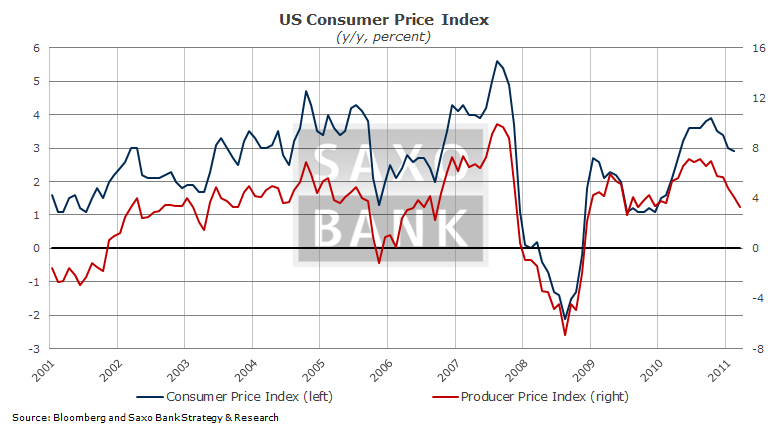

Not only have we finally managed a week with little mention of Greece - at least in this post anyway - but we are also treated to yet another inflation report today from the US - third day in a row - with CPI up for grabs after yesterday's PPI report confirmed our expectation of a deceleration in price pressure in the US. That is not all there is in terms of data today though. We will also see Industrial Production and University of Michigan Consumer Confidence reports.

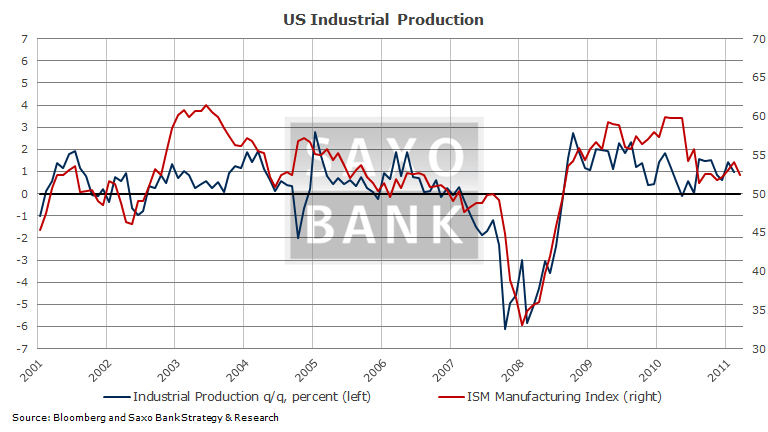

Feb. US CPI (12:30) to rise month-on-month, but the trend is slowing: Yesterday's Producer Price Index showed weakening inflation pressures with the headline year-on-year change down to 3.3 percent from 4.1 percent earlier - as indicated by Wednesday's Import Price Index - while the core index was unchanged at 3 percent y/y. Consensus looks for energy prices to make its mark in today's CPI report actually like they did in the PPI report with a forecast of 0.4 percent m/m which will still see us at an unchanged annual pace of 2.9 percent. We look for further deceleration in the CPI however in the coming months. Core CPI is expected to rise 0.2 percent m/m or 2.2 percent y/y. Feb. US Industrial Production (13:15) to rise 0.5% after weak January: January's disappointing unchanged production did not corroborate well with all the surveys (e.g. the ISM Manufacturing Index was at 54.1), with the culprit being the weather. In other words, utilities declined 2.5 percent m/m and mining declined 1.8 percent while manufacturing was actually up 0.7 percent. We expect the report to "get back in line" with the rest of the evidence of healthy industrial production today and so does consensus with a 0.4 percent monthly increase. Capacity Utilization is seen rising to 78.8 percent, the highest level since mid-2008 from 78.5 percent.

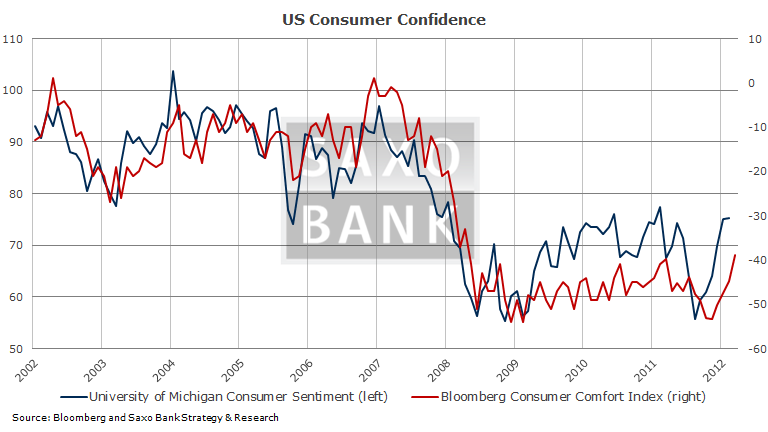

Feb. US Industrial Production (13:15) to rise 0.5% after weak January: January's disappointing unchanged production did not corroborate well with all the surveys (e.g. the ISM Manufacturing Index was at 54.1), with the culprit being the weather. In other words, utilities declined 2.5 percent m/m and mining declined 1.8 percent while manufacturing was actually up 0.7 percent. We expect the report to "get back in line" with the rest of the evidence of healthy industrial production today and so does consensus with a 0.4 percent monthly increase. Capacity Utilization is seen rising to 78.8 percent, the highest level since mid-2008 from 78.5 percent. Mar. University of Michigan Consumer Sentiment (13:55) to rise despite gas prices? The various consumer confidence reports have been resilient to gas prices so far this year. Indeed, the weekly Bloomberg Consumer Comfort Index rose to its highest level since early 2008 last week and has suddenly moved markedly higher to -33.7 after having spent the better part of four years around -45 to -50. It bodes well for today's report and suggests in line with our thinking that while so sharp an increase in gas prices is not welcome, it also it not yet at a level where it will affect consumer behaviour materially.

Mar. University of Michigan Consumer Sentiment (13:55) to rise despite gas prices? The various consumer confidence reports have been resilient to gas prices so far this year. Indeed, the weekly Bloomberg Consumer Comfort Index rose to its highest level since early 2008 last week and has suddenly moved markedly higher to -33.7 after having spent the better part of four years around -45 to -50. It bodes well for today's report and suggests in line with our thinking that while so sharp an increase in gas prices is not welcome, it also it not yet at a level where it will affect consumer behaviour materially.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Numbers to Watch: CPI, Industrial Production, UOM Confidence

Published 03/16/2012, 10:50 AM

Updated 03/19/2019, 04:00 AM

3 Numbers to Watch: CPI, Industrial Production, UOM Confidence

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.