We continue the series of PMI numbers today as the finalised wurozone manufacturing numbers, plus UK construction, are scheduled for release. We will also be treated to German labour market numbers. We then turn our atttention to the US and the ADP employment report, the traditional warm-up report ahead of Friday's 'nonfarm payrolls' employment report, and then factory orders.

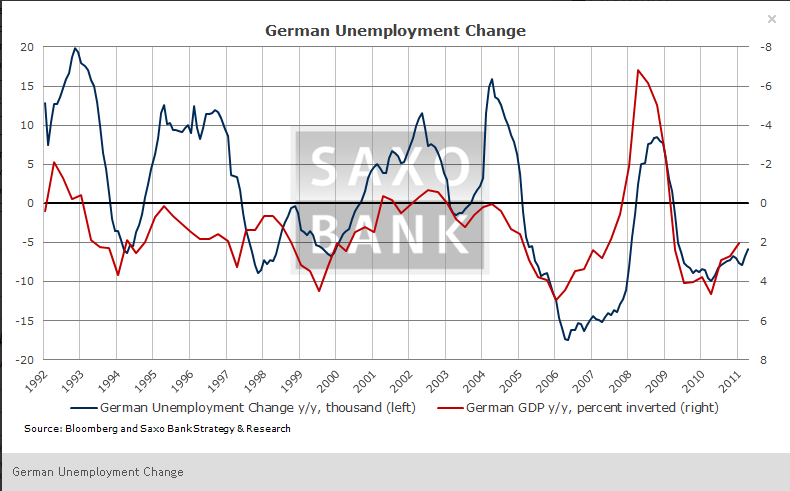

April German Unemployment Change (07:55 GMT) to continue to improve: The locomotive of growth in the eurozone, Germany, may have shifted down in gears, but the union's largest economy remains a far more well-oiled machine than most of the other economies in the struggling euro bloc. In particular the German labour market has gone from strength to strength in spite of the debt crisis, with the unemployment rate down at 6.7%, the lowest print since the reunification, and consensus looks for further improvement in April. Though the rate is not expected to change, the number of unemployed is seen declining yet again, this time by 10k, and if we ignore a one-time blip in October when an extra 6k unemployed were registrered, the trend of fewer unemployed has been in place since June 2009.

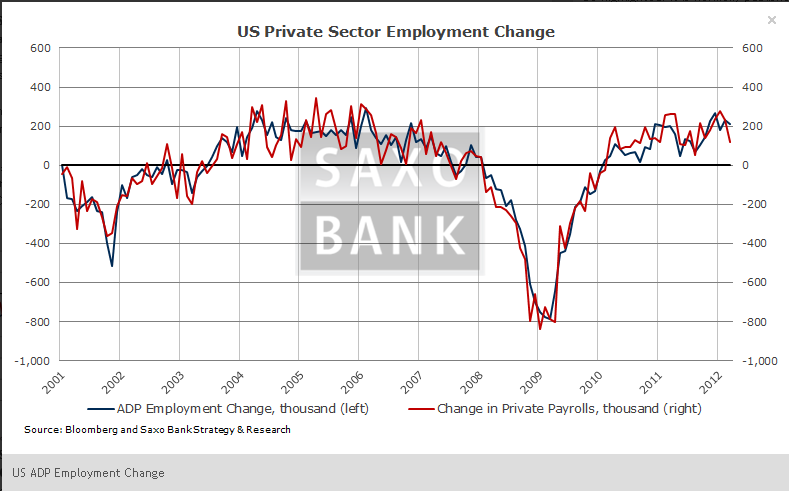

April US ADP Employment Change (12:15) to show weaker, but still moderate job growth: The private sector has done a reasonable job of keeping the US economy afloat in recent quarters despite headwinds from both Asia and notably Europe. And this was indeed needed, as the public sector has lost 575k jobs since the end of the recession (in the same time span the private sector has added 2.89 million.) as state and local governments have struggled to correct the ship amid budget cuts. Consensus looks for another reasonably strong, if sequentially smaller, increase in the private sector of 170k in April down from 209k. This will, if realised, be the smallest increase in the private sector workforce since October's 142k.

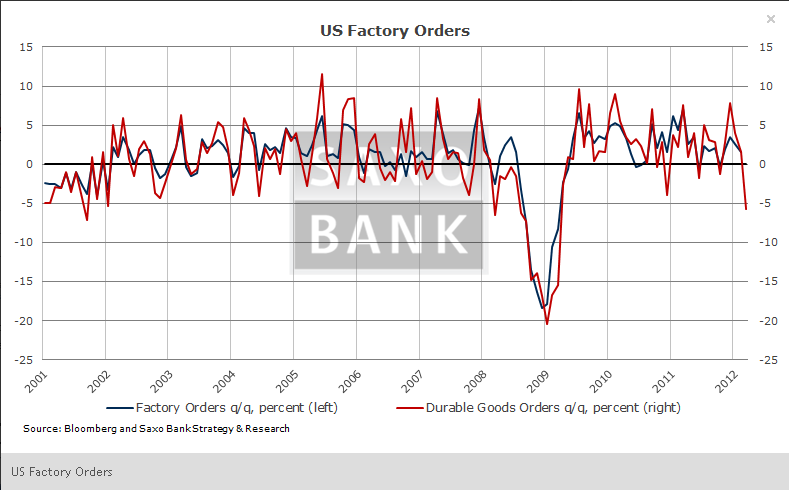

March US Factory Orders (14:00) to drop on the back of weak Durable Goods Orders: Total factory orders, of which durables are roughly half, are seen down 1.7% m/m due to the sharp drop of 4.2% recorded in the (already released) Durable Goods Orders report, which was quite a bit worse than expectations of -1.7%. Hence consensus looks for nondurables to rise 0.4% on the month. The revisions contained in the Durable Goods Orders report also suggests a downward revision to February's Factory Orders gain of 1.3%.

Before these three reports, keep an eye out for PMIs from Europe, though most are finalised versions and hence not likely to change much.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Numbers To Watch: German Unemployment, US ADP & Factory Orders

Published 05/03/2012, 03:52 AM

Updated 03/19/2019, 04:00 AM

3 Numbers To Watch: German Unemployment, US ADP & Factory Orders

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.