The “Model Zacks Strong Buys & Buy” screen incorporates the very best of Zacks research. The Zacks Rank is, of course, the foundation of this portfolio, which requires only #1s (Strong Buys) and #2s (Buys). But that’s just the beginning. Layered on top is a Zacks Industry Rank in the top 50% and Zacks Style Scores of A or B. When added all together, you get a collection of stocks that have been performing well and should continue to do so.

A look at the current portfolio shows a surprising amount of retail names of all types. The three stocks below are all retailers of one type or another that recently passed the tough criteria of this screen. Make sure to click the link above to see all the current stocks on the list.

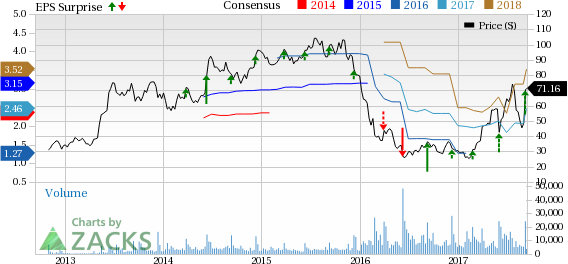

RH (RH)

If you’re in the market for some furniture and willing to spend some real money, then RH (RH) (formerly Restoration Hardware) is quickly becoming the place to go. Thanks to a strong fiscal second quarter report, the stock has soared more than 51%...in just the past 2 weeks! Its earnings estimate revisions have been equally as impressive of late.

The company reported fiscal second quarter earnings per share of 65 cents, which was up 47.7% from last year. The result soared past the Zacks Consensus Estimate of 47 cents by 38.3%, contributing to a four-quarter average beat of 21.7%. It was the fifth straight quarter with a positive surprise.

RH is part of the retail – home furnishing space. Therefore, it is in the top 18% of the Zacks Industry Rank, putting it in the 47th spot out of 256. It’s not too much of a stretch to say that RH is probably one of the big reasons why the space is so high on the list. It reported revenues of $615.3 million in its latest quarter, improving 13.2% from last year and beating our consensus of $612.7 million. Comparable brand revenue was up 7%.

Those numbers are all great, but it doesn’t account for the 50%+ gain in the stock since the beginning of September. Instead, the analysts were most impressed with RH’s outlook for the full fiscal year. It now expected earnings per share of $2.43 to $2.67, compared to the earlier guidance of between $1.67 and $1.94. It also sees revenues at $2.4 billion to $2.5 billion.

The Zacks Consensus Estimate for this (ending January 2018) is now at $2.46 per share, which is up 24.2% in the past 30 days. It is also advanced 14.4% in just the past 7 days thanks to that strong quarterly report. For next fiscal year (ending January 2019), earnings should jump as much as 43% to $3.52 per share. The Zacks Consensus Estimate has improved 23% over the past month and 13.9% in the past week.

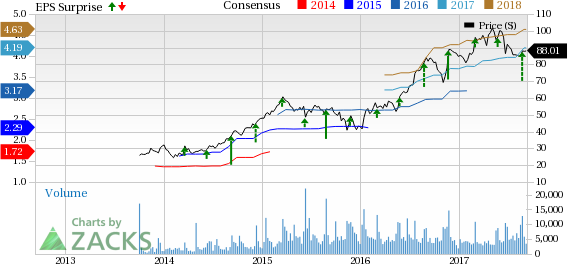

Burlington Stores (BURL)

Believe it or not, but Amazon (NASDAQ:AMZN) is not the only retailer in town. The online juggernaut may re-designing the shopping landscape, but you can never overlook the allure of good, old-fashioned cheap prices. Off-price retailer Burlington Stores (BURL) knows this dynamic well, helping it put together 15 straight quarters of better-than-expected earnings and 18 straight quarters of same-store sales growth.

In its fiscal second quarter report, BURL topped the Zacks Consensus Estimate by 44% with earnings per share of 72 cents. We were only expecting 50 cents. Its four-quarter average is now nearly 18%. Net sales inched past our estimate by reaching $1.36 billion, or 8.6% better than last year. Same-store sales were up 3.5% in the quarter.

Shares of BURL are only up approximately 3.5% so far this year, but that’s quite an impressive feat in the post-Amazon world. Take for example that its industry (Retail – discount stores) is very well placed in the top 27% of the Zacks Industry Rank with the 68th spot out of 256. And yet, the space is actually down by about nearly 3% this year as it struggles in a tough arena.

But BURL refuses to be intimidated. The company opened four new stores in the quarter bringing the total count to 600, plans to remodel 34 stores this fiscal year, and plans to open 37 net new stores instead of just 30. It expects total sales to increase between 8.4% and 8.9% this fiscal year with adjusted earnings of $4.11 to $4.18 per share. These totals will get a boost from a 53rd week in the year.

Analysts appreciate what BURL is doing. So much so, in fact, that all 7 covering analysts raised their estimates for this fiscal year and next over the past 30 days. The Zacks Consensus Estimate for the fiscal year ending January 2018 is now $4.19 per share, which is up 5.5% in a month. Earnings are expected to grow 10.5% next fiscal year (ending January 2019) to $4.63, which has gained 2.7% in its own right over the past 30 days.

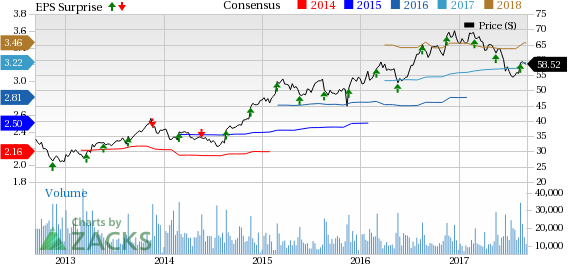

Ross Stores (NASDAQ:ROST) (ROST)

Burlington wasn’t the only member of the Discount Stores industry to make it through this screen’s stringent criteria. Ross Stores (ROST) is also finding success in an increasingly challenging space. The company has enjoyed a good month, as shares are up 6.6% after another solid quarterly report.

In its fiscal second quarter from last month, earnings per share of 82 cents beat the Zacks Consensus Estimate by approximately 7.9% and was 15.5% better than last year. It has now beaten our estimates for 13 straight quarters with a four-quarter average surprise of nearly 6.3%.

Total sales of $3.43 billion also beat our expectations of $3.37 billion, while also improving 7.9% from the previous year. Same-stores sales were up 4%. ROST experienced broad-based growth across all merchandise categories and regions.

Despite challenges, the company’s expansion plan remains intact. It expects to open 40 new stores in the fiscal third quarter (30 Ross outlets and 10 dd’s Discounts). For the full fiscal year, the plan is to open 90 stores (70 Ross and 20 dd’s), excluding plans to relocate or close 10 existing stores.

ROST now expects earnings per share between $3.16 and $3.23 for fiscal 2017, which is better than the previous outlook of $3.07 to $3.17 and would mark year-over-year growth of 12% to 14%. All 11 covering analysts liked what they saw in the quarter and raised their expectations for this fiscal year (ending January 2018). The Zacks Consensus Estimate is now at $3.22 per share, marking a gain of 2.2% in the past 30 days.

Agreement among analysts has been strong for next fiscal year as well. Earnings are expected to grow by a further 7.5% for the year ending January 2019 to $3.46 per share as nine of 10 covering analysts raised their expectations.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020. The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Download the new report now >>

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Restoration Hardware Holdings Inc. (RH): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post