The EU finance ministers meet in Copenhagen, Denmark, today to discuss ways to strengthen the beleaguered union so that it will be able to fight off renewed weakness in one or more countries, if (when) that happens. The European Stability Mechanism (ESM) in particular is bound to get a lot of attention, with Germany so far unwilling to increase the EUR 500 ceiling.

That is not all that is on the programme today, and we have found three more tangible things to watch out for, namely three end-of-month reports on prices, income/spending, and production

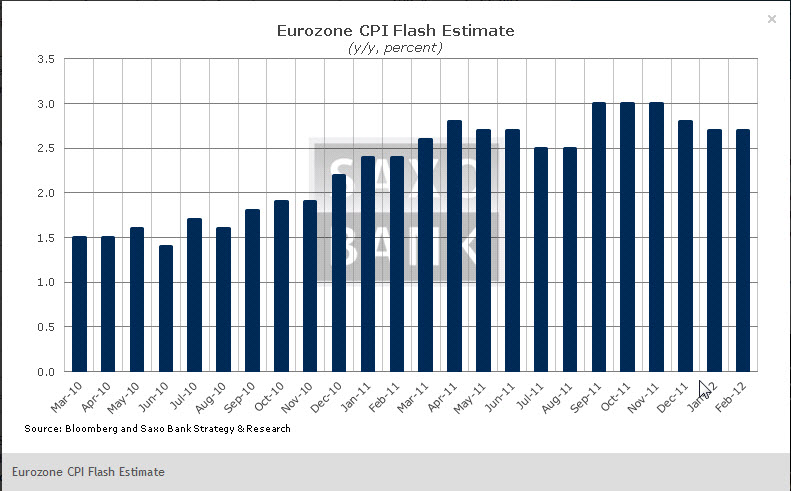

- Mar. Eurozone CPI Estimate (09:00 GMT) to decelerate? Despite economic weakness, inflation in the Eurozone has been stubbornly high, but deceleration is in progress. We expect this to continue, although high energy prices will contribute on the upside. Consensus sees today's flash report on March CPI paint a picture of prices growing at 2.5% y/y this month versus 2.7% a month ago and a peak of 3% in November.

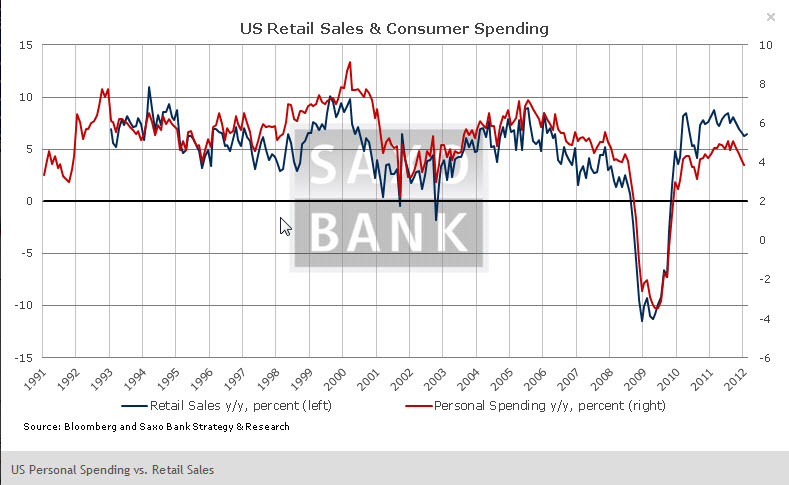

- Feb. US Personal Spending & Income (12:30) to rise robustly? We worried a month ago, when the last report on income and spending was released that income was lagging behind, and as a result consumers had drawn down their savings to fund their purchases. This is still a real concern, in particular in light in the very weak development in inflation-adjusted income, but at least the savings rate has moved a bit higher to 4.6% from 4.3% in both September and November of last year. Consensus is quite optimistic ahead of today's report (no doubt aided by the solid Retail Sales report a few weeks back, which showed a large 1.1% increase m/m), expecting gains of 0.4% and 0.6% in income and spending, respectively.

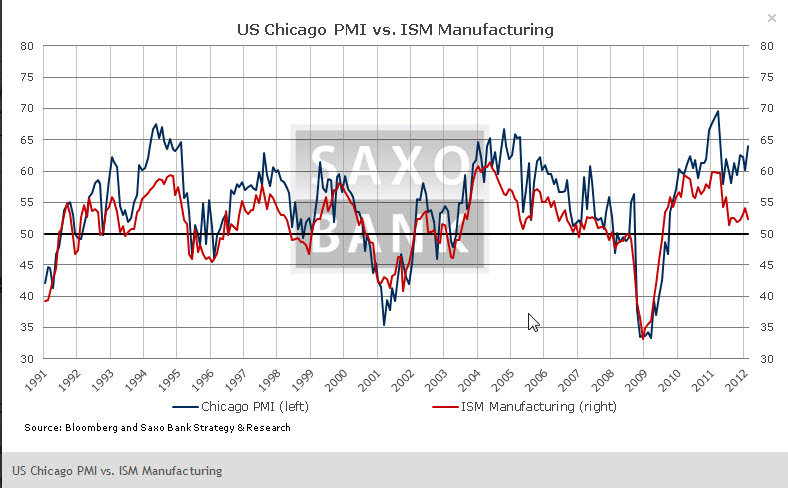

- Mar. US Chicago PMI (13:45) to continue to outperform ISM Manufacturing: As always, we will get the Chicago PMI report today as a teaser ahead of Monday's ISM Manufacturing report and consensus continues to expect the former to comfortably outperform the latter as is often the case during expansions. Consensus targets 63 vs. 64 last month despite the fact that the forward-looking new orders component rose sharply to 69.2 in February from 63.6 in January.