Several updates on the US economy are front and center today, starting with the weekly report on new jobless claims. Later, a weekly gauge of consumer sentiment will be released via the Bloomberg Consumer Comfort Index. Soon after, the February numbers on existing home sales will be published.

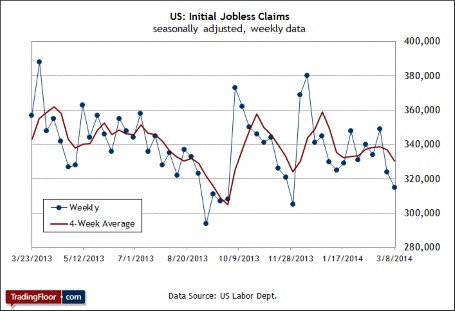

US Initial Jobless claims (12.30 GMT): This leading indicator is looking bullish again. In the last two weekly updates, new filings for unemployment benefits dropped by healthy amounts, leaving the current number of claims at its lowest level since last November. Although some economists think that a modest reversal is in store for today, the consensus forecast of 325,000 isn't a big move relative to the 315,000 total for the week through March 8 (seasonally-adjusted data).

Bear in mind that a downside surprise of any magnitude would be a strong signal for thinking the labour market is poised for substantially stronger growth in the spring and beyond. That’s considered a low-probability event at the moment. But if the crowd is wrong and claims tumble, it may be time to revise expectations up a bit.

Meantime, the recent drop in claims is among the stronger indicators for seeing the recent run of mixed economic news as a temporary affair due to the harsh winter. That line of analysis will survive intact even if today’s consensus forecast holds and filings remain close to a four-month low.

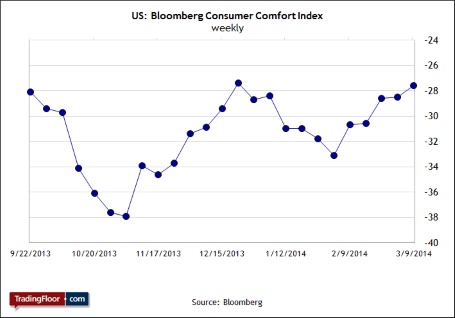

US Bloomberg Consumer Comfort Index (13.45 GMT): Retail sales rebounded in February and rose a bit more than expected. The upbeat news is welcome after a month of disappointing economic reports. It’s still not clear if there’s more than Old Man Winter behind the wobbly numbers, but a higher level of consumer spending certainly adds to the evidence for assuming that we’ll see stronger comparisons once the warmer weather kicks in.

Today’s weekly release of consumer expectations will offer more context for deciding if February’s rise in spending is more than a one-time event. In the previous report, the Bloomberg Consumer Comfort Index posted its fifth straight advance and rose to its highest level since late-December. That also puts this benchmark close to the recent peak from last August, when the macro outlook was considerably brighter all around. “Better employment prospects and a reduced pace of firings in the economy has bolstered confidence in the broader economy,” a Bloomberg economist noted last week.

If this weekly gauge can deliver another increase, the outlook looks good for anticipating that the economy will enjoy a stronger run of growth in the spring.

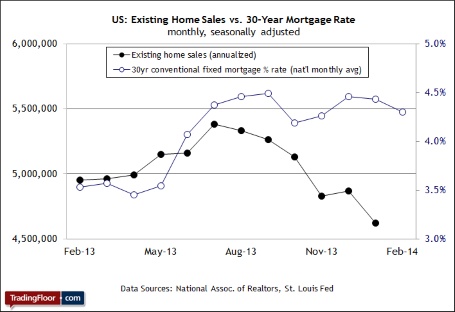

US Existing Home Sales (14.00 GMT): Housing has been one of the weaker corners of the economy lately, as this week’s update on February housing starts reminds us. New residential construction fell for the third month in row, raising fresh concerns about the health of this key sector. But here too the weather may be a factor. In fact, a robust increase in newly-issued housing permits last month suggests as much. Applications to build homes jumped nearly 8 percent in February although that was due to the surge in multi-family permits. Single-family housing applications, by contrast, slipped nearly 2 percent.

In short, there’s still uncertainty about what’s in store for the housing market but perhaps today’s news on existing home sales will provide more clarity. Here also, the trend of late has been discouraging. Sales of previously built homes, which accounts for the lion’s share of residential real estate transactions, fell sharply in January to the lowest level in more than a year. “Disruptive and prolonged winter weather patterns across the country are impacting a wide range of economic activity, and housing is no exception,” said Lawrence Yun, the chief economist at the National Association of Realtors, the group that publishes the existing sales data. “At the same time, we can’t ignore the ongoing headwinds of tight credit, limited inventory, higher prices and higher mortgage interest rates.”

Although the consensus forecast is seeing another dip in today’s update, economists think that the decline will be marginal. If so, that may be a sign that demand is stabilising. In turn, that leaves room for thinking that the March report may bring better news. It doesn’t hurt that mortgage rates have been more or less holding steady lately. Nonetheless, the state of housing looks shaky at the moment and so it’ll be useful to see how or if the outlook changes in today’s data.