Some mixed data out of Asia earlier to kick start the day. On the positive side, China's (official) PMI Manufacturing rose to its highest level in 13 months in April at 53.3 (53.6 expected) and 53.1 prior though there has been some talk since about seasonality pushing the number higher. Austrlia, on the other hand, not only cut rates more than expected by 50bps to 3.75% vs. 4% expected, but its version of PMI Manufacturing declined to a miserable 43.9 from 49.5 earlier - the lowest level since the depths of the global recession. We continue with the "global PMI day" today as the UK and US will also release their April numbers and we also get Construction Spending from the latter to boot.

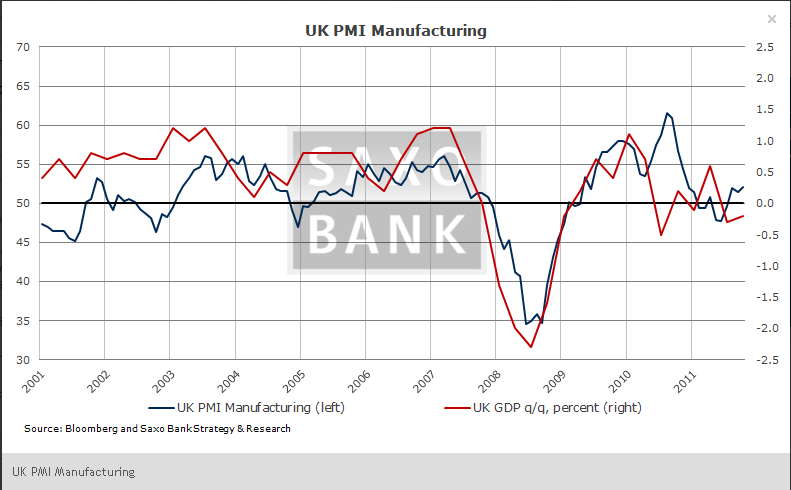

April UK PMI Manufacturing (08:30 GMT) to ease somewhat: Despite some improvement in the numbers from the UK they have failed to beat expectations. The Citi Surprise Index from the UK is back below zero at -7.6 having peaked at 97.6 in mid-February. This was also evident in last week's GDP release, which saw the economy return to recession with a -0.2% q/q print in 1Q'12 (after -0.3% in 4Q'11) as private and public sector austerity more than offset any gains from other parts of the economy. Consensus looks for more of the same in today's PMI Manufacturing report, which they forecast will show a slowdown to 51.5 in April from 52.1 a month earlier.

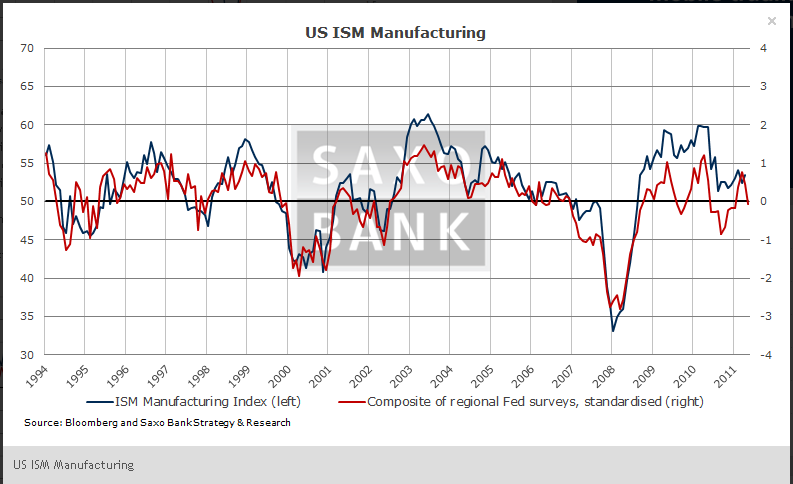

April US ISM Manufacturing (14:00) to decelerate, but still grow: Yesterday's Chicago PMI was not exactly an optimistic precursor of today's national PMI report as the index plunged 6 points to 56.2 vs. expectations of 60. Especially the Production and to some extent New Orders components were poor, but on the other hand it is worth mentioning that this auto-dependent report has been overstating US growth for several years now as the auto sector has rebounded forcefully from near extinction in Great Recession. Therefore a similar sharp drop should not be expected in today's report, but will rather more likely ease lower in line with the string of regional Fed surveys that have done the same.

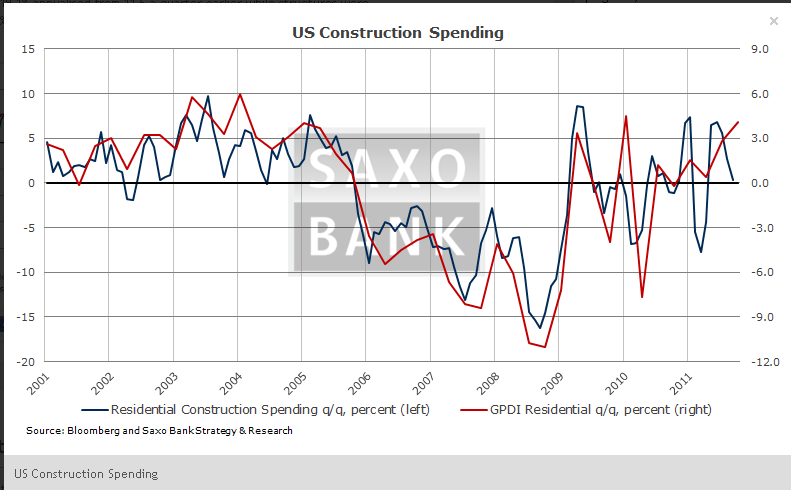

March US Construction Spending (14:00) to improve towards end of Q1: As it feeds directly into the GDP report this report bears watching. A weak February (-1.1% m/m) is expected to be replaced by a halfway comeback on March of +0.5% according to consensus. In the first take on Q1 GDP (which was released last week and showed growth of 2.2% q/q ann.) residential investment were estimated to have risen 19.1% annualised from 11.6 a quarter earlier while structures were seen down 12% from -0.9% prior.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Numbers To Watch: UK PMI, US ISM Manufacturing & Construction Spending

Published 05/01/2012, 03:11 AM

Updated 03/19/2019, 04:00 AM

3 Numbers To Watch: UK PMI, US ISM Manufacturing & Construction Spending

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.