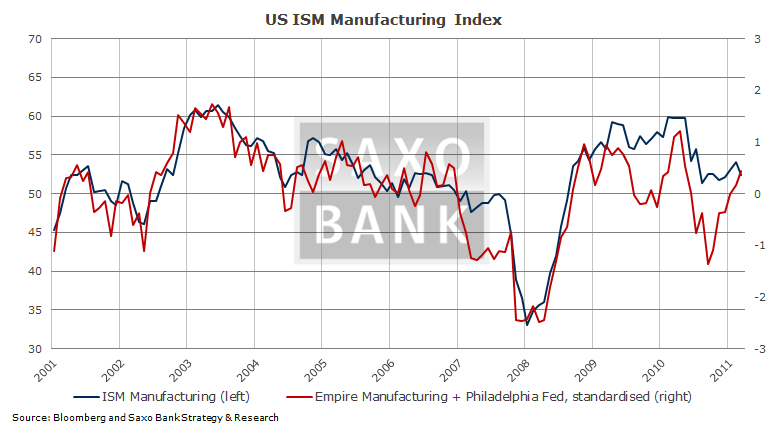

US Mar. Empire Manufacturing (12:30) and Philadelphia Fed. (14:00) to show healthy expansion? The first two regional Fed surveys for March will be released today, with consensus expecting mixed results, but results nevertheless which point to expansion. If the two surveys realise consensus' forecasts of 17.5 and 12, respectively, it is indicative of an ISM Manufacturing Index reading around 54.4 (compared to 52.4 presently).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Numbers to Watch: US Surveys, PPI and Jobless Claims

Published 03/15/2012, 05:37 AM

Updated 03/19/2019, 04:00 AM

3 Numbers to Watch: US Surveys, PPI and Jobless Claims

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.