With a Greek election now officially scheduled for May 6 - where the current technocrat government will be replaced - we can return to the numbers watching game. And today promises to be exciting, with several high profile US reports all reported simultaneously and before that Industrial Production from the struggling - and economically divided - Eurozone.

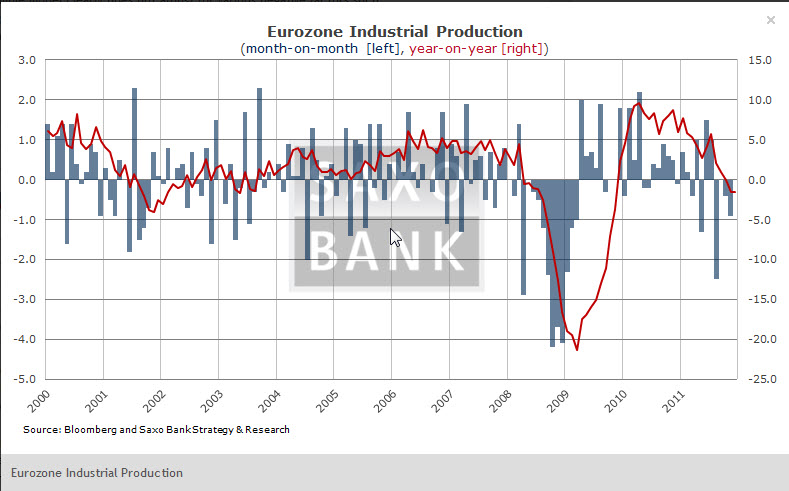

Feb. Eurozone Industrial Production (09:00 GMT) to decline: The chasm between the haves and have-nots in the Eurozone continues to widen, with Germany and the surrounding countries doing well - relatively speaking, at least - while most Southern economies struggle. This is, of course, reflected in overall production, which consensus sees down 0.2% m/m in February after a revised flat reading in January (from +0.2%). While this is by no means impressive, a simple model of GDP vs. industrial production suggests a positive 1Q'12 GDP growth print. Having said that, such a simple model clearly does not adjust for various negative factors such as the ongoing austerity measures, which weigh negatively on most Eurozone governments' impact on GDP. Hence we still expect another drop in economic activity in the first quarter. Consensus is currently forecasting a -0.2% 1Q'12 GDP growth number (the GDP report will be out on May 15).

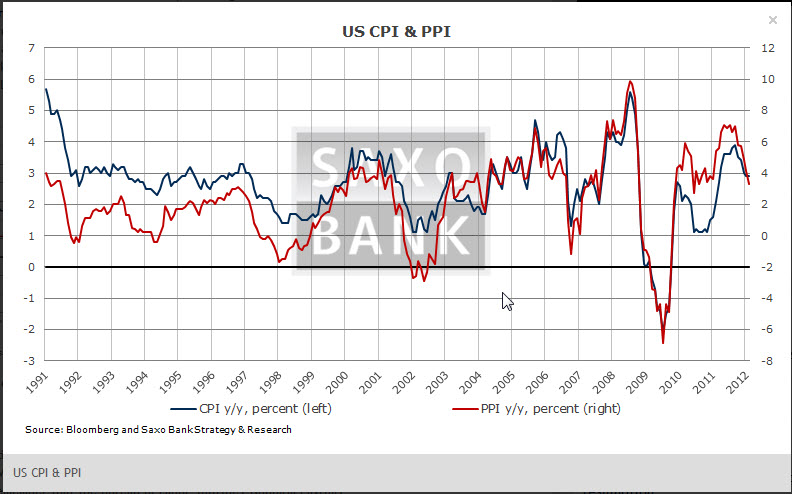

Mar. US Producer Price Index (12:30) to show deceleration: Yesterday's report on import prices confirmed our view of a deceleration in US price indices. They printed 3.4% y/y (in line with expectations) in March vs. 5% a month earlier. The question is for how long? While today's report on producer prices is expected to show a deceleration in y/y inflation to 3.1% from 3.3% - which is quite reasonable given the close correlation of the two series (something we detailed in yesterday's 3 numbers to watch: housing starts, import prices & Beige Book) - the longer-term outlook suggests the the deceleration will not last much longer; potentially to around mid-to-late summer with import prices turning first. Consensus looks for PPI to increase by 0.3% m/m and 3.1% y/y compared with 0.4% and 3.3% in February.

US Initial Jobless Claims (12:30): Despite the US Trade Balance also scheduled for publication at 12:30 , we will keep a closer eye on the jobless claims report, particularly in light of last Friday's much weaker than expected employment report, which saw only 120,000 nonfarm payrolls added in March against 205,000 expected. Initial Jobless Claims did not see a deterioration similar to what we saw in payrolls in March. This suggests both that the labour market is holding up rather well (remember that the Bureau of Labor Statistics' Nonfarm Payrolls number is an estimate just like ADP Employment), but also that any weather-related payback was, perhaps, not a big contributor to the March downside surprise. That means we could well see weakness in the coming employment reports as well. Consensus forecasts 355,000 new claims for jobless benefits (357k last week) and 3.335mln. claims for continuing benefits (3.338mln.).

As noted above we will also be treated to the February US Trade Balance report at 12:30, and consensus expects a deficit of $51.8bln. - a narrowing of $1.2mln. compared with January. This report has a direct impact on 1Q'12 GDP so expect changes to tracking estimates in case of a large surprise (either way).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 numbers to watch: Eurozone ind. prod., US PPI, jobless claims

Published 04/12/2012, 05:25 AM

3 numbers to watch: Eurozone ind. prod., US PPI, jobless claims

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.