The release of the anecdotal Beige Book from the Federal Reserve is among the key events today, but before we get to that we have Housing Starts from Canada and the Import Price Index from the US.

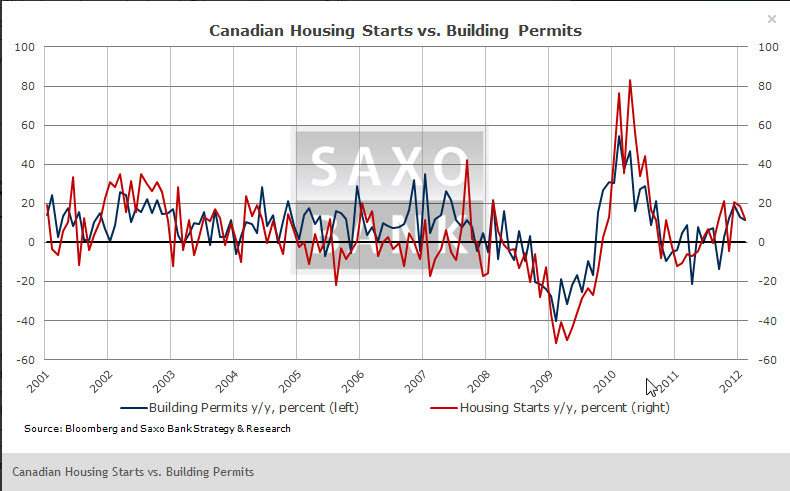

Mar. Canadian Housing Starts (12:15 GMT) to stay range-bound: Though the Canadian housing market has so far managed to escape mostly unharmed from the global recession, the sector is nevertheless struggling to move decisively higher. Permits rose 3.9% in the twelve months through February with starts up 5.4%. This suggests that there is not much upside potential in the immediate future and consensus is in line with the assessment, targeting 200,000 starts, down by 1,100 since February.

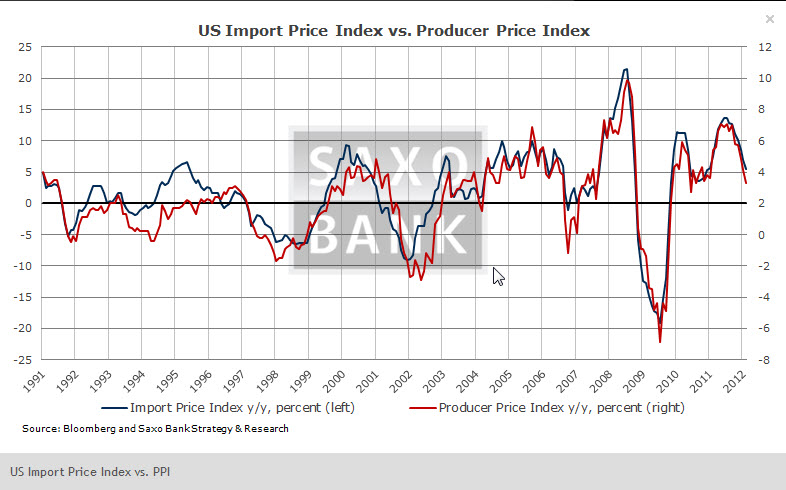

Mar. US Import Price Index (12:30) to continue to decelerate: The fading of temporary factors has seen inflation trend lower in the US and we look for a futher deceleration in March. The Import Price Index, which is correlated to the Producer Price Index (out tomorrow at 12:30), is expected to gain 0.9% m/m, but drop to 3.4% from 5.5% y/y. Though gasoline remains high for the year, commodities overall are not too strong, which points to further weakness in the various price indices in the coming months.

US Fed's Beige Book (18:00): The Beige Book, the anecdotal description by Federal Reserve Banks of economic conditions in the districts, is expected to show a US economy which is heading into lower gear - but not reverse. Expectations for 1Q GDP are currently running at 2% q/q (annualised) and we expect more of the same in this second quarter. (Note: a bit later in the evening (21:30) Fed vice chair Yellen will speak about "The Economic Outlook and Monetary Policy" in New York.)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 numbers to watch: housing starts, import prices, & Beige Book

Published 04/12/2012, 05:16 AM

3 numbers to watch: housing starts, import prices, & Beige Book

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.